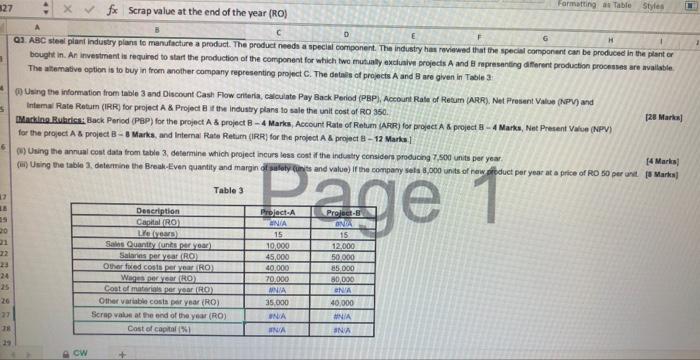

Question: 327 1 C 1 Formatting as Table Styles fx Scrap value at the end of the year (RO) D G H Q.1. ABC steel plan

327 1 C 1 Formatting as Table Styles fx Scrap value at the end of the year (RO) D G H Q.1. ABC steel plan industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be produced in the plant or bought in. An investment is required to start the production of the component for which two mutually exclusive projects A and representing different production processes are available Theatemative option is to buy in from another company representing project. The details of projects A and B are given in Table Using the information from table 3 and Discount Cash Flow criteria, calculate Pay Back Period (PBP), Account Rate of Retum (ARR), Net Prosent Value (NPV) and Intema Rate Return (IRR) for project A & Project of the industry plans to sale the unit cost of RO 350. 128 Marka Machine Rubrica: Back Period (PSP) for the project A & project 3 - Marks Account Rate of Rotum (ARR) for project A & project 8 - 4 Marks, Net Present Value (NPV) for the project A & project B-8 Marks and Internal Rate Return (IRR) for the project A & project 8 - 12 Marka Using the annual cost data from table 3. determine which project incurs less cost of the industry considera producing 7,500 units per year [4 Marks! (H) Using the table 3. determine the Break-even quantity and margin ostety nits and value) If we company set 8,000 units of raw sreduet per year at a price of RO 50 per unit ja Marks 5 Table 3 17 Page Project A Project - 15 21 22 23 24 25 Description Capital Le (years) Sains Quantity unts per year) Salaries per year (RO) Other fred.costo por Year RO) Wory (RO) Cost of materials per year (RO) Other variable costs per year (RO) Scrapval at the end of the year (RO) Cost of capital 15 10.000 45,000 40.000 70,000 MNIA 35.000 UNA 15 12,000 50.000 85.000 80 DOO ENA 40,000 ANIA 27 78 ANA INA cw + 327 1 C 1 Formatting as Table Styles fx Scrap value at the end of the year (RO) D G H Q.1. ABC steel plan industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be produced in the plant or bought in. An investment is required to start the production of the component for which two mutually exclusive projects A and representing different production processes are available Theatemative option is to buy in from another company representing project. The details of projects A and B are given in Table Using the information from table 3 and Discount Cash Flow criteria, calculate Pay Back Period (PBP), Account Rate of Retum (ARR), Net Prosent Value (NPV) and Intema Rate Return (IRR) for project A & Project of the industry plans to sale the unit cost of RO 350. 128 Marka Machine Rubrica: Back Period (PSP) for the project A & project 3 - Marks Account Rate of Rotum (ARR) for project A & project 8 - 4 Marks, Net Present Value (NPV) for the project A & project B-8 Marks and Internal Rate Return (IRR) for the project A & project 8 - 12 Marka Using the annual cost data from table 3. determine which project incurs less cost of the industry considera producing 7,500 units per year [4 Marks! (H) Using the table 3. determine the Break-even quantity and margin ostety nits and value) If we company set 8,000 units of raw sreduet per year at a price of RO 50 per unit ja Marks 5 Table 3 17 Page Project A Project - 15 21 22 23 24 25 Description Capital Le (years) Sains Quantity unts per year) Salaries per year (RO) Other fred.costo por Year RO) Wory (RO) Cost of materials per year (RO) Other variable costs per year (RO) Scrapval at the end of the year (RO) Cost of capital 15 10.000 45,000 40.000 70,000 MNIA 35.000 UNA 15 12,000 50.000 85.000 80 DOO ENA 40,000 ANIA 27 78 ANA INA cw +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts