Question: 1 Floating Rate Bonds Floating rate bonds, unlike regular fixed coupon bonds, have coupon rates that change based on prevailing term structure. This change takes

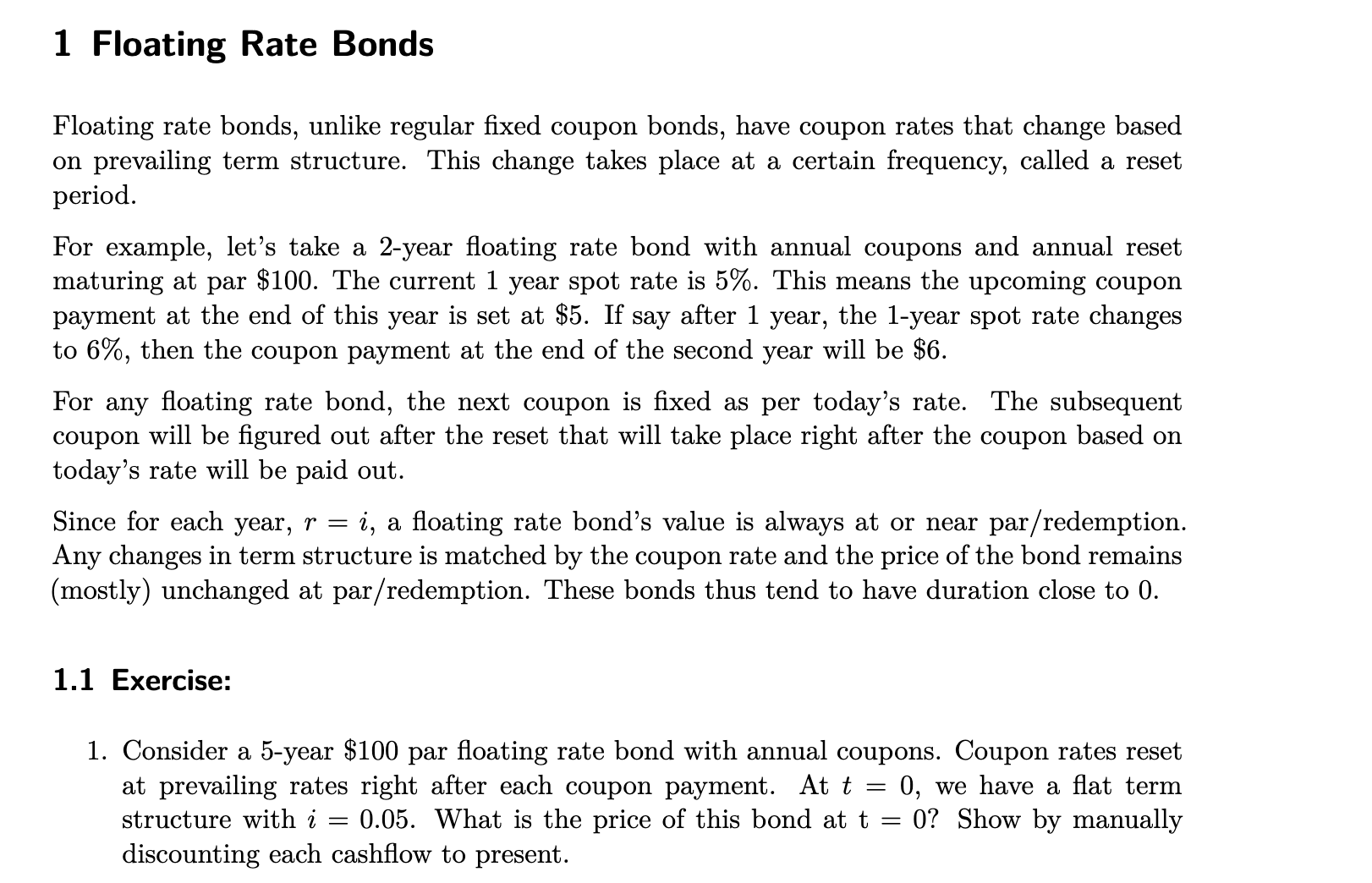

Floating Rate Bonds Floating rate bonds, unlike regular fixed coupon bonds, have coupon rates that change based on prevailing term structure. This change takes place at a certain frequency, called a reset period. For example, let's take a year floating rate bond with annual coupons and annual reset maturing at par $ The current year spot rate is This means the upcoming coupon payment at the end of this year is set at $ If say after year, the year spot rate changes to then the coupon payment at the end of the second year will be $ For any floating rate bond, the next coupon is fixed as per today's rate. The subsequent coupon will be figured out after the reset that will take place right after the coupon based on today's rate will be paid out. Since for each year, ri a floating rate bond's value is always at or near parredemption Any changes in term structure is matched by the coupon rate and the price of the bond remains mostly unchanged at parredemption These bonds thus tend to have duration close to Exercise: Consider a year $ par floating rate bond with annual coupons. Coupon rates reset at prevailing rates right after each coupon payment. At t we have a flat term structure with i What is the price of this bond at mathrmt Show by manually discounting each cashflow to present.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock