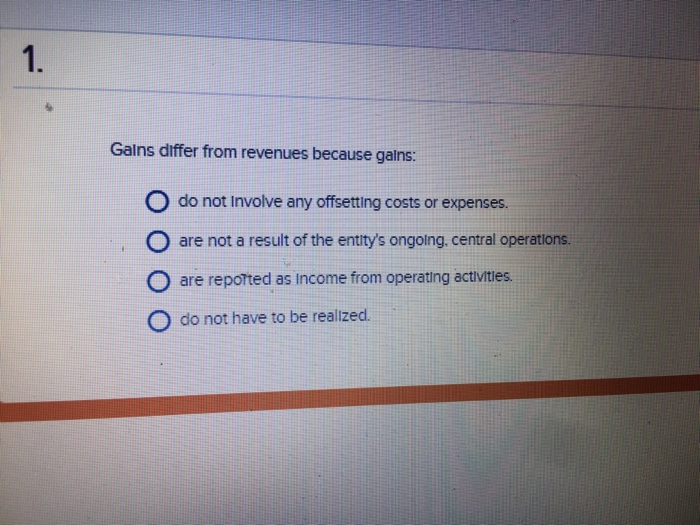

Question: 1. Galns differ from revenues because gains: O do not involve any offsetting costs or expenses. O are not a result of the entity's ongolng.

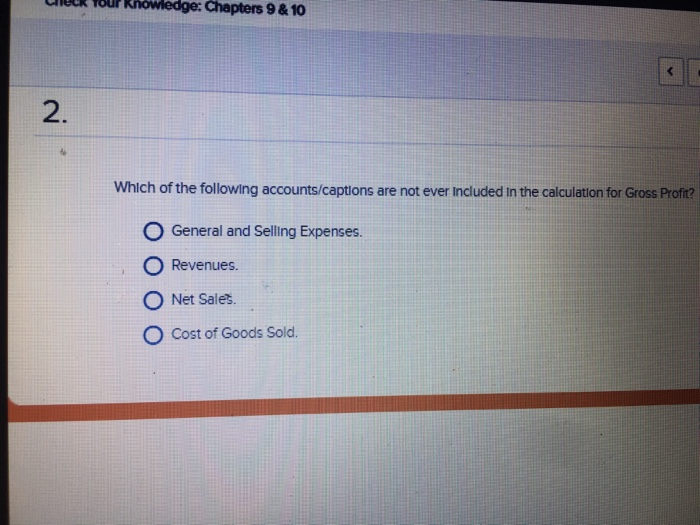

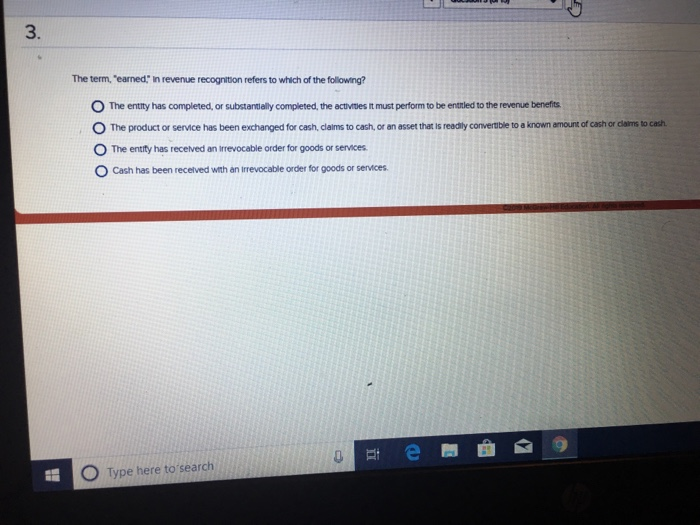

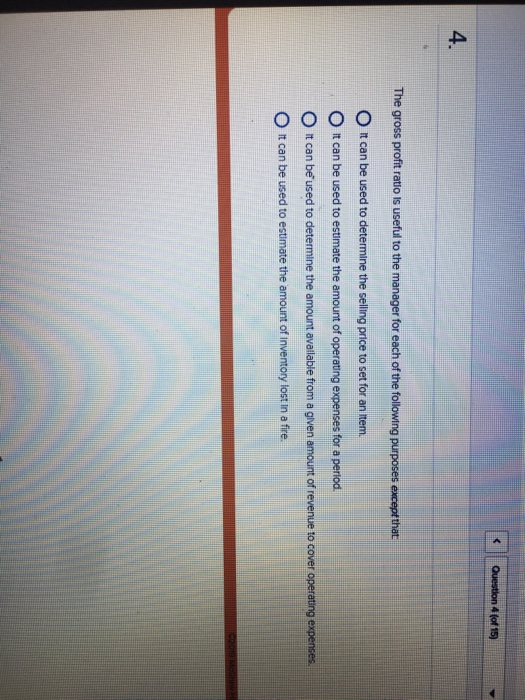

1. Galns differ from revenues because gains: O do not involve any offsetting costs or expenses. O are not a result of the entity's ongolng. central operations. O are repoted as income from operating activties O do not have to be realized. Chapters 9& 10 2. Which of the following accounts/captions are not ever Included in the calculation for Gross Profit? O General and Selling Expenses. O Revenues. O Net Sales. O Cost of Goods Sold. 3. The term, "earned," In revenue recognition refers to which of the following? O The entity has completed, or substantally completed, the actvives It must perform to be entrled to the revenue benefts. O The product or service has been exchanged for cash, claims to cash, or an asset that is reedily convertbie to a known armount of cash or claims to O The entity has recelved an Irrevocable order for goods or services O Cash has been received with an irrevocable order for goods or services Type here to search 4 (of 15) 4. The gross profit ratio is useful to the manager for each of the following purposes except that O t can be used to determine the selling price to set for an item O It can be used to estimate the amount of operating expenses for a period. 0 it can be' used to determine the amount available from a given amount of revenue to cover operating expenses. O t can be used to estimate the amount of inventory lost in a fre

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts