Question: pleas , Write the formula before solving the question 1- Here are the data on two companies. The Treasury bill rate is 4% and the

pleas , Write the formula before solving the question

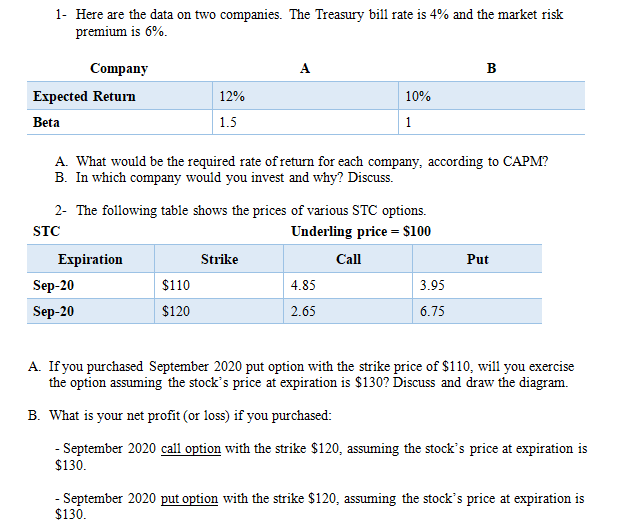

1- Here are the data on two companies. The Treasury bill rate is 4% and the market risk premium is 6%. Company Expected Return 12% 10% Beta 1.5 A. What would be the required rate of return for each company, according to CAPM? B. In which company would you invest and why? Discuss. 2- The following table shows the prices of various STC options. STC Underling price = $100 Expiration Strike Call Sep-20 $110 4.85 3.95 Sep-20 $120 2.65 6.75 Put A. If you purchased September 2020 put option with the strike price of $110, will you exercise the option assuming the stock's price at expiration is $130? Discuss and draw the diagram. B. What is your net profit (or loss) if you purchased: - September 2020 call option with the strike $120, assuming the stock's price at expiration is - September 2020 put option with the strike $120, assuming the stock's price at expiration is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts