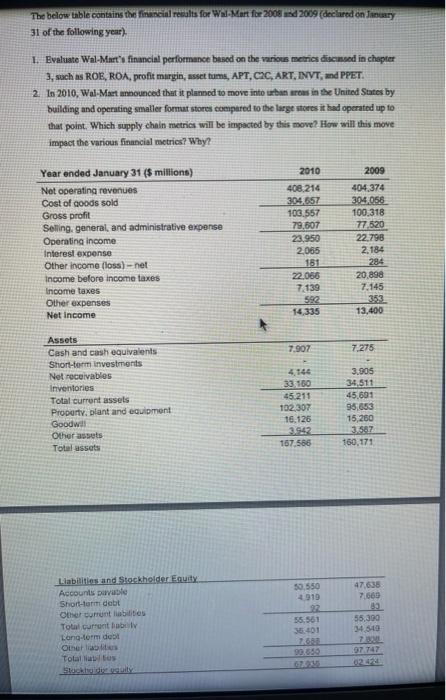

1. Evaluate Wal-Marts financial performance based on the various metrics discussed in chapter

3, such as ROE, ROA, profit margin, asset turns, APT, C2C, ART, INVT, and PPET.

2. In 2010, Wal-Mart announced that it planned to move into urban areas in the United States by

building and operating smaller format stores compared to the large stores it had operated up to

that point. Which supply chain metrics will be impacted by this move? How will this move

impact the various financial metrics? Why?

2010 2009

Net operating revenues 408,214 404,374

Cost of goods sold 304,657 304,056

Gross profit 103,557 100,318

Selling, general, 79,607 77,520

administrative expense

Operating income 23,950 22,798

Interest expense 2,065 2,184

Other income (loss) net 181 284

Income before income taxes 22,066 20,898

Income taxes 7,139 7,145

Other expenses 592 353

Net income 14,335 13,400

Assets

Cash and cash equivalents 7,907 7,275

Short-term investments - -

Net receivables 4,144 3,905

Inventories 33,160 34,511

Total current assets 45,211 45,691

Property, plant 102,307 95,653

and equipment

Goodwill 16,126 15,260

Other assets 3,942 3,567

Total assets 167,586 160,171

Liabilities and Stockholder Equity

Accounts payable 50,550 47,638

Short -term debt 4,919 7,669

Other current liabilities 92 83

Total current liability 55,561 55,390

Long -term debt 36,401 34,549

Other liabilities 7,688 7,808

Total liabilities 99,650 97,747

Stockholder equity 67,936 62,424

31 of the following year). 1. Evaluate Wal-Mart's financial performance besed on the various metries discensed in chapter 3, such as ROK, ROA, profit mirgin, ssset tums, APT, C2C, ART, DVT, and PPET: 2. In 2010, Wal-Mart announced that it planned to move into utban areas in the United States by building and operating smaller formut stores coenpared to the large atceres it had openated up to that point. Which supply chain metries will be impacted by this move? How will this move impact the various financial metries? Why