Question: 1. Holding everything else constant and a given interest rate, the price of a zero-coupon bond should decrease as time to maturity decreases. True or

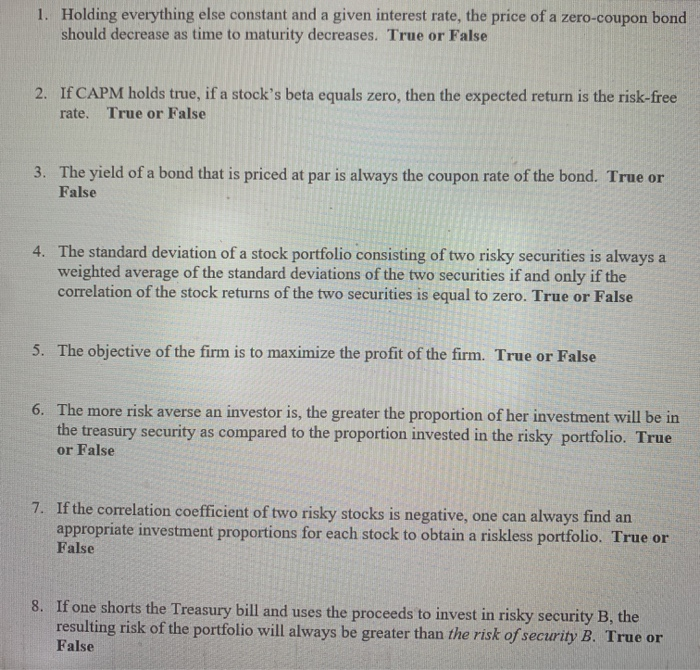

1. Holding everything else constant and a given interest rate, the price of a zero-coupon bond should decrease as time to maturity decreases. True or False 2. If CAPM holds true, if a stock's beta equals zero, then the expected return is the risk-free rate. True or False 3. The yield of a bond that is priced at par is always the coupon rate of the bond. True or False 4. The standard deviation of a stock portfolio consisting of two risky securities is always a weighted average of the standard deviations of the two securities if and only if the correlation of the stock returns of the two securities is equal to zero. True or False 5. The objective of the firm is to maximize the profit of the firm. True or False 6. The more risk averse an investor is, the greater the proportion of her investment will be in the treasury security as compared to the proportion invested in the risky portfolio. True or False 7. If the correlation coefficient of two risky stocks is negative, one can always find an appropriate investment proportions for each stock to obtain a riskless portfolio. True or False 8. If one shorts the Treasury bill and uses the proceeds to invest in risky security B, the resulting risk of the portfolio will always be greater than the risk of security B. True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts