Question: 1) How much value did the leveraged recap create for shareholders? To answer this question compute the change in the sealed airs market value of

1) How much value did the leveraged recap create for shareholders? To answer this question compute the change in the sealed airs market value of equity from 4/27/1989 to 4/28/1989

2. What is the present value of the interest tax shield that is created by the new subordinated notes?

3. What is the present value of the interest tax shield that is created by the bank loan? Assume that year 0 is the end of year 1988.

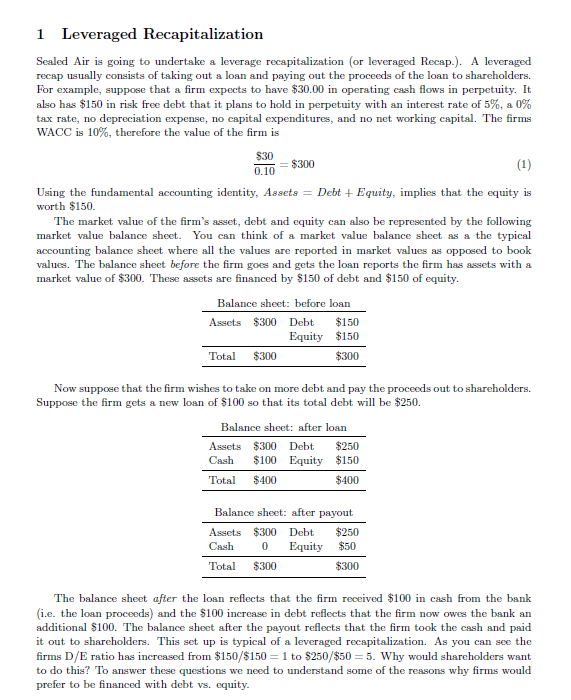

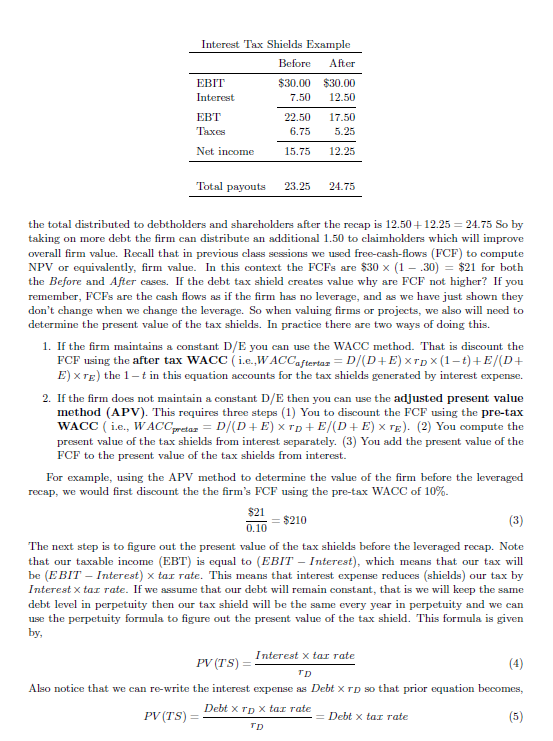

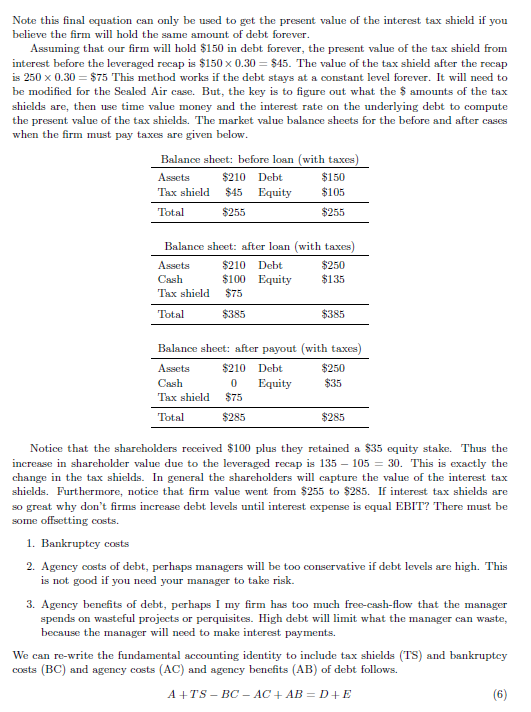

1 Leveraged Recapitalization Sealed Air is going to undertake a leverage recapitalization (or leveraged Recap.). A leveraged recap usually consists of taking out a loan and paying out the proceeds of the loan to shareholders. For example, suppose that a firm expects to have $30.00 in operating cash flows in perpetuity. It also has $150 in risk free debt that it plans to hold in perpetuity with an interest rate of 5%, a 0% tax rate, no depreciation expense, no capital expenditures, and no net working capital. The firms WACC is 10%, therefore the value of the firm is $30 $300 0.10 (1) Using the fundamental accounting identity, Assets Debt Equity, implies that the equity is worth $150. The market value of the firm's asset, debt and equity can also be represented by the following market value balance sheet. You can think of a market value balance sheet as a the typical accounting balance sheet where all the values are reported in market values as opposed to book values. The balance sheet before the firm goes and gets the loan reports the firm has assets with a market value of $300. These assets are financed by $150 of debt and $150 of equity. Balance sheet: before loan Assets $300 Debt $150 Equity $150 Total $300 $300 Now suppose that the firm wishes to take on more debt and pay the proceeds out to shareholders Suppose the firm gets a new loan of $100 so that its total debt will be $250. Balance sheet: after loan Assets $300 Debt $250 Cash $100 Equity $150 Total $400 $400 Balance sheet: after payout Assets $300 Debt $250 Cash Equity $50 Total $300 $300 The balance sheet after the losn reflects that the firm received $100 in cash from the bank (i.e. the loan proceeds) and the S100 increase in debt reflects that the firm now owes the bank an additional $100. The balance sheet after the payout reflects that the firm took the cash and paid it out to shareholders. This set up is typical of a leveraged recapitalization. As you can see the firms D/E ratio has increased from $150/$150 1 to $250/$50 5. Why would shareholders want to do this? To answer these questions we need to understand some of the reasons why firms would prefer to be financed with debt vs. equity. 1 Leveraged Recapitalization Sealed Air is going to undertake a leverage recapitalization (or leveraged Recap.). A leveraged recap usually consists of taking out a loan and paying out the proceeds of the loan to shareholders. For example, suppose that a firm expects to have $30.00 in operating cash flows in perpetuity. It also has $150 in risk free debt that it plans to hold in perpetuity with an interest rate of 5%, a 0% tax rate, no depreciation expense, no capital expenditures, and no net working capital. The firms WACC is 10%, therefore the value of the firm is $30 $300 0.10 (1) Using the fundamental accounting identity, Assets Debt Equity, implies that the equity is worth $150. The market value of the firm's asset, debt and equity can also be represented by the following market value balance sheet. You can think of a market value balance sheet as a the typical accounting balance sheet where all the values are reported in market values as opposed to book values. The balance sheet before the firm goes and gets the loan reports the firm has assets with a market value of $300. These assets are financed by $150 of debt and $150 of equity. Balance sheet: before loan Assets $300 Debt $150 Equity $150 Total $300 $300 Now suppose that the firm wishes to take on more debt and pay the proceeds out to shareholders Suppose the firm gets a new loan of $100 so that its total debt will be $250. Balance sheet: after loan Assets $300 Debt $250 Cash $100 Equity $150 Total $400 $400 Balance sheet: after payout Assets $300 Debt $250 Cash Equity $50 Total $300 $300 The balance sheet after the losn reflects that the firm received $100 in cash from the bank (i.e. the loan proceeds) and the S100 increase in debt reflects that the firm now owes the bank an additional $100. The balance sheet after the payout reflects that the firm took the cash and paid it out to shareholders. This set up is typical of a leveraged recapitalization. As you can see the firms D/E ratio has increased from $150/$150 1 to $250/$50 5. Why would shareholders want to do this? To answer these questions we need to understand some of the reasons why firms would prefer to be financed with debt vs. equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts