Question: 1 ) How do I use end - of - May market capitalization data in STATA to show that the Russell 2 0 0 0

How do I use endofMay market capitalization data in STATA to show that the Russell Regression Discontinuity design is valid for the cutoff? Next, how do I use the endofMay market capitalization data in STATA to estimate what the effects of indexing on stock prices are using a bandwidth of

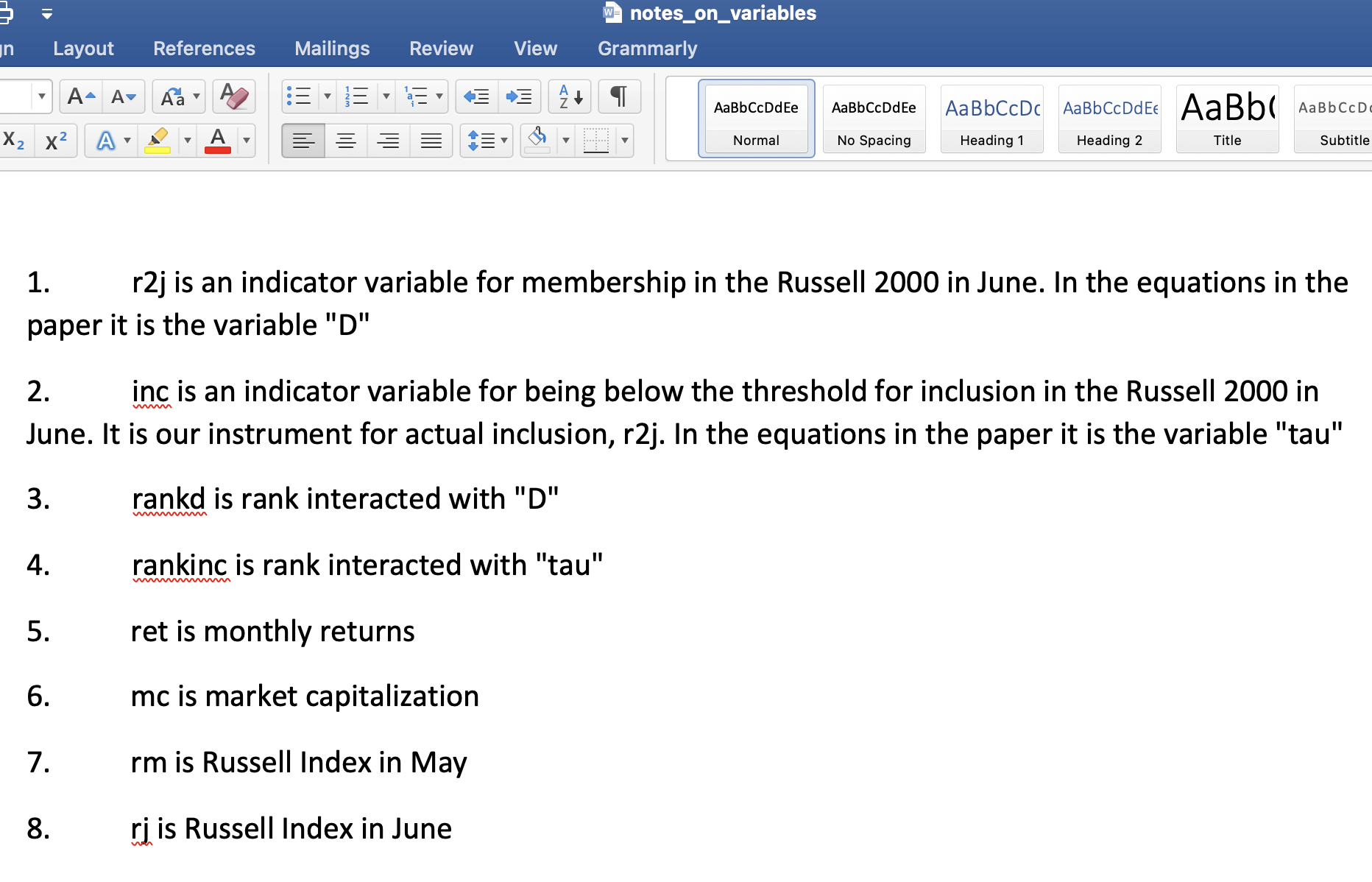

rj is an indicator variable for membership in the Russell in June. In the equations in the paper it is the variable D

inc is an indicator variable for being below the threshold for inclusion in the Russell in

June. It is our instrument for actual inclusion, rj In the equations in the paper it is the variable "tau"

rankd is rank interacted with D

rankinc is rank interacted with "tau"

ret is monthly returns

mc is market capitalization

rm is Russell Index in May

quad ri is Russell Index in June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock