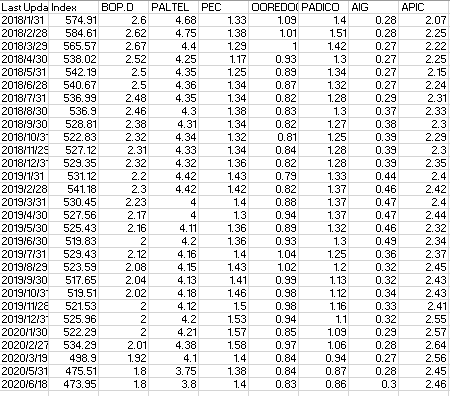

Question: 1. Find EPS? 2.Using a P/E multiple approach and assuming an average P/E ratio for the investment industry of 15.57, what is PADICO intrinsic value?

1. Find EPS?

2.Using a P/E multiple approach and assuming an average P/E ratio for the investment industry of 15.57, what is PADICO intrinsic value? (assuming 250,000,000 shares outstanding)

3.Based on the P/E multiple approach and current trading price, is PADICO overvalued or undervalued?

Last Upda Index 2018/1/31 574.91 2018/2/28 584.61 2018/3/29 565.57 2018/4/30 538.02 2018/5/31 542.19 2018/6/28 540.67 2018/7/31 536.99 2018/8/30 536.9 2018/9/30 528.81 2018/10/3 522.83 2018/11/25 527.12 2018/12/3 529.35 2019/1/31 531.12 2019/2/28 541.18 2019/3/31 530.45 2019/4/30 527.56 2019/5/30 525.43 2019/6/30 519.83 2019/7/31 529.43 2019/8/29 523.59 2019/9/30 517.65 2019/10/31 519.51 2019/11/28 521.53 2019/12/3 525.96 2020/1/30 522.29 2020/2/27 534.29 2020/3/19 498.9 2020/5/31 475.51 2020/6/18 473.95 BOP.D PALTEL PEC 2.6 4.68 2.62 4.75 2.67 4.4 2.52 4.25 2.5 4.35 2.5 4.36 2.48 4.35 2.46 4.3 2.38 4.31 2.32 4.34 2.31 4.33 2.32 4.32 2.2 4.42 2.3 4.42 2.23 4 2.17 4 2.16 4.11 2 4.2 2.12 4.16 2.08 4.15 2.04 4.13 2.02 4.18 4.12 4.2 4.21 2.01 4.38 1.92 4.1 1.8 3.75 1.8 3.8 OOREDOI PADICO AIG 1.33 1.09 1.4 1.38 1.01 1.51 1.29 1 1.42 1.17 0.93 1.3 1.25 0.89 1.34 1.34 0.87 1.32 1.34 0.82 1.28 1.38 0.83 1.3 1.34 0.82 1.27 1.32 0.81 1.25 1.34 0.84 1.28 1.36 0.82 1.28 1.43 0.79 1.33 1.42 0.82 1.37 1.4 0.88 1.37 1.3 0.94 1.37 1.36 0.89 1.32 1.36 0.93 1.3 1.4 1.04 1.25 1.43 1.02 1.2 1.41 0.99 1.13 1.46 0.98 1.12 1.5 0.98 1.16 1.53 0.94 1.1 1.57 0.85 1.09 1.58 0.97 1.06 1.4 0.84 0.94 1.38 0.84 0.87 1.4 0.83 0.86 APIC 0.28 2.07 0.28 2.25 0.27 2.22 0.27 2.25 0.27 2.15 0.27 2.24 0.29 2.31 0.37 2.33 0.38 2.3 0.39 2.29 0.39 2.3 0.39 2.35 0.44 2.4 0.46 2.42 0.47 2.4 0.47 2.44 0.46 2.32 0.49 2.34 0.36 2.37 0.32 2.45 0.32 2.43 0.34 2.43 0.33 2.41 0.32 2.55 0.29 2.57 0.28 2.64 0.27 2.56 0.28 2.45 0.3 2.46 NNN Last Upda Index 2018/1/31 574.91 2018/2/28 584.61 2018/3/29 565.57 2018/4/30 538.02 2018/5/31 542.19 2018/6/28 540.67 2018/7/31 536.99 2018/8/30 536.9 2018/9/30 528.81 2018/10/3 522.83 2018/11/25 527.12 2018/12/3 529.35 2019/1/31 531.12 2019/2/28 541.18 2019/3/31 530.45 2019/4/30 527.56 2019/5/30 525.43 2019/6/30 519.83 2019/7/31 529.43 2019/8/29 523.59 2019/9/30 517.65 2019/10/31 519.51 2019/11/28 521.53 2019/12/3 525.96 2020/1/30 522.29 2020/2/27 534.29 2020/3/19 498.9 2020/5/31 475.51 2020/6/18 473.95 BOP.D PALTEL PEC 2.6 4.68 2.62 4.75 2.67 4.4 2.52 4.25 2.5 4.35 2.5 4.36 2.48 4.35 2.46 4.3 2.38 4.31 2.32 4.34 2.31 4.33 2.32 4.32 2.2 4.42 2.3 4.42 2.23 4 2.17 4 2.16 4.11 2 4.2 2.12 4.16 2.08 4.15 2.04 4.13 2.02 4.18 4.12 4.2 4.21 2.01 4.38 1.92 4.1 1.8 3.75 1.8 3.8 OOREDOI PADICO AIG 1.33 1.09 1.4 1.38 1.01 1.51 1.29 1 1.42 1.17 0.93 1.3 1.25 0.89 1.34 1.34 0.87 1.32 1.34 0.82 1.28 1.38 0.83 1.3 1.34 0.82 1.27 1.32 0.81 1.25 1.34 0.84 1.28 1.36 0.82 1.28 1.43 0.79 1.33 1.42 0.82 1.37 1.4 0.88 1.37 1.3 0.94 1.37 1.36 0.89 1.32 1.36 0.93 1.3 1.4 1.04 1.25 1.43 1.02 1.2 1.41 0.99 1.13 1.46 0.98 1.12 1.5 0.98 1.16 1.53 0.94 1.1 1.57 0.85 1.09 1.58 0.97 1.06 1.4 0.84 0.94 1.38 0.84 0.87 1.4 0.83 0.86 APIC 0.28 2.07 0.28 2.25 0.27 2.22 0.27 2.25 0.27 2.15 0.27 2.24 0.29 2.31 0.37 2.33 0.38 2.3 0.39 2.29 0.39 2.3 0.39 2.35 0.44 2.4 0.46 2.42 0.47 2.4 0.47 2.44 0.46 2.32 0.49 2.34 0.36 2.37 0.32 2.45 0.32 2.43 0.34 2.43 0.33 2.41 0.32 2.55 0.29 2.57 0.28 2.64 0.27 2.56 0.28 2.45 0.3 2.46 NNN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts