Question: 1. Do you trust the defect rate data provided by the suppliers? 2. What are your impressions of the supplier evaluation criteria used by Sarah?

1. Do you trust the defect rate data provided by the suppliers? 2. What are your impressions of the supplier evaluation criteria used by Sarah? What changes would you suggest? 3. Is there anything that you think Sarah could do to get a better deal from BGK?

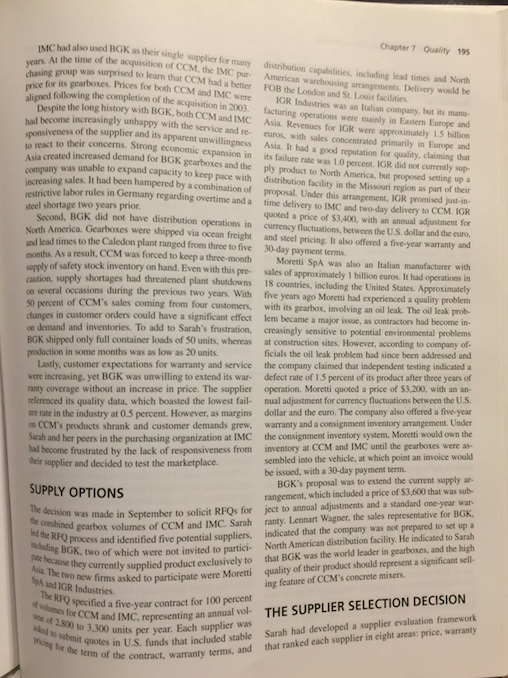

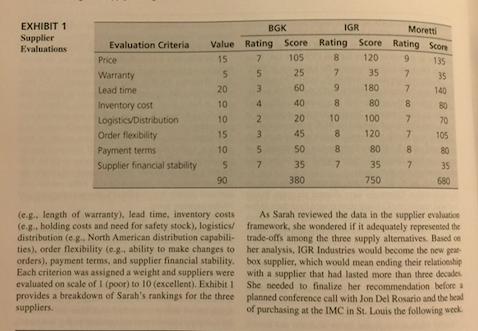

Case 7-2 Caledon Concrete Mixers was in supply, where combining purchases between the two As Sarah Jenkins, material manager at Caledon Concrete Miners, ended her conference call with Jon Del Rosario operations for some products had yielded significant savings Jon Del Rosario, purchasing manager in the corporate pe from corporate purchasing, she woodered what recommen- dations she should make regarding the selection of a gearbox chasing group in Chicago, was responsible for coordinating purchasing between the Caledon and St. Louis plants. supplier. The corporate purchasing group in Chicago was Sarah Jenkins was responsible for materials manage advocating switching to a new supplier, but Sarah remained ment at CCM. An MBA graduate from the Ivey Business concerned about the risks of ending a long-term supply ar School, Sarah had worked at CCM for more than 20 years. rangement with a key supplier. It was now December the 3rd and she wanted to make a final recommendation before Reporting to the general manager, her responsibilities in cluded logistics and transportation, purchasing, inventory the plant shut down for the annual Christmas holiday break. control, and production planning. Her counterparts in fi- CALEDON CONCRETE MIXERS nance and accounting, quality, operations, sales, HR, and engineering rounded out the senior management team. Located north of Toronto, Canada, in Caledon, Ontario, Caledon Concrete Mixers (CCM) was a manufacturer THE GEARBOX of truck-mounted concrete mixers. Founded in 1910, the company employed 140 people in its 150,000 square foot While the concrete mixer truck was in operation, it was plant, including 100 unionized hourly workers, and had necessary to continuously rotate the load to prepare the annual sales of approximately $25 million. Nearly 40 per concrete and avoid consolidation. The gearbox was locat cent of company sales were exported, mainly to the United ed at the bottom of the large mixing drum and was used States to transmit torque from the hydraulic motor drive shaft CCM had a strong reputation for quality and service in which rotated the drum. The gearbox also permitted the the industry. It operated as a private business until 2003, operator to adjust the speed and direction of the rotation when it was purchased by Illinois Machinery Corporation The gearbox was one of approximately 150 compo (IMC). IMC was a global manufacturer and marketer of nents that CCM used for the assembly of their concrete access equipment, specialty vehicles, and truck bodies mixers. The gearbox used by CCM came in two varia for the defense, concrete placement, refuse hauling, and tions, depending on the model of the concrete mixer. Each fire and emergency markets. Annual revenues in the most current fiscal year were 59 billion and IMC had approxi- gearbox cost approximately $3,600 and volumes at CCM ranged from 950 to 1.100 units per year. mately 18,000 employees Concrete mixer transport trucks were designed to mix concrete and haul it to the construction site. Customers CURRENT SUPPLY ARRANGEMENT typically specified the truck model, which was ordered from the original equipment manufacturer. CCM fitted the CCM and the St. Louis operation both used BGK GmbH vehicle with the concrete mixing equipment, which includ- as the single source for gearboxes. BGK was a large diver ed a large drum and discharge system. Systems were cus sified German manufacturing company with annual res tomized based on vehicle size (es, 2-6 axles), discharge produced gearboxes for industrial applications in a wide enues of 12 billion euros. The division that supplied CCM system (front or rear), and capacity (maximum capacity to carry 14 cubic yards of payload). range of industries, such as material handling equipment IMC had an operation in St. Louis that manufactured a energy, and mining. The company had a reputation for high similar product line to CCM under a different brand name quality and reliability, although its products were typically with annual revenues approximately double the Canadian more expensive than those of their competitors. plant. Although IMC operated under a decentralized model The relationship with CCM and BGK dated back mere than 30 years. BGK offered a standard one-year warranty its gearboxes, but Sarah was not aware that CCM had ever experienced any notable quality problems and customers were generally satisfied with performance of the product CCM and the St. Louis operation cooperated in areas of engi- neering. purchasing and sales, while operating automously with separate leadership teams. One key area for synergies Chapter 7 Quality 195 distribution capabilities, including lead times and North American warehousing arrangements. Delivery would be FOB the London and St. Louis facilities IGR Industries was an Italian company, but its mane facturing operations were mainly in Eastern Europe and Asia. Revenues for IGR were approximately 1.5 billion euros, with sales concentrated primarily in Europe and IMC had also used BGK as their single supplier for many years. At the time of the acquisition of CCM, the IMC put chasing group was surprised to learn that CCM had a better price for its gearboxes. Prices for both CCM and IMC were aligned following the completion of the acquisition in 2003 Despite the long history with BGK, both CCM and IMC had become increasingly unhappy with the service and re- sponsiveness of the supplier and its apparent unwillingness Asia. It had a good reputation for quality, claiming that to react to their concerns. Strong economic expansion in Asia created increased demand for BGK gearboxes and the ply product to North America, but proposed setting up a its failure rate was 10 percent. IGR did not currently sup company was unable to expand capacity to keep pace with increasing sales. It had been hampered by a combination of proposal. Under this arrangement, IGR promised juice distribution facility in the Missouri region as part of their restrictive labor rules in Germany regarding overtime and a steel shortage two years prior time delivery to IMC and two-day delivery to CCM.IGR Second, BGK did not have distribution operations in quoted a price of $3,400, with an annual adjustment for North America. Gearboxes were shipped via occan freight and steel pricing. It also offered a five-year warranty and currency fluctuations between the US dollar and the curo, and lead times to the Caledon plant ranged from three to five 30-day payment terms. months. As a result, CCM was forced to keep a three-month Moretti SpA was also an Italian manufacturer with supply of safety stock inventory on hand. Even with this pre- sales of approximately 1 billion euros. It had operations in caution, supply shortages had threatened plant shutdowns 18 countries, including the United States. Approximately on several occasions during the previous two years. With five years ago Moretti had experienced a quality problem 50 percent of CCM's sales coming from four customers, with its gearbox, involving an oil leak. The oil leak prob- changes in customer orders could have a significant effect lem became a major issue, as contractors had become in- on demand and inventories. To add to Sarah's frustration, creasingly sensitive to potential environmental problems BGK shipped only full container loads of 50 units, whereas at construction sites. However, according to company of production in some months was as low as 20 units. ficials the oil leak problem had since been addressed and Lastly, customer expectations for warranty and service the company claimed that independent testing indicated a were increasing, yet BGK was unwilling to extend its war- defect rate of 1.5 percent of its product after three years of ranty coverage without an increase in price. The supplier operation. Moretti quoted a price of $3.200, with an an- referenced its quality data, which boasted the lowest fail- nual adjustment for currency fluctuations between the U.S. ure rate in the industry at 0.5 percent. However, as margins dollar and the euro. The company also offered a five-year on CCM's products shrank and customer demands grew, warranty and a consignment inventory arrangement. Under Sarah and her peers in the purchasing organization at IMC the consignment inventory system, Moretti would own the had become frustrated by the lack of responsiveness from inventory at CCM and IMC until the gearboxes were as sembled into the vehicle, at which point an invoice would their supplier and decided to test the marketplace. be issued, with a 30-day payment term. BGK's proposal was to extend the current supply ar SUPPLY OPTIONS rangement, which included a price of $3,600 that was sub- The decision was made in September to solicit RFQs for ject to annual adjustments and a standard one-year war ranty. Lennart Wagner, the sales representative for BGK De combined gearbox volumes of CCM and IMC. Sarah ed the RFQ process and identified five potential suppliers, indicated that the company was not prepared to set up a deding BGK, two of which were not invited to partici- North American distribution facility. He indicated to Sarah te because they currently supplied product exclusively to Asia. The two new firms asked to participate were Moretti quality of their product should represent a significant sell that BGK was the world leader in gearboxes, and the high volumes for CCM and IMC representing an annual vol- THE SUPPLIER SELECTION DECISION The RFQ specified a five-year contract for 100 percent me of 2.500 to 3.300 units per year. Each supplier was wed to submit quotes in U.S. funds that included stable on for the term of the contract, warranty terms, and SpA and IGR Industries ing feature of CCM's concrete mixers. Sarah had developed a supplier evaluation framework that ranked each supplier in eight areas: price, warranty Moretti EXHIBIT 1 Supplier Evaluations 135 140 Evaluation Criteria Price Warranty Lead time Inventory cost Logistic Distribution Order flexibility Payment terms Supplier financial stability BGK IGR Value Rating Score Rating Score Rating Score 15 7 105 8 120 9 5 5 25 7 35 7 35 203 60 9 180 7 10 4 40 8 808 80 10 2 20 10 100 7 153 45 8 120 7 105 105 50 8 80 8 80 5 7 35 7 35 7 35 90 380 750 680 70 (e.g., length of warranty), lead time, inventory costs As Sarah reviewed the data in the supplier evaluation (e.g., holding costs and need for safety stock), logistics/framework, she wondered if it adequately represented the distribution (e.g., North American distribution capabili trade-offs among the three supply alternatives. Based on ties), order flexibility (e.g., ability to make changes to her analysis, IGR Industries would become the new gear orders), payment terms, and supplier financial stability. box supplier, which would mean ending their relationship Each criterion was assigned a weight and suppliers were with a supplier that had lasted more than three decades evaluated on scale of l (poor) to 10 (excellent). ExhibitShe needed to finalize her recommendation before a provides a breakdown of Sarah's rankings for the three planned conference call with Jon Del Rosario and the head suppliers. of purchasing at the IMC in St. Louis the following week