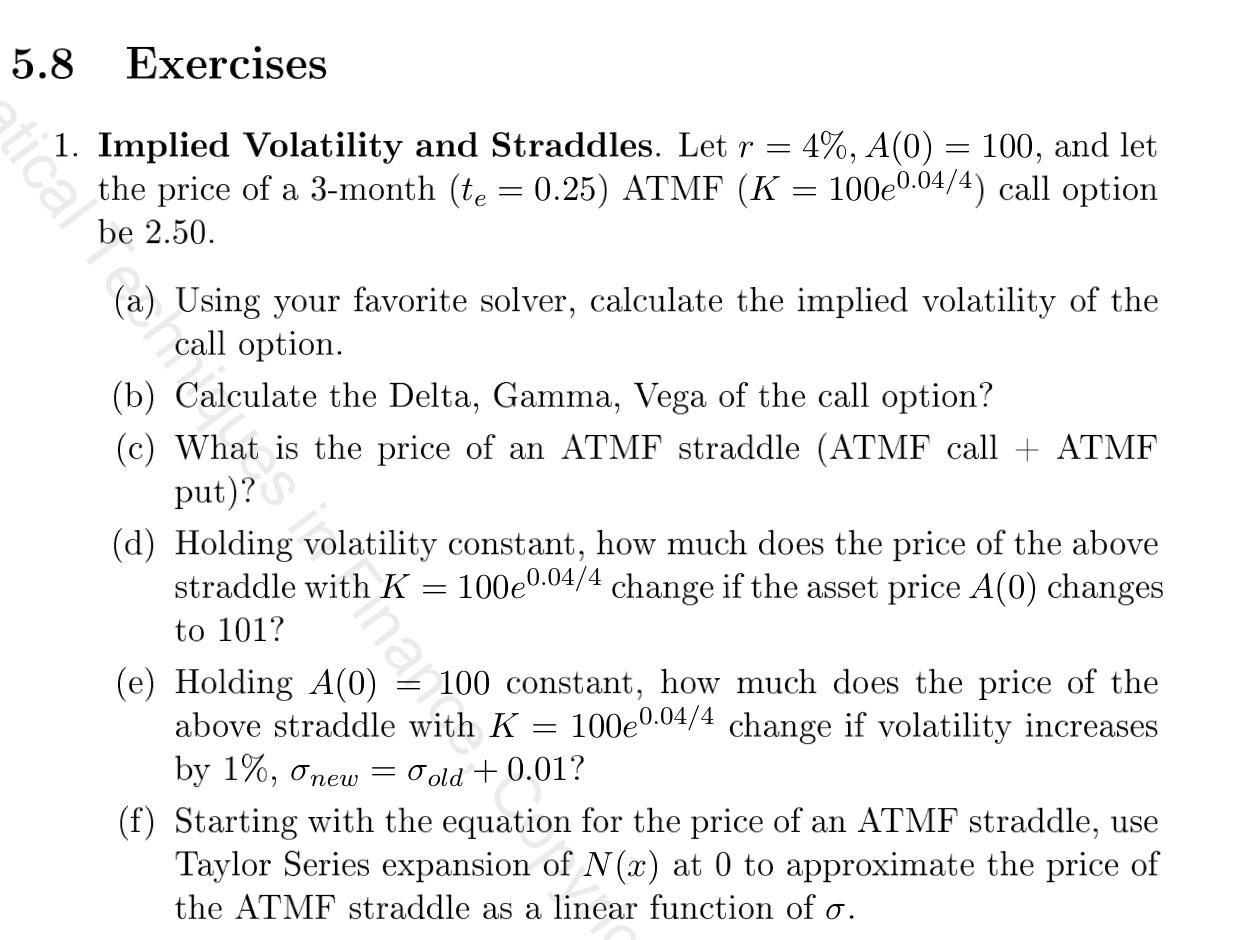

Question: 5.8 Exercises 1. Implied Volatility and Straddles. Let r = 4%, A(0) = 100, and let the price of a 3-month (te = 0.25) ATMF

5.8 Exercises 1. Implied Volatility and Straddles. Let r = 4%, A(0) = 100, and let the price of a 3-month (te = 0.25) ATMF (K 100e0.04/4) call option = (a) Using your favorite solver, calculate the implied volatility of the call option. (b) Calculate the Delta, Gamma, Vega of the call option? (c) What is the price of an ATMF straddle (ATMF call + ATMF put)? (d) Holding volatility constant, how much does the price of the above straddle with K = 100e0.04/4 change if the asset price A(0) changes to 101? (e) Holding A(0) 100 constant, how much does the price of the above straddle with K 100e0.04/4 change if volatility increases by 1%, Onew = Cold + 0.01? (f) Starting with the equation for the price of an ATMF straddle, use Taylor Series expansion of N(x) at 0 to approximate the price of the ATMF straddle as a linear function of o. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts