Question: what's the answer? 1. Holding everything else constant and a given interest rate, the price of a zero-coupon bond should decrease as time to maturity

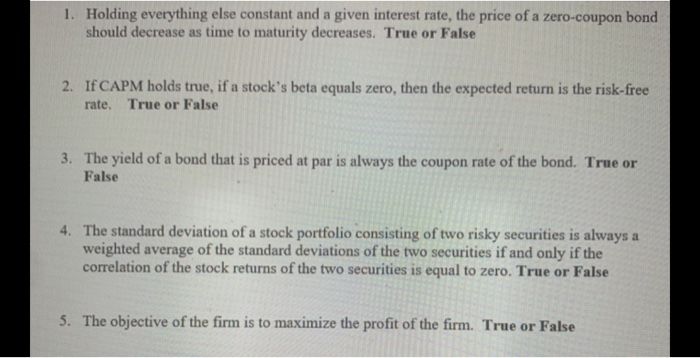

1. Holding everything else constant and a given interest rate, the price of a zero-coupon bond should decrease as time to maturity decreases. True or False 2. If CAPM holds true, if a stock's beta equals zero, then the expected return is the risk-free rate. True or False 3. The yield of a bond that is priced at par is always the coupon rate of the bond. True or False 4. The standard deviation of a stock portfolio consisting of two risky securities is always a weighted average of the standard deviations of the two securities if and only if the correlation of the stock returns of the two securities is equal to zero. True or False 5. The objective of the firm is to maximize the profit of the firm. True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts