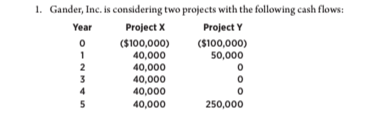

Question: 1. Gander, Inc. is considering two projects with the following cash flows: Year Project X Project Y 0 ($100,000) ($100,000) 40,000 50,000 40,000 40,000 40,000

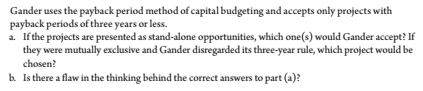

1. Gander, Inc. is considering two projects with the following cash flows: Year Project X Project Y 0 ($100,000) ($100,000) 40,000 50,000 40,000 40,000 40,000 40,000 250,000 Gander uses the payback period method of capital budgeting and accepts only projects with payback periods of three years or less. .. If the projects are presented as stand-alone opportunities, which one(s) would Gander accept? If they were mutually exclusive and Gander disregarded its three-year rule, which project would be chosen? Is there a flaw in the thinking behind the correct answers to part(a)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock