Question: #1 fill in blank, debt financing ... its normal target (beyond / equal to) #2 is answers are shown. Not sure if the last answer

#1 fill in blank, "debt financing ... its normal target" (beyond / equal to)

#1 fill in blank, "debt financing ... its normal target" (beyond / equal to)

#2 is answers are shown.

Not sure if the last answer is correct "Which of the two theories.."

If correct I will make sure to thumbs up, thank you!

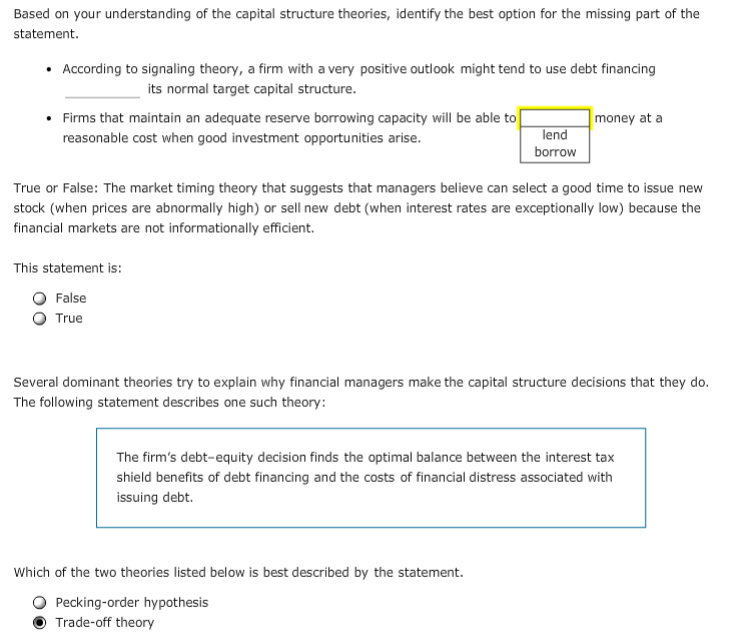

Based on your understanding of the capital structure theories, identify the best option for the missing part of the statement According to signaling theory, a firm with a very positive outlook might tend to use debt financing ts normal target capital structure. Firms that maintain an adequate reserve borrowing capacity will be able to money at a lend borrow reasonable cost when good investment opportunities arise. True or False: The market timing theory that suggests that managers believe can select a good time to issue new stock (when prices are abnormally high) or sell new debt (when interest rates are exceptionally low) because the financial markets are not informationally efficient. This statement is: O False O True Several dominant theories try to explain why financial managers make the capital structure decisions that they do The following statement describes one such theory: The firm's debt-equity decision finds the optimal balance between the interest tax shield benefits of debt financing and the costs of financial distress associated with issuing debt. Which of the two theories listed below is best described by the statement. O Pecking-order hypothesis Trade-off theory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts