Question: 1. GreenTech Manufacturing plc is evaluating two forklift systems to use in its plant that produces the towers for a windmill power farm. The costs

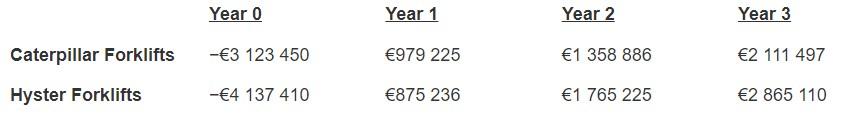

1. GreenTech Manufacturing plc is evaluating two forklift systems to use in its plant that produces the towers for a windmill power farm. The costs and the cash flows from these systems are shown here. If the company uses a 12 per cent discount rate for all projects, determine which forklift system should be purchased using the net present value (NPV) approach.

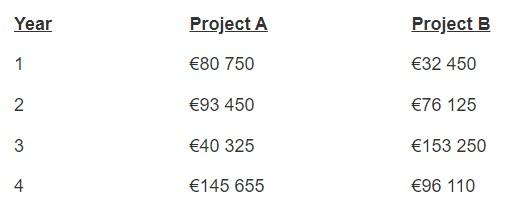

2. Les Artisanats de Limoges SA is evaluating two independent capital projects that together will cost the company 250 000. The two projects will provide the following cash flows:

Which project will be chosen if the companys payback criterion is three years? What if the company accepts all projects as long as the payback period is less than five years?

3. Compute the IRR for each of the two forklift systems in question number 1. Explain if the IRR decision is different from the one determined by NPV?

Year 0 Year 1 Year 2 Year 3 Caterpillar Forklifts - 3 123 450 979 225 1 358 886 2 111 497 Hyster Forklifts -4 137 410 875 236 1 765 225 2 865 110 Year Project A Project B 1 80 750 32 450 N 2 93 450 76 125 3 40 325 153 250 4 145 655 96 110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts