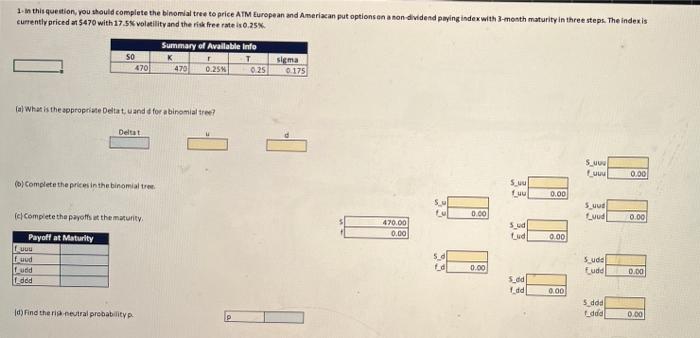

Question: 1. In this question, you should complete the binomial tree to price ATM European and American put options on a non dividend paying index with

1. In this question, you should complete the binomial tree to price ATM European and American put options on a non dividend paying index with 3-month maturity in three steps. The Index is currently priced at 5470 with 17.5% volatility and the risk free rate 0.25% SO 470 Summary of Available info K T 470 0.25% 025 sigma 0175 (a) What is the appropriate Deltatuando for abinomial tree Deltat -1 SLU fuu 0.00 (b) Complete the prices in the binomial tren Suu Luu 0.00 S. LL 5 uud el complete the payoffs at the maturity 0.00 Luud 0.00 470.00 0.00 Sud Lud 0.00 Payoff at Maturity fuuu fuud udd Iddd 5.d col 0.00 Sude Eudd 0.00 5dd Idd 0.00 Id) Find the ri neutral probability 5deal ddd 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts