Question: 1. For two options, a call and a put, holding everything else constant, what will happen to the option price when: 1. volatility increases; 2.

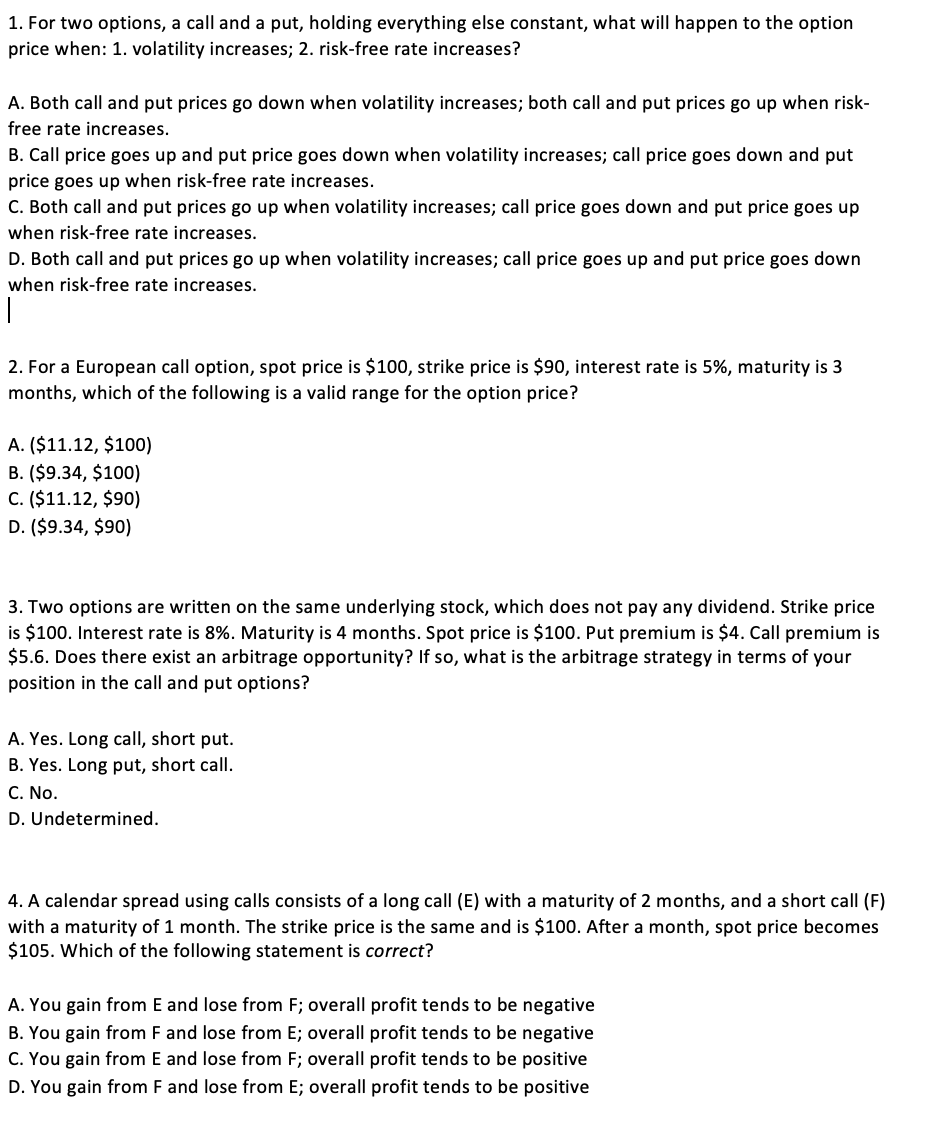

1. For two options, a call and a put, holding everything else constant, what will happen to the option price when: 1. volatility increases; 2. risk-free rate increases? A. Both call and put prices go down when volatility increases; both call and put prices go up when risk- free rate increases. B. Call price goes up and put price goes down when volatility increases; call price goes down and put price goes up when risk-free rate increases. C. Both call and put prices go up when volatility increases; call price goes down and put price goes up when risk-free rate increases. D. Both call and put prices go up when volatility increases; call price goes up and put price goes down when risk-free rate increases. 2. For a European call option, spot price is $100, strike price is $90, interest rate is 5%, maturity is 3 months, which of the following is a valid range for the option price? A. ($11.12, $100) B. ($9.34, $100) C. ($11.12, $90) D. ($9.34, $90) 3. Two options are written on the same underlying stock, which does not pay any dividend. Strike price is $100. Interest rate is 8%. Maturity is 4 months. Spot price is $100. Put premium is $4. Call premium is $5.6. Does there exist an arbitrage opportunity? If so, what is the arbitrage strategy in terms of your position in the call and put options? A. Yes. Long call, short put. B. Yes. Long put, short call. C. No. D. Undetermined. 4. A calendar spread using calls consists of a long call (E) with a maturity of 2 months, and a short call with a maturity of 1 month. The strike price is the same and is $100. After a month, spot price becomes $105. Which of the following statement is correct? A. You gain from E and lose from F; overall profit tends to be negative B. You gain from Fand lose from E; overall profit tends to be negative C. You gain from E and lose from F; overall profit tends to be positive D. You gain from Fand lose from E; overall profit tends to be positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts