Question: 1. Find the implied utilizations. a) (CPAs) = b) (RPs) = c) (AAs) = 2. Which resource is the bottleneck? a) 3. How many employees

1. Find the implied utilizations.

a) (CPAs) =

b) (RPs) =

c) (AAs) =

2. Which resource is the bottleneck?

a)

3. How many employees of each type should be employed to be able to handle the expected workload? (The firm will not employ part-time workers)

a) (CPAs) =

b) (RPs) =

c) (AAs) =

*Please provide Explanation and Formula

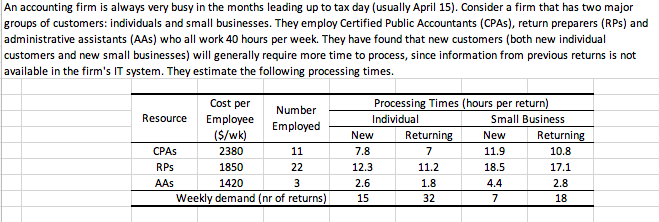

An accounting firm is always very busy in the months leading up to tax day (usually April 15). Consider a firm that has two major groups of customers: individuals and small businesses. They employ Certified Public Accountants (CPAs), return preparers (RPs) and administrative assistants (AAs) who all work 40 hours per week. They have found that new customers (both new individual customers and new small businesses) will generally require more time to process, since information from previous returns is not available in the firm's IT system. They estimate the following processing times. Cost per Number Resource Employee Employed ($/wk) CPAS 2380 11 RPS 1850 22 AAs 1420 3 Weekly demand (nr of returns) Processing Times (hours per return) Individual Small Business New Returning New Returning 7.8 7 11.9 10.8 12.3 11.2 18.5 17.1 2.6 1.8 4.4 2.8 15 32 7 18Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts