Question: The Case above is 6.1 The case above is 6.9 Read Case 6.1 and 6.9 and answer the question below in at least 100 words:

The Case above is 6.1

The Case above is 6.1

The case above is 6.9

The case above is 6.9

Read Case 6.1 and 6.9 and answer the question below in at least 100 words:

Q) What ethical standards should apply in foreign countries? Should U.S. companies follow U.S. standards?

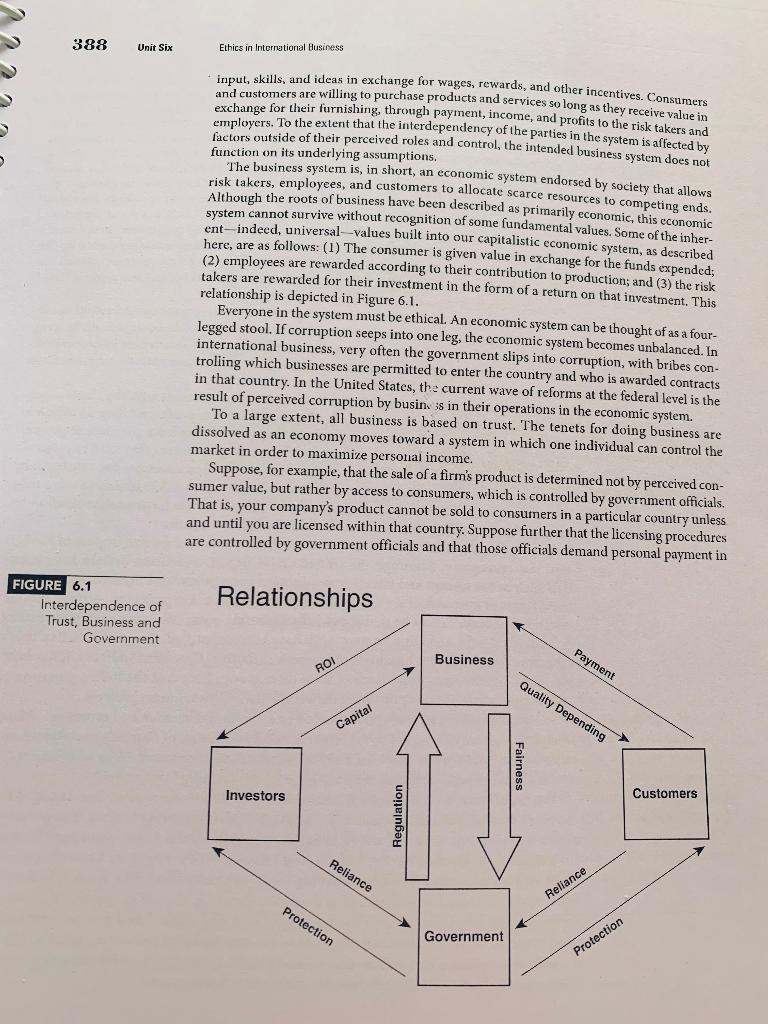

Conflicts between the Corporation's Ethics and Business Practices in Foreign Countries Reading 6.1 Why an International Code of Ethics Would Be Good for Business The global market presents firms with more complex ethical issues than they would expe- rience if operations were limited to one country and one culture. Moral standards vary across cultures. In some cases, cultures change and evolve to accept conduct that was not previously acceptable. For example, in some countries, it is permissible for donors to sell body organs for transplantation. Residents of other countries have sold their kidneys to buy televisions or just to improve their standard of living. In the United States, the buy- ing and selling of organs by individuals is not permitted, but recently experts have called for such a system as a means of resolving the supply-and-demand dilemma that exists because of limited availability of donors and a relative excess of needy recipients. In many executive training seminars for international business, executives are taught to honor customs in other countries and to "do as the Romans do" Employees are often confused by this direction. A manager for a U.S. title insurer provides a typical example. He complained that if he tipped employees in the U.S. public-recording agencies for expediting property filings, the manager would not only be violating the company's code of ethics but could also be charged with violations of the Real Estate Settlement Procedures Act and state and federal antibribery provisions. Yet, that same type of practice is permitted, recognized, and encouraged in other countries as a cost of doing business. Paying a regulatory agency in the United States to expe- dite a licensing process would be considered bribery of a public official. Yet, many businesses maintain that they cannot obtain such authorizations to do business in other countries unless such payments are made. So-called "grease," or facilitation, payments are permitted under the Foreign Corrupt Practices Act, but legality does not necessarily make such payments ethical An inevitable question arises when custom and culture clash with ethical standards and moral values adopted by a firm. Should the national culture or the company code of ethics be the controlling factor? Typical business responses to the question of whether cultural norms or company codes of ethics should take precedence in international business operations are the following: Who am I to question the culture of another country? Who am I to impose U.S. standards on all the other nations of the world? Isn't legality the equivalent of ethical behavior? The attitude of businesses is one that permits ethical deviations in the name of cultural sensi- tivity. Many businesses fear that the risk of offending is far too high to impose U.S. ethical standards on the conduct of business in other countries. 'From Larry Smeltzer and Marianne M. Jennings, "Why an International Code of Business Ethics Woula Be Good for Business," Journal of Business Ethics 17, 1998, pp. 57-66. ronal, or duplicated, in whole or in part. Due to electronic rights, rome thund party content may be suppressed from the Rock and Chapteris) Comercoming reserves the right to move in whole nr in nart Wrn 09.200.913 o remove additional contestat any time if subsequent rights restrictions require it. Conflicts between the Corporation's Ethics and Business Practices in foreign countries Section 387 One of the misunderstandings of U.S.-based businesses is that ethical standards in the United States vary significantly from the ethical standards in other countries. Operating under this misconception can create a great deal of ethical confusion among employees. What is known as the "Golden Rule" in the United States actually has existed for some time in other religions and cultures and among philosophers. Following is a list of how this simple rule is phrased in different writings. The principle is the same even if the words vary slightly. Strategically, businesses and their employees are more comfortable when they operate under uniform standards. This simple rule may provide them with that standard. Categorical Imperative: How Would You Want to Be Treated? Would you be comfortable with a world in which your standards were followed? Christian Principle: "The Golden Rule": And as yo would that men should do to you, do ye also to them likewise --Luke 6:31 Thou shalt love ... thy neighbor as thyself - Luke 10:27 Confucius: What you do not want or to yourself, do not do to others. Aristotle: We should behave to our friends as we wish our friends to behave to us. Judaism: What you hate, do not do to anyone. Buddhism: Hurt not others with that which pains thyself. Islam: No one of you is a believer until he loves for his brother what he loves for himself. Hinduism: Do nothing to thy neighbor which thou wouldst not have him do to thee. Sikhism: Treat others as you would be treated yourself. Plato: May I do to others as / would that they do unto me. The successful operation of commerce is dependent on an ethical business foundation. A look at the three major parties in business explains this point. These parties are the risk takers, the employees, and the customers. Risk takers-those furnishing the capital neces- sary for production-are willing to take risks on the assumption that their products will be judged by customers' assessment of their value. Employees are willing to offer production 388 Unit Six Unit Six Ethics in International Husiness input, skills, and ideas in exchange for wages, rewards, and other incentives. Consumers and customers are willing to purchase products and services so long as they receive value in employers. To the extent that the interdependency of the parties in the system is affected by factors outside of their perceived roles and control, the intended business system does not function on its underlying assumptions. The business system is in short, an economic system endorsed by society that allows risk takers, employees, and customers to allocate scarce resources to competing ends. system cannot survive without recognition of some fundamental values. Some of the inher- (2) employees are rewarded according to their contribution to production; and (3) the risk here, are as follows: (1) The consumer is given value in exchange for the funds expended; takers are rewarded for their investment in the form of a return on that investment. This relationship is depicted in Figure 6.1. Everyone in the system must be ethical . An economic system can be thought of as a four- legged stool. If corruption seeps into one leg, the economic system becomes unbalanced. In international business, very often the government slips into corruption, with bribes con trolling which businesses are permitted to enter the country and who is awarded contracts in that country. In the United States, the current wave of reforms at the federal level is the result of perceived corruption by busin, as in their operations in the economic system. To a large extent, all business is based on trust. The tenets for doing business are dissolved as an economy moves toward a system in which one individual can control the market in order to maximize personal income. Suppose, for example, that the sale of a firm's product is determined not by perceived con- sumer value, but rather by access to consumers, which is controlled by government officials. That is, your company's product cannot be sold to consumers in a particular country unless and until you are licensed within that country. Suppose further that the licensing procedures are controlled by government officials and that those officials demand personal payment in FIGURE 6.1 Interdependence of Trust, Business and Government Relationships Payment Business ROI Quality Depending Capital Fairness Investors Customers Reliance Reliance Protection Government Protection Conflicts between the Corporation's Ethics and Business Practices in Foreign countries 389 Section A exchange for your company's right to even apply for a business license. Payment size may be the system have been changed. Consumers no longer directly determine the demand. arbitrarily determined by officials who withhold portions for themselves. The basic values of Beyond just the impact on the basic economic system, ethical breaches involving grease payments introduce an element beyond a now recognized component in economic performance: consumer confidence in long-term economic performance. Economist Douglas Brown has described the differences between the United States and other coun- italil plaining why capitalism works here and not in all nations. His theory is that cap- be possible, about the basic cu si dependent on an interdependent system of production. For economic entertain hat othe concept of a level playing field, and about the absence of corruption. To the extent risk takers, and en feel comfortable about a market driven by the capitalism will be made. Significant monetary costs are incurred by business systems based sumptions, the investment and commitments necessary for economic growth via on other than In developing countries where there are speed; or grease , payments and resulting cor- ruption by government officials , the actual money involved may not be significant in terms of the nation's culture. Such activities and payments introduce an element of demoralizar takers to step forward tion and cynicism that thwart entrepreneurial activity when these nations most need risk Bribes and guanxi (gifts) in China given to establish connections with the Chinese gov- ernment are estimated at 3% to 5% of operating costs for companies, totaling $3 billion to $5 billion of foreign investment in 1993. But China incurs costs from the choices govern- ment officials make in return for payments. For example, guanxi are often used to persuade government officials to transfer government assets to foreign investors for substantially less than their value. Chinese government assets have fallen over $50 billion in value over the same period of economic growth, primarily because of the large undervaluation by government officials in these transactions with foreign companies. Perhaps Italy and Brazil provide the best examples of the long-term impact of foreign business corruption. Although the United States, Japan, and Great Britain have scan- dals such as the savings and loan failures, political corruption, and insurance regulation, these forms of misconduct are not indicative of corruption that pervades entire economic systems. The same cannot be said about Italy. Elaborate connections between government officials, the Mafia, and business executives have been unearthed. As a result, half of Italy's cabinet has resigned, and hundreds of business executives have been indicted. It has been estimated that the interconnections of these three groups have cost the Italian government $200 billion, as well as compromising the completion of government projects. In Brazil, the level of corruption has led to a climate of murder and espionage. Many foreign firms have elected not to do business in Brazil because of so much uncertainty and risk- beyond the normal financial risks of international investment. Why send an execu- tive to a country where officials may use force when soliciting huge bribes? The Wall Street Journal offered an example of how Brazil's corruption has damaged the country's economy despite growth and opportunity in surrounding nations. The governor of the northeastern state of Paraiba in Brazil, Ronaldo Cunha Lima, was angry because his predecessor, Tarcisio Burity, had accused Limas son of corruption. Lima shot Burity twice in the chest while Burity was having lunch at a restaurant. The speaker of Brazil's Senate praised Lima for his courage in doing the shooting himself as opposed to sending from prosecution by Paraiba's state legislature. No one spoke for the victim, and the lack of someone else. Lima was given a medal by the local city council and granted immunity support was reflective of a culture controlled by self-interest that benefits those in control. Unfortunately, these self-interests preclude economic development. Unit Six Ethics in International Business Economists in Brazil document hyperinflation and systemic corruption. A So Paulo businessman observed, The fundamental reason we can't get our act together is we're an amoral society." This businessperson probably understands capitalism. Privatization that has helped the economies of Chile, Argentina, and Mexico cannot take hold in Brazil because government officials enjoy the benefits of generous wages and returns from the businesses they control. The result is that workers are unable to earn enough even to clothe their families; 20% of the Brazilian population lives below the poverty line; and crime has reached levels of nightly firefights. Brazil's predicament has occurred over time, as graft, collusion, and fraud have become entrenched in the government-controlled economy. Discussion Questions 1. What did you learn about universal values and eth- ics from the categorical imperative list? 2. What happens when a society does not have ethical standards? Be sure to discuss the example of the situation in Brazil. 3. Who are the victims of corruption and graft? 4. Do you think following U.S. ethical standards in other countries is wise? Would it be unethical not to follow those standards? Explain your answer. Coco 62 Nome 99 ... Reading 6.9 A Primer on the FCPA 52 Perhaps the most widely known criminal statute affecting firms that operate internation- ally is the Foreign Corrupt Practices Act (FCPA; 15 U.S.C. $$ 78dd-1). The FCPA applies to business concerns that have their principal offices in the United States. It contains antibrib- ery provisions as well as accounting controls for these firms and was passed to curb the use of bribery in foreign operations of these companies. History, Purpose, and Application of the FCPA First passed in 1977, the FCPA is the result of an investigation by the Securities and Exchange Commission (SEC) that uncovered questionable foreign payments by large stock issuers who were based in the United States. Approximately 435 U.S. corporations made improper or questionable payments totaling $300 million in Japan, the Netherlands, and Korea. The FCPA prohibits making, authorizing, or promising payments or gifts of money or anything of value to government and NGO officials with the intent to corrupt for the pur- pose of obtaining or retaining business for or with or directing business. That one-sentence prohibition has many components, and those components are covered in the following subsections. What Constitutes a Payment under the FCPA? The decisions in cases and Justice Department guidelines have given us the following: cash, country club memberships, excessive comped travel travel that does not include seminars or presentations and consists of, for example, shopping trips to Paris for government offi- cials or their spouses), cash donations to political parties, payment of cell phone or utility bills for government officials, and giving luxury gifts such as sports cars and furs to gov- ernment officials or their spouses. In 2012, the Justice Department first published its Resource Guide for the Foreign Corrupt Practices Act (FCPA). The 130-page guide, which is available online, is updated annually and includes the kinds of things companies can do that are not prohibited. For example, the following are not violations of FCPA according to the guide: 1. Small gifts of expressions of gratitude, provided there is transparency in the giving 2. Small gifts to local charities, provided the gift is consistent with the company's general philanthropic goals and is not "large" 3. Wedding gift to a government official (if not too large) sAdapted from Marianne M. Jennings, Business: Its Legal, Ethical, and Global Environment, 11th ed 411 Er duplicated in whole or in part. Due to electronic rights, some third party content may be suppressed from the Book and/or chapters) the right to additional -12 Unit Six Ethics in International Business 4. Hats, t-shirts, pins, and pens that companies offer at trade show booths that government officials take 5. Payment of the bar tab for drinks for government officials at a group meeting 6. Payment for travel (even including cab fare, but not chauffeur driven limos) and reasonable meals to the United States for training at a company's facility foreign dignitaries can even take in a baseball garne at company expense during such training without the company risking an FCPA violation Payments to foreign officials for "facilitation" often referred to as grease payments, are not prohibited under FCPA so long as these payments are made only to get the officials to do jobs that they might not do ordinarily or would do slowly without some payment. More detail on facilitation payments follows. What Is "Obtaining, Retaining, or Directing Business"? The types of activities included under obtaining, retaining, or directing business" are the following: winning contracts, influencing a procurement process, circumventing rules in order to get products imported, gaining access to non-public bid information, evading taxes or penalties, influencing the outcome of lawsuits or regulatory actions, obtaining exceptions to regulations, avoiding contract termination, asking regulators or officials to exclude your competitors from their country, evading customs duties, and extending drilling contracts. For example, if an American company trying to win a bid on a contract for the con- struction of highways in a foreign country paid a government official there who was responsible for awar 'ing such construction contracts a "consulting fee" of $25,000, the American company would be in violation of the FCPA. The payment was of money; it was made to a foreign official; and it was made for the purpose of obtaining business within that country. Titan Corporation violated the FCPA when money it paid to an agent in Benin was passed along to the reelection campaign of the president of Benin. The result was an increased management fee for Titan's operation of the telecommunications system in Benin. The payments were uncovered as Lockheed Martin was conducting due diligence for purposes of a merger with Titan. Titan voluntarily disclosed the payment and paid a total fine of $28.5 million as follows: $13 million criminal penalty, $12.6 million disgorge- ment (benefit), and $2.9 million in interest. Who Is Covered under FCPA? The types of officials covered under the FCPA (to whom gifts may not be directed) include foreign officials, political parties, party officials, candidates for office, and any NGO. Using any person who will transmit the gift or money to one of the other types of people also is prohibited. Changes in 1998 added the NGO coverage so that officials such as those with the United Nations, the Olympics, or the IMF are now covered under the act. The bribery involved in awarding the 2002 Olympics held in Salt Lake City resulted in this expansion of the statute's coverage. The international 2015 FIFA investigation that resulted in FCPA charges is another example of an NGO (The International Federation of Association Foot- ball) being subjected to the antibribery laws (see Case 6.10). Use of Agents and the FCPA When the FCPA was passed initially, many companies tried to find ways around the bribery prohibitions. Companies would hire foreign agents or consultants to help them gain busi- ness in countries and allowed these "third parties" to act independently. However, many of these consultants paid others who then paid bribes to officials. Under the FCPA, even these types of arrangements can constitute a violation if the consulting fees are high, odd payment arrangements occur, or the company has reason to know of a potential or actual violation. Companies must be able to establish that they have performed "due diligence" bhines. Grease Payments, and "When in Home ple, if a U.S. company hired a consultant who charged the company $25,000 in fees and in investigating those hired as their agents and consultants in foreign countries. For exam- $25,000 in expenses, the U.S. company would be, under Justice Department guidelines, of expenses are known as red flags for U.S. companies. The Justice Department uses this on notice for excessive expenses that could signal potential bribes being paid. These types information as a means of establishing intent, even when the company may not know pre- cisely what was done with the funds and what was paid to whom. The FCPA and "Grease" or Facilitation Payments Payments to foreign officials for "facilitation often referred to as grease payments, are not prohibited under FCPA so long as these payments are made only to get the officials These grease payments can be made for obtaining permits , licenses, or other official documents, processing governmental papers, such as visas and work orders; provid- ing police protection and mail pickup and delivery, providing phone service, power, and water supply; loading and unloading cargo or protecting perishable products; and scheduling inspections associated with contract performance or transit of goods across the country. Penalties for Violation of the FCPA Penalties for individuals who have violated the FCPA can run up to $250,000 per iolation and five years' imprisonment. Corporate fines can be up to $2 million per violation. Also, under the Alternative Fines Act, the Justice Department can seek to obtain twc times the benefit the bribe attempted to gain, known as disgorgement. For example, if a company paid a bribe to obtain a $100 million contract for computer services for a foreign govern- ment, the potential fine could be twice the profit on that contract, or $20 million if the profit on the contract was $10 million. The Justice Department and the SEC continue a steady stream of FCPA charges. During 2010, FCPA charges peaked at 74. In 2011, there were 48 charges and in 2012 only 23. From 2013 to 2015, there were 25 FCPA cases brought against many large companies, including Bristol-Meyers Squibb, Avon, Hitachi, Mead-Johnson, Goodyear, and Ralph Lauren Ralph Lauren Corporation reported that the Lauren Argentina subsidiary had been paying the customs agents in that country what was called "Loading and Delivery Expenses," ranging between $750 and $3,847 per payment, for a total of $593,000 over a five-year period in order to get Lauren goods into the country. In addition, the customs agents were given purses and other high-dollar items in order to secure their favor for goods entry." Lauren paid a $1.6 million fine to settle the case and closed the Argentina subsidiary. For 2016, there were nine cases through June, including Och-Ziff Capital Management and Embraer. Och-Ziff, one of the largest hedge funds, paid bribes to senior government officials in Libya, the Democratic Republic of the Congo, Chad, and Niger. An Och-Ziff employee then ordered the removal of language from their internal audit report that called for an investigation of suspected bribery payments by a business partner. Och-Ziff paid a $213 million criminal penalty and agreed to have an independent compliance monitor to prevent future lapses under a deferred prosecution agreement. The U.S. Justice Department believes that, U.S. companies that are paying bribes to foreign officials are undermining government institutions around the world. It is a hugely SiPeter Lattman, "Ralph Lauren Corp. Agrees to Pay Fine in Bribery Case," New York Times. April 23, 2013 Unit Six Ethics in International Business 1 destabilizing force."* The Department prosecutes accordingly. Former Halliburton executive Albert J. Stanley (aka. Jack Stanley) received a seven-year sentence-the longest one ever imposed since the FCPA was passed in 1977.95 In 2008, Siemens agreed to pay a $800 million fine, the largest since the FCPA passage. The FCPA and U.S. Competitiveness One of the long-standing concerns about the FCPA is whether it has placed U.S. businesses at a competitive disadvantage in those countries in which bribery is generally accepted as a way to win contracts and government benefits. However, a survey by the US Government Accounting Office of the companies affected by the FCPA found that the ability of compa- nies from other countries to bribe officials did not give them a competitive advantage. The survey found that U.S. trade increased in 51 of 56 foreign countries after the FCPA went into effect. The increase was attributed to the position adopted by U.S. companies with respect to their competitors--if they could not bribe government officials, they would dis- close publicly information about bribes made by any of the companies from other nations. FCPA and the Organization for Economic Cooperation and Development (OECD) The Organization for Economic Cooperation and Development (OECD) is now support- ive of the U.S. FCPA and its principles. Member countries have enacted legislation foi om- pliance with its international pact against bribery. The OECD's 38 members56 now work together to investigate companies' activities across borders. However, only the United States, Germany, Norway, and Switzerland actively enforce their antibribery statutes. The British version of the FCPA took effect in July 2011 and has required significant changes in companies in terms of compliance and monitoring payments. When Congress amended the FCPA to implement the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, the amendments expanded the act's jurisdiction to cover all U.S. citizens acting outside the United States and all non-U.S. citizens acting inside the United States. The convention basically adopts the standards of the United States under the FCPA and requires nations signing the agreement to impose criminal penalties, seize profits earned through bribery, and rein in government officials who accept illicit payments by actively prosecuting them along with the companies making the payments. Discussion Questions 1. Explain the difference between a bribe and a facili- tation payment. 2. Discuss the responsibilities of companies in pre- venting FCPA violationsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts