Question: 1. Explain how fixed, variable, and mixed costs behave (i) in total and, (ii) on a per-unit basis with a change in the activity level

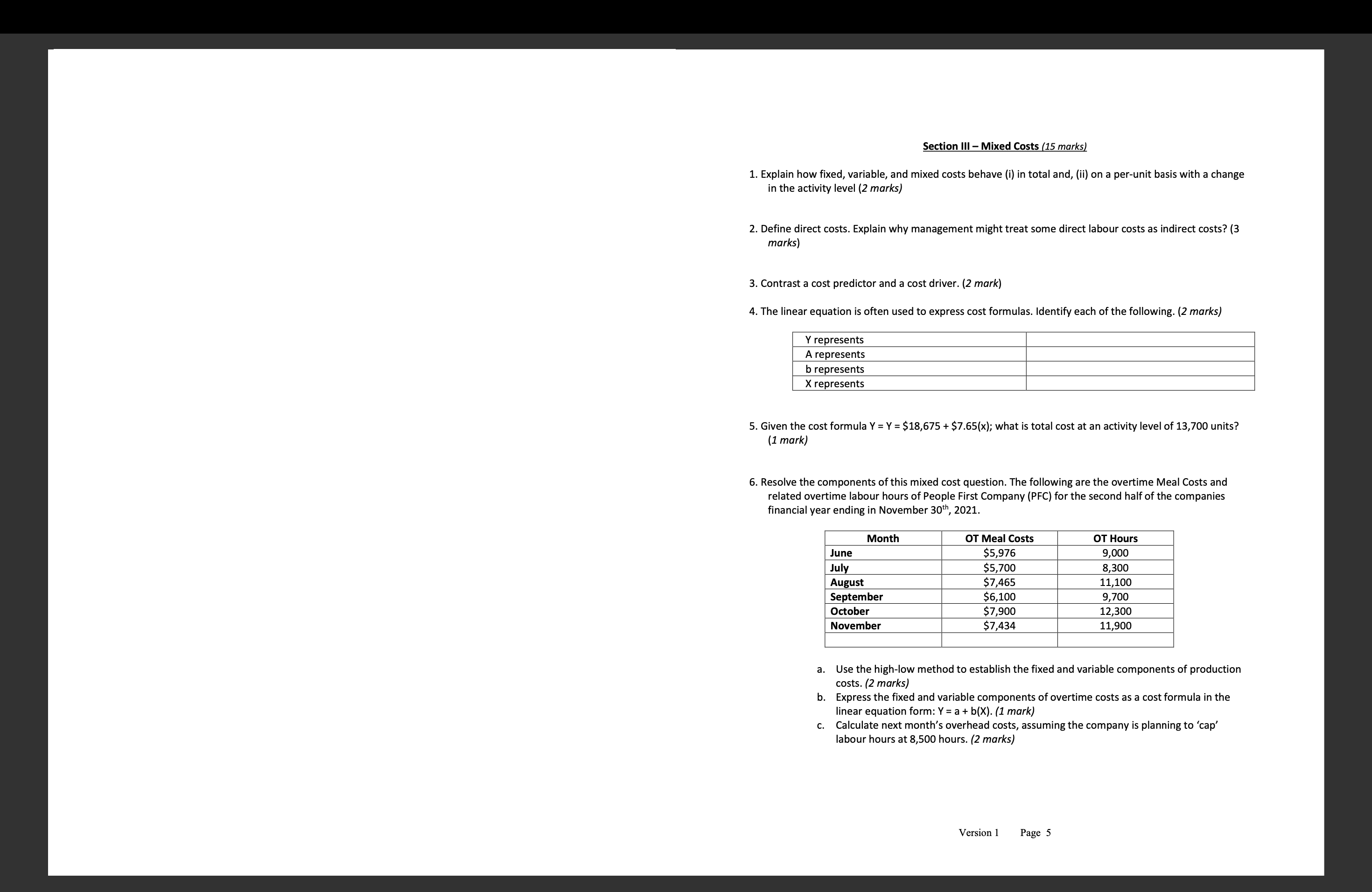

1. Explain how fixed, variable, and mixed costs behave (i) in total and, (ii) on a per-unit basis with a change in the activity level (2 marks) 2. Define direct costs. Explain why management might treat some direct labour costs as indirect costs? (3 marks) 3. Contrast a cost predictor and a cost driver. (2 mark) 4. The linear equation is often used to express cost formulas. Identify each of the following. (2 marks) 5. Given the cost formula Y=Y=$18,675+$7.65(x); what is total cost at an activity level of 13,700 units? (1 mark) 6. Resolve the components of this mixed cost question. The following are the overtime Meal Costs and related overtime labour hours of People First Company (PFC) for the second half of the companies financial year ending in November 30th,2021. a. Use the high-low method to establish the fixed and variable components of production costs. (2 marks) b. Express the fixed and variable components of overtime costs as a cost formula in the linear equation form: Y=a+b(X). (1 mark) c. Calculate next month's overhead costs, assuming the company is planning to 'cap' labour hours at 8,500 hours. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts