Question: Question 7 ( 1 . 5 points ) Listen ( Time allowance: 3 9 minutes ) Soft _ Water Company is considering replacing its old

Question points

Listen

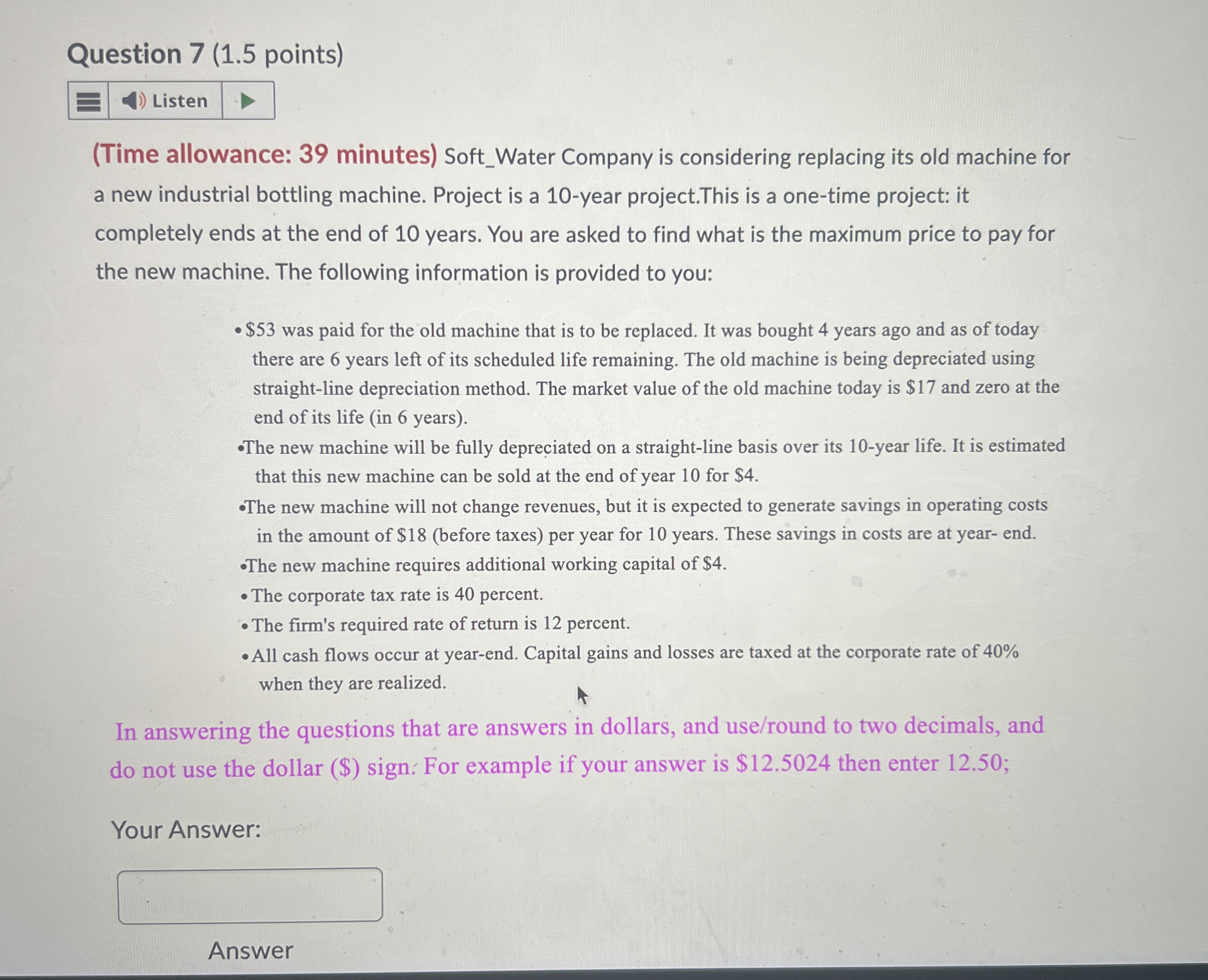

Time allowance: minutes SoftWater Company is considering replacing its old machine for a new industrial bottling machine. Project is a year project.This is a onetime project: it completely ends at the end of years. You are asked to find what is the maximum price to pay for the new machine. The following information is provided to you:

$ was paid for the old machine that is to be replaced. It was bought years ago and as of today there are years left of its scheduled life remaining. The old machine is being depreciated using straightline depreciation method. The market value of the old machine today is $ and zero at the end of its life in years

The new machine will be fully depreciated on a straightline basis over its year life. It is estimated that this new machine can be sold at the end of year for $

The new machine will not change revenues, but it is expected to generate savings in operating costs in the amount of $before taxes per year for years. These savings in costs are at year end.

The new machine requires additional working capital of $

The corporate tax rate is percent.

The firm's required rate of return is percent.

All cash flows occur at yearend. Capital gains and losses are taxed at the corporate rate of when they are realized.

In answering the questions that are answers in dollars, and useround to two decimals, and do not use the dollar $ sign. For example if your answer is $ then enter ;

Your Answer:

Answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock