Question: 1) find risk free rate (rf) and expected return on market portfolio 2) what is the beta of the stock if your expectation is consistent

1) find risk free rate (rf) and expected return on market portfolio

2) what is the beta of the stock if your expectation is consistent with CAPM

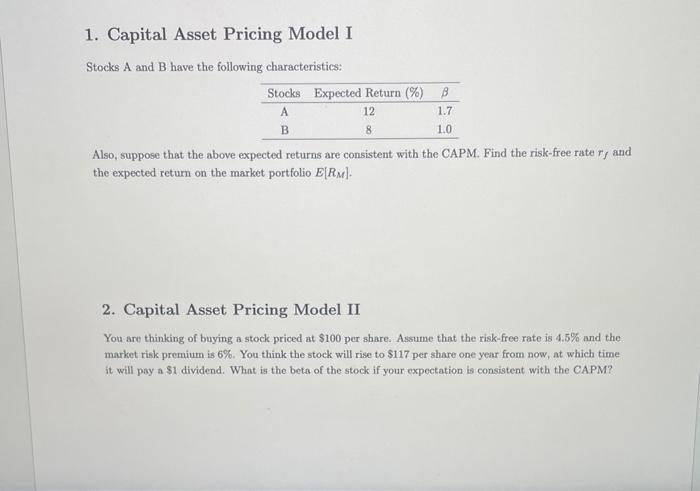

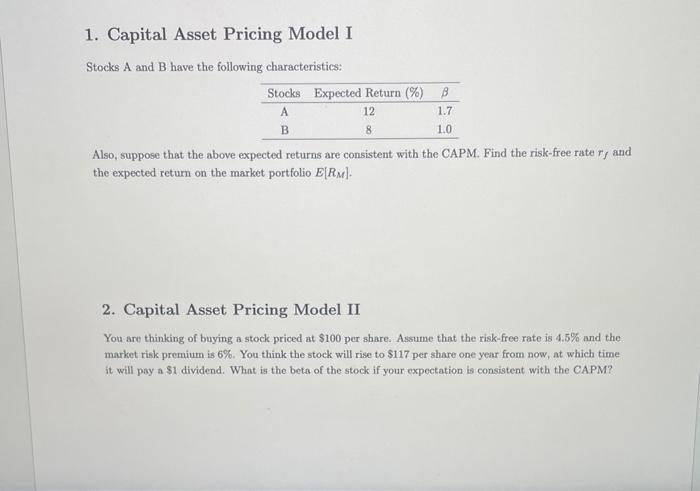

1. Capital Asset Pricing Model I Stocks A and B have the following characteristics: Also, suppose that the above expected returns are consistent with the CAPM. Find the risk-free rate rf and the expected return on the market portfolio E[RM]. 2. Capital Asset Pricing Model II You are thinking of buying a stock priced at $100 per share. Assume that the risk-free rate is 4.5% and the market risk premium is 6%. You think the stock will rise to $117 per share one year from now, at which time it will pay a $1 dividend. What is the beta of the stock if your expectation is consistent with the CAPM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock