Question: 1. Explain the relationship between a bond's fixed coupon rate and its yield to maturity. (2 marks) 2. An 8 year bond has a yield

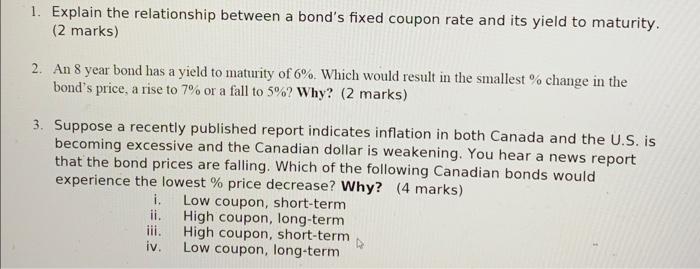

1. Explain the relationship between a bond's fixed coupon rate and its yield to maturity. (2 marks) 2. An 8 year bond has a yield to maturity of 6%. Which would result in the smallest % change in the bond's price, a rise to 7% or a fall to 5% ? Why? (2 marks) 3. Suppose a recently published report indicates inflation in both Canada and the U.S. is becoming excessive and the Canadian dollar is weakening. You hear a news report that the bond prices are falling. Which of the following Canadian bonds would experience the lowest % price decrease? Why? (4 marks) i. Low coupon, short-term ii. High coupon, long-term iii. High coupon, short-term iv. Low coupon, long-term

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts