Question: 1 Find the Operating Cash Flows for each year (show your work/calculations). 2) Find the change in net working capital (NWC) for each year (show

1 Find the Operating Cash Flows for each year (show your work/calculations).

2) Find the change in net working capital (NWC) for each year (show your work/calculations).

3 Find Net Capital Spending (NCS) for each year, and the after tax cash flow from the sale of assets in year 4 (show your work/calculations).

4 Find the CFFA for each year (show your work/calculations).

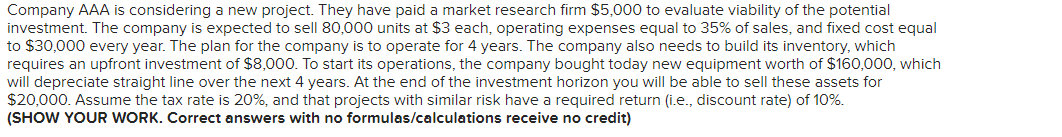

Company AAA is considering a new project. They have paid a market research firm $5,000 to evaluate viability of the potential investment. The company is expected to sell 80,000 units at $3 each, operating expenses equal to 35% of sales, and fixed cost equal to $30,000 every year. The plan for the company is to operate for 4 years. The company also needs to build its inventory, which requires an upfront investment of $8,000. To start its operations, the company bought today new equipment worth of $160,000, which will depreciate straight line over the next 4 years. At the end of the investment horizon you will be able to sell these assets for $20,000. Assume the tax rate is 20%, and that projects with similar risk have a required return (i.e., discount rate) of 10% (SHOW YOUR WORK. Correct answers with no formulas/calculations receive no credit) Company AAA is considering a new project. They have paid a market research firm $5,000 to evaluate viability of the potential investment. The company is expected to sell 80,000 units at $3 each, operating expenses equal to 35% of sales, and fixed cost equal to $30,000 every year. The plan for the company is to operate for 4 years. The company also needs to build its inventory, which requires an upfront investment of $8,000. To start its operations, the company bought today new equipment worth of $160,000, which will depreciate straight line over the next 4 years. At the end of the investment horizon you will be able to sell these assets for $20,000. Assume the tax rate is 20%, and that projects with similar risk have a required return (i.e., discount rate) of 10% (SHOW YOUR WORK. Correct answers with no formulas/calculations receive no credit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts