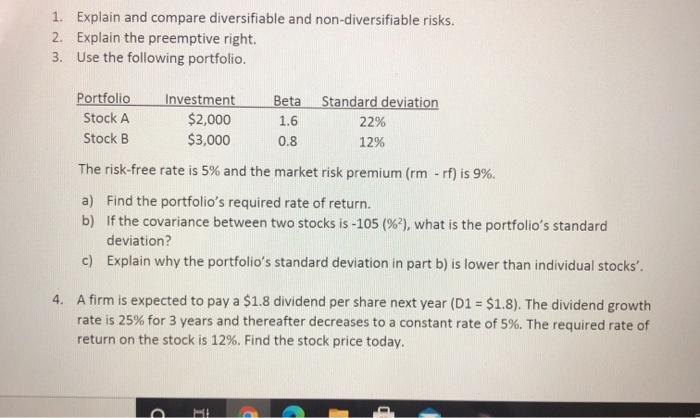

Question: 1. Explain and compare diversifiable and non-diversifiable risks. 2. Explain the preemptive right. 3. Use the following portfolio. Portfolio Investment Beta Standard deviation Stock A

1. Explain and compare diversifiable and non-diversifiable risks. 2. Explain the preemptive right. 3. Use the following portfolio. Portfolio Investment Beta Standard deviation Stock A $2,000 1.6 22% Stock B $3,000 0.8 12% The risk-free rate is 5% and the market risk premium (rm -rf) is 9%. a) Find the portfolio's required rate of return. b) If the covariance between two stocks is -105 (%), what is the portfolio's standard deviation? c) Explain why the portfolio's standard deviation in part b) is lower than individual stocks'. 4. A firm is expected to pay a $1.8 dividend per share next year (D1 = $1.8). The dividend growth rate is 25% for 3 years and thereafter decreases to a constant rate of 5%. The required rate of return on the stock is 12%. Find the stock price today. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts