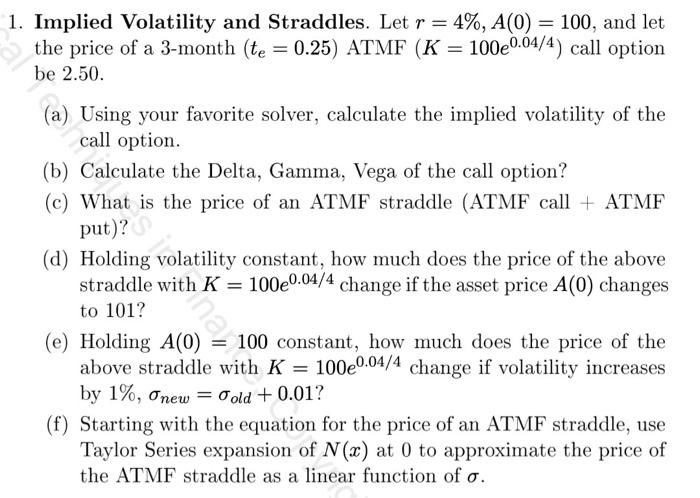

Question: 1. Implied Volatility and Straddles. Let r = 4%, A(0) = 100, and let the price of a 3-month (te = 0.25) ATMF (K =

1. Implied Volatility and Straddles. Let r = 4%, A(0) = 100, and let the price of a 3-month (te = 0.25) ATMF (K = 100e0.04/4) call option be 2.50. , call option. (b) Calculate the Delta, Gamma, Vega of the call option? (c) What is the price of an ATMF straddle (ATMF call + ATMF put)? (d) Holding volatility constant, how much does the price of the above straddle with K = 100e0.04/4 change if the asset price A(0) changes to 101? (e) Holding A(0) = 100 constant, how much does the price of the above straddle with K = 100e0.04/4 change if volatility increases by 1%, Onew = Cold + 0.01? (f) Starting with the equation for the price of an ATMF straddle, use Taylor Series expansion of N(x) at 0 to approximate the price of the ATMF straddle as a linear function of o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts