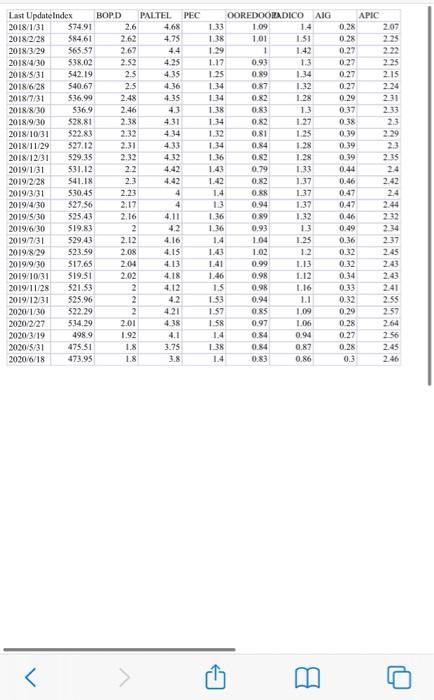

Question: please answer as soon as Last UpdateIndex BOPD PALTEL PEC 2018/1/31 574.91 2.6 4.68 2018/2/28 584,61 2.62 4.75 2018/3/29 565 57 2.67 4.4 2018/4/30 538.02

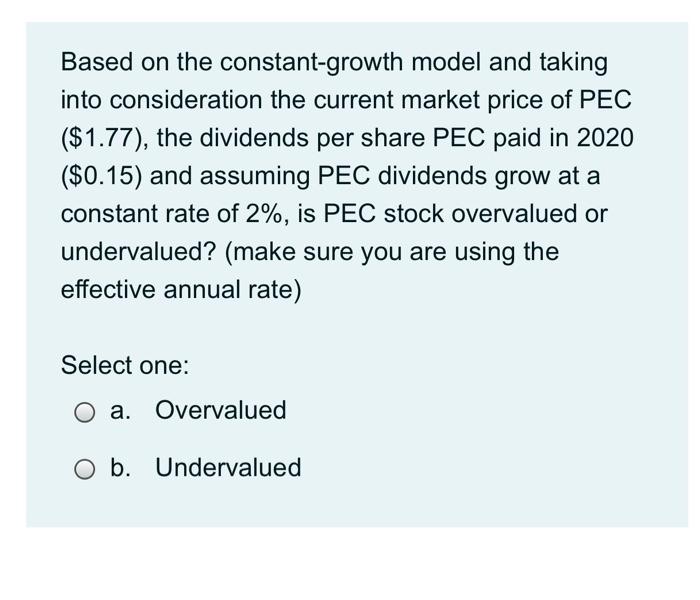

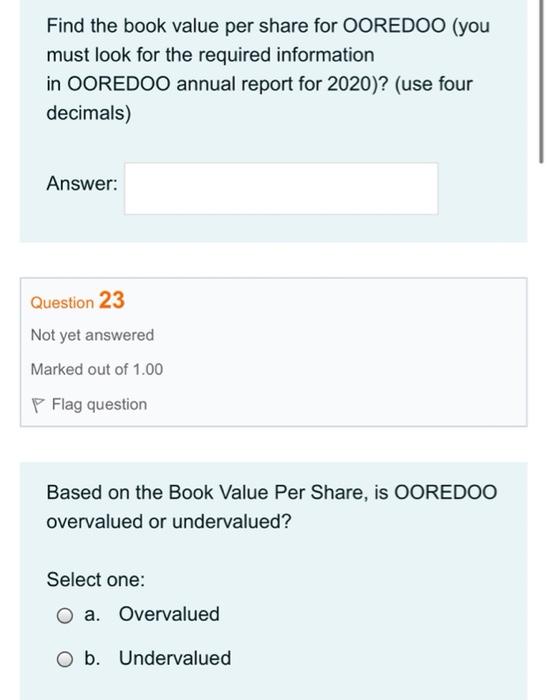

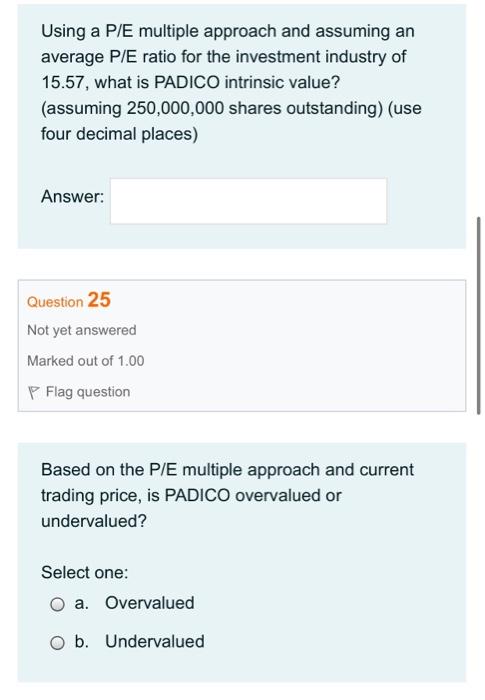

Last UpdateIndex BOPD PALTEL PEC 2018/1/31 574.91 2.6 4.68 2018/2/28 584,61 2.62 4.75 2018/3/29 565 57 2.67 4.4 2018/4/30 538.02 2.52 4.25 2018/5/31 542.19 25 4.35 2018/628 540.67 2.5 4.36 2018/7/31 536.99 2.48 4.35 2018/8/30 $36.9 2.46 4.3 2018/9/30 528.81 2.38 431 2018/10/31 $22.83 2.32 4 34 2018/11/29 527.12 2.31 4.33 2018/12/31 529.35 2.32 4.32 2019/1/31 531.12 22 4.42 2019/2/28 541.18 2.3 4.42 2019/3/31 530.45 2.23 4 2019/4/30 527.56 2.17 4 2019/5/30 525 43 2.16 4.11 2019/6/30 519.83 2 2019/7/31 529.43 2.12 4.16 2019/8/29 523.59 2.08 4.15 2019/9/30 $17.65 2.04 4.13 2019/10/31 319.51 2.02 4.18 2019/11/28 $21.53 2 4.12 2019/12/31 525.96 2 42 2020/1/30 522.29 2 421 2020/2/27 534,29 2.01 4.38 2020/3/19 4989 1.92 2020/5/31 475.51 1.8 3.75 20206/18 473.95 1.8 3.8 OOREDOORDICO AIG APIC 1.33 1.09 1.4 0.28 2.07 1.38 1.01 1.51 0.28 225 1.29 1 1.42 0.27 2.22 1.17 0.93 1.3 0.27 225 1.25 0.89 1.34 0.27 215 1.34 0.87 1.32 0.27 2.24 1.34 0.82 1.28 0.29 231 1.38 0.83 1.3 0.37 233 1.34 0.82 1.27 0.38 2.3 1.32 0.81 1.25 0.39 2.29 1.34 0.84 1.28 0.39 2.3 1.36 0.82 1.28 0.39 235 1.43 0.79 1.33 0.44 2.4 1.42 0.82 1.37 0.46 2.42 1.4 0.X 1.37 0.47 24 1.3 0.94 1.37 0.47 2.44 1.36 0.89 1.32 0.46 1.36 0.93 1.3 0.49 1.4 1.04 1.25 0.36 237 1.43 1.02 1.2 0.32 2.45 1.41 0.99 1.13 0132 2.43 1.46 0.98 1.12 0.34 2.43 1.5 0.98 1.16 0.33 2.41 1.53 0.94 1.1 0.32 2.55 1.57 0.85 1.09 0.29 2.57 1.58 0.97 0.28 264 1.4 0.84 0.94 0.27 256 1.38 0.84 0.87 1.4 0.83 0.86 0.3 2.46 42 2.34 1 06 4.1 028 245 Based on the constant-growth model and taking into consideration the current market price of PEC ($1.77), the dividends per share PEC paid in 2020 ($0.15) and assuming PEC dividends grow at a constant rate of 2%, is PEC stock overvalued or undervalued? (make sure you are using the effective annual rate) Select one: O a. Overvalued O b. Undervalued Find the book value per share for OOREDOO (you must look for the required information in OOREDOO annual report for 2020)? (use four decimals) Answer: Question 23 Not yet answered Marked out of 1.00 P Flag question Based on the Book Value Per Share, is OOREDOO overvalued or undervalued? Select one: a. Overvalued O b. Undervalued Using a P/E multiple approach and assuming an average P/E ratio for the investment industry of 15.57, what is PADICO intrinsic value? (assuming 250,000,000 shares outstanding) (use four decimal places) Answer: Question 25 Not yet answered Marked out of 1.00 P Flag question Based on the P/E multiple approach and current trading price, is PADICO overvalued or undervalued? Select one: O a. Overvalued O b. Undervalued Last UpdateIndex BOPD PALTEL PEC 2018/1/31 574.91 2.6 4.68 2018/2/28 584,61 2.62 4.75 2018/3/29 565 57 2.67 4.4 2018/4/30 538.02 2.52 4.25 2018/5/31 542.19 25 4.35 2018/628 540.67 2.5 4.36 2018/7/31 536.99 2.48 4.35 2018/8/30 $36.9 2.46 4.3 2018/9/30 528.81 2.38 431 2018/10/31 $22.83 2.32 4 34 2018/11/29 527.12 2.31 4.33 2018/12/31 529.35 2.32 4.32 2019/1/31 531.12 22 4.42 2019/2/28 541.18 2.3 4.42 2019/3/31 530.45 2.23 4 2019/4/30 527.56 2.17 4 2019/5/30 525 43 2.16 4.11 2019/6/30 519.83 2 2019/7/31 529.43 2.12 4.16 2019/8/29 523.59 2.08 4.15 2019/9/30 $17.65 2.04 4.13 2019/10/31 319.51 2.02 4.18 2019/11/28 $21.53 2 4.12 2019/12/31 525.96 2 42 2020/1/30 522.29 2 421 2020/2/27 534,29 2.01 4.38 2020/3/19 4989 1.92 2020/5/31 475.51 1.8 3.75 20206/18 473.95 1.8 3.8 OOREDOORDICO AIG APIC 1.33 1.09 1.4 0.28 2.07 1.38 1.01 1.51 0.28 225 1.29 1 1.42 0.27 2.22 1.17 0.93 1.3 0.27 225 1.25 0.89 1.34 0.27 215 1.34 0.87 1.32 0.27 2.24 1.34 0.82 1.28 0.29 231 1.38 0.83 1.3 0.37 233 1.34 0.82 1.27 0.38 2.3 1.32 0.81 1.25 0.39 2.29 1.34 0.84 1.28 0.39 2.3 1.36 0.82 1.28 0.39 235 1.43 0.79 1.33 0.44 2.4 1.42 0.82 1.37 0.46 2.42 1.4 0.X 1.37 0.47 24 1.3 0.94 1.37 0.47 2.44 1.36 0.89 1.32 0.46 1.36 0.93 1.3 0.49 1.4 1.04 1.25 0.36 237 1.43 1.02 1.2 0.32 2.45 1.41 0.99 1.13 0132 2.43 1.46 0.98 1.12 0.34 2.43 1.5 0.98 1.16 0.33 2.41 1.53 0.94 1.1 0.32 2.55 1.57 0.85 1.09 0.29 2.57 1.58 0.97 0.28 264 1.4 0.84 0.94 0.27 256 1.38 0.84 0.87 1.4 0.83 0.86 0.3 2.46 42 2.34 1 06 4.1 028 245 Based on the constant-growth model and taking into consideration the current market price of PEC ($1.77), the dividends per share PEC paid in 2020 ($0.15) and assuming PEC dividends grow at a constant rate of 2%, is PEC stock overvalued or undervalued? (make sure you are using the effective annual rate) Select one: O a. Overvalued O b. Undervalued Find the book value per share for OOREDOO (you must look for the required information in OOREDOO annual report for 2020)? (use four decimals) Answer: Question 23 Not yet answered Marked out of 1.00 P Flag question Based on the Book Value Per Share, is OOREDOO overvalued or undervalued? Select one: a. Overvalued O b. Undervalued Using a P/E multiple approach and assuming an average P/E ratio for the investment industry of 15.57, what is PADICO intrinsic value? (assuming 250,000,000 shares outstanding) (use four decimal places) Answer: Question 25 Not yet answered Marked out of 1.00 P Flag question Based on the P/E multiple approach and current trading price, is PADICO overvalued or undervalued? Select one: O a. Overvalued O b. Undervalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts