Question: 1. Explain the similarities and differences between job-order costing systems and process costing systems List three Kuwaiti companies that would likely use a job-order costing

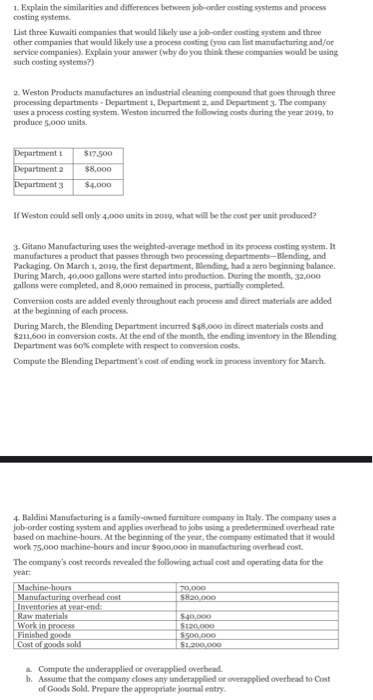

1. Explain the similarities and differences between job-order costing systems and process costing systems List three Kuwaiti companies that would likely use a job-order costing system and three other companies that would likely use a process costing (you can list manufacturing and/or service companies). Explain your answer (why do you think these companies would be using such costing systems?) 2. Weston Products manufactures an industrial cleaning compound that goes through three processing departments - Department , Department 2 and Department 3. The company uses a process costing system. Weston incurred the following costs during the year 2019, to produce 5.000 units. Department Department 2 Department 3 $17.500 $8,000 $4,000 If Weston could sell only 4,000 units in 2019, what will be the cost per unit produced? 3. Gitano Manufacturing uses the weighted average method in its process costing system. It manufactures a product that passes through two processing departments-Blending and Packaging. On March 1, 2019, the first department, Blending, had a zero beginning balance. During March, 40,000 gallons were started into production. During the month, 32,000 gallons were completed, and 8,000 remained in process, partially completed Conversion costs are added evenly throughout each process and direct materials are added at the beginning of each process During March, the Blending Department incurred $48,000 in direct materials costs and $211,600 in conversion costs. At the end of the month, the ending inventory in the Blending Department was 60% complete with respect to conversion costs Compute the Blending Department's cost of ending work in process inventory for March. 4. Baldini Manufacturing is a family-owned furniture company in Italy. The company uses a job-order costing system and applies overhead to jobs using a predetermined overhead mate based on machine-hours. At the beginning of the year, the company estimated that it would work 75,000 machine-hours and incur $900,000 in manufacturing overhead cost. The company's cost records revealed the following actual cost and operating data for the year: 20,000 S820.000 Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process Finished goods Cost of goods sold $40,000 $120,000 $500,000 $1.200.000 a Compute the underapplied or overapplied overhead. b. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry 1. Explain the similarities and differences between job-order costing systems and process costing systems List three Kuwaiti companies that would likely use a job-order costing system and three other companies that would likely use a process costing (you can list manufacturing and/or service companies). Explain your answer (why do you think these companies would be using such costing systems?) 2. Weston Products manufactures an industrial cleaning compound that goes through three processing departments - Department , Department 2 and Department 3. The company uses a process costing system. Weston incurred the following costs during the year 2019, to produce 5.000 units. Department Department 2 Department 3 $17.500 $8,000 $4,000 If Weston could sell only 4,000 units in 2019, what will be the cost per unit produced? 3. Gitano Manufacturing uses the weighted average method in its process costing system. It manufactures a product that passes through two processing departments-Blending and Packaging. On March 1, 2019, the first department, Blending, had a zero beginning balance. During March, 40,000 gallons were started into production. During the month, 32,000 gallons were completed, and 8,000 remained in process, partially completed Conversion costs are added evenly throughout each process and direct materials are added at the beginning of each process During March, the Blending Department incurred $48,000 in direct materials costs and $211,600 in conversion costs. At the end of the month, the ending inventory in the Blending Department was 60% complete with respect to conversion costs Compute the Blending Department's cost of ending work in process inventory for March. 4. Baldini Manufacturing is a family-owned furniture company in Italy. The company uses a job-order costing system and applies overhead to jobs using a predetermined overhead mate based on machine-hours. At the beginning of the year, the company estimated that it would work 75,000 machine-hours and incur $900,000 in manufacturing overhead cost. The company's cost records revealed the following actual cost and operating data for the year: 20,000 S820.000 Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process Finished goods Cost of goods sold $40,000 $120,000 $500,000 $1.200.000 a Compute the underapplied or overapplied overhead. b. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts