Question: 1. Exercise One: An equity researcher at Fiterman Capital estimates the following dividends, and stock price for Nike stock shown in the table below. Given

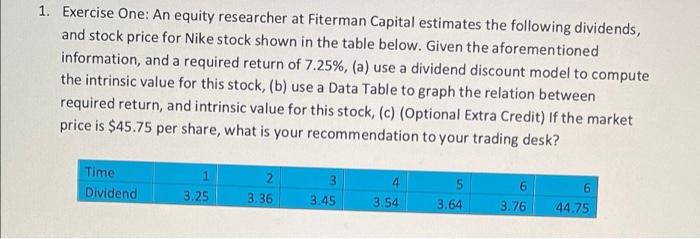

1. Exercise One: An equity researcher at Fiterman Capital estimates the following dividends, and stock price for Nike stock shown in the table below. Given the aforementioned information, and a required return of 7.25%, (a) use a dividend discount model to compute the intrinsic value for this stock, (b) use a Data Table to graph the relation between required return, and intrinsic value for this stock, (c) (Optional Extra Credit) If the market price is $45.75 per share, what is your recommendation to your trading desk? Time Dividend 1 3.25 4 2 3.36 3 3.45 5 3.64 3.54 6 3.76 44.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts