Question: 1. Download this worksheet and compute Units-of-Service Depreciation using the following assumptions: - Cost to be depreciated =$50,000 - Salvage value = zero - Total

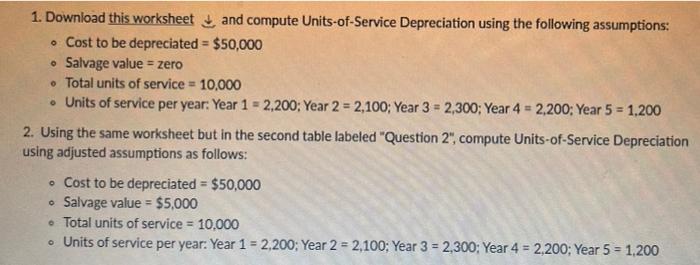

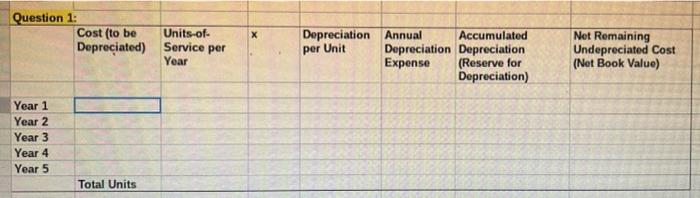

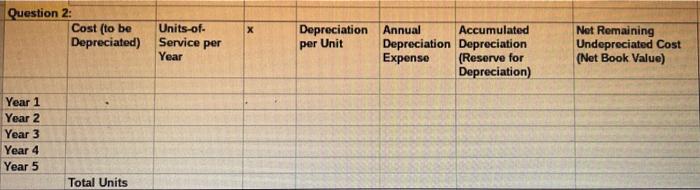

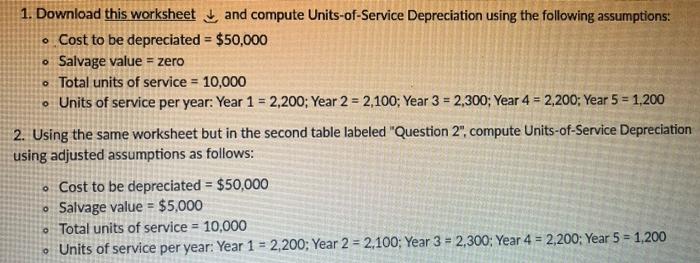

1. Download this worksheet and compute Units-of-Service Depreciation using the following assumptions: - Cost to be depreciated =$50,000 - Salvage value = zero - Total units of service =10,000 - Units of service per year: Year 1=2,200; Year 2=2,100; Year 3=2,300; Year 4=2,200; Year 5=1,200 2. Using the same worksheet but in the second table labeled "Question 2", compute Units-of-Service Depreciation using adjusted assumptions as follows: - Cost to be depreciated =$50,000 - Salvage value =$5,000 - Total units of service =10,000 - Units of service per year: Year 1=2,200; Year 2=2,100; Year 3=2,300; Year 4=2,200; Year 5=1,200 Question 2: 1. Download this worksheet and compute Units-of-Service Depreciation using the following assumptions: - Cost to be depreciated =$50,000 - Salvage value = zero - Total units of service =10,000 - Units of service per year: Year 1=2,200; Year 2=2,100; Year 3=2,300; Year 4=2,200; Year 5=1,200 2. Using the same worksheet but in the second table labeled "Question 2", compute Units-of-Service Depreciation using adjusted assumptions as follows: - Cost to be depreciated =$50,000 - Salvage value =$5,000 - Total units of service =10,000 - Units of service per year: Year 1=2,200; Year 2=2,100; Year 3=2,300; Year 4=2,200; Year 5=1,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts