Question: 1. For Bears Enterprises, the equity valuation using Book Value is? Round to the nearest million and use the $ symbol.....for example, $238.7 million should

1. For Bears Enterprises, the equity valuation using Book Value is? Round to the nearest million and use the $ symbol.....for example, $238.7 million should be answered as $239.

2. For Bears Enterprises, what is the equity valuation using the market value methodology?

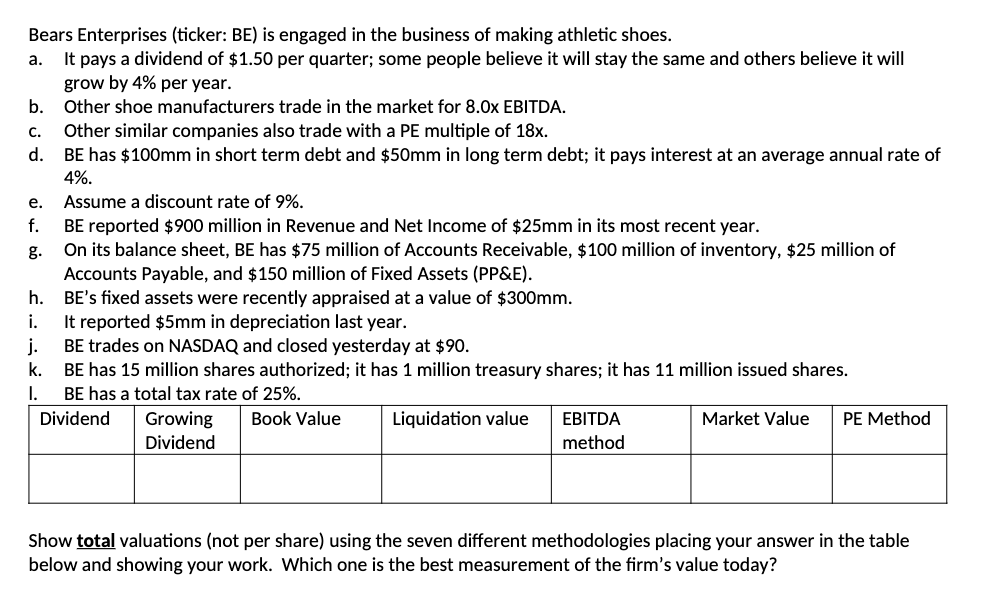

a. e. Bears Enterprises (ticker: BE) is engaged in the business of making athletic shoes. It pays a dividend of $1.50 per quarter; some people believe it will stay the same and others believe it will grow by 4% per year. b. Other shoe manufacturers trade in the market for 8.0x EBITDA. C. Other similar companies also trade with a PE multiple of 18x. d. BE has $ 100mm in short term debt and $50mm in long term debt; it pays interest at an average annual rate of 4%. Assume a discount rate of 9%. f. BE reported $900 million in Revenue and Net Income of $25mm in its most recent year. g. On its balance sheet, BE has $75 million of Accounts Receivable, $100 million of inventory, $25 million of Accounts Payable, and $150 million of Fixed Assets (PP&E). h. BE's fixed assets were recently appraised at a value of $300mm. i. It reported $5mm in depreciation last year. j. BE trades on NASDAQ and closed yesterday at $90. k. BE has 15 million shares authorized; it has 1 million treasury shares; it has 11 million issued shares. 1. BE has a total tax rate of 25%. Dividend Growing Book Value Liquidation value EBITDA Market Value PE Method Dividend method Show total valuations (not per share) using the seven different methodologies placing your answer in the table below and showing your work. Which one is the best measurement of the firm's value today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts