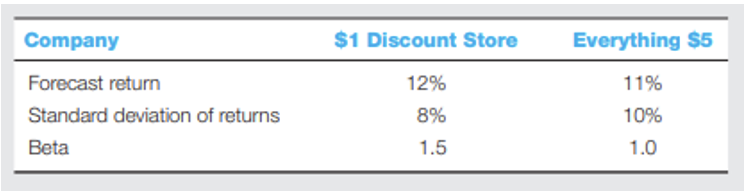

Question: 1 - Here are data on two companies. The T - bill rate is 4 % and the market risk premium is 6 % .

Here are data on two companies. The Tbill rate is and the market risk premium is

What would be the fair return for each company, according to the capital asset pricing model CAPMLO

Characterize each company in the previous problem as underpriced, overpriced, or properly priced. LO

What is the expected rate of return for a stock that has a beta of if the expected return on the market is LO

a

b More than

c Cannot be determined without the riskfree rate. Kaskin, Inc., stock has a beta of and Quinn, Inc., stock has a beta of Which of the following statements is most accurate? LO

a The expected rate of return will be higher for the stock of Kaskin, Inc., than that of Quinn, Inc.

b The stock of Kaskin, Inc., has more total risk than Quinn, Inc.

c The stock of Quinn, Inc., has more systematic risk than that of Kaskin, Inc.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock