Question: Solve question 1 and 2 using binomial trees with 20 time steps. Solve question 3 using Monte Carl Simulations. Provide all necessary details on parameters,

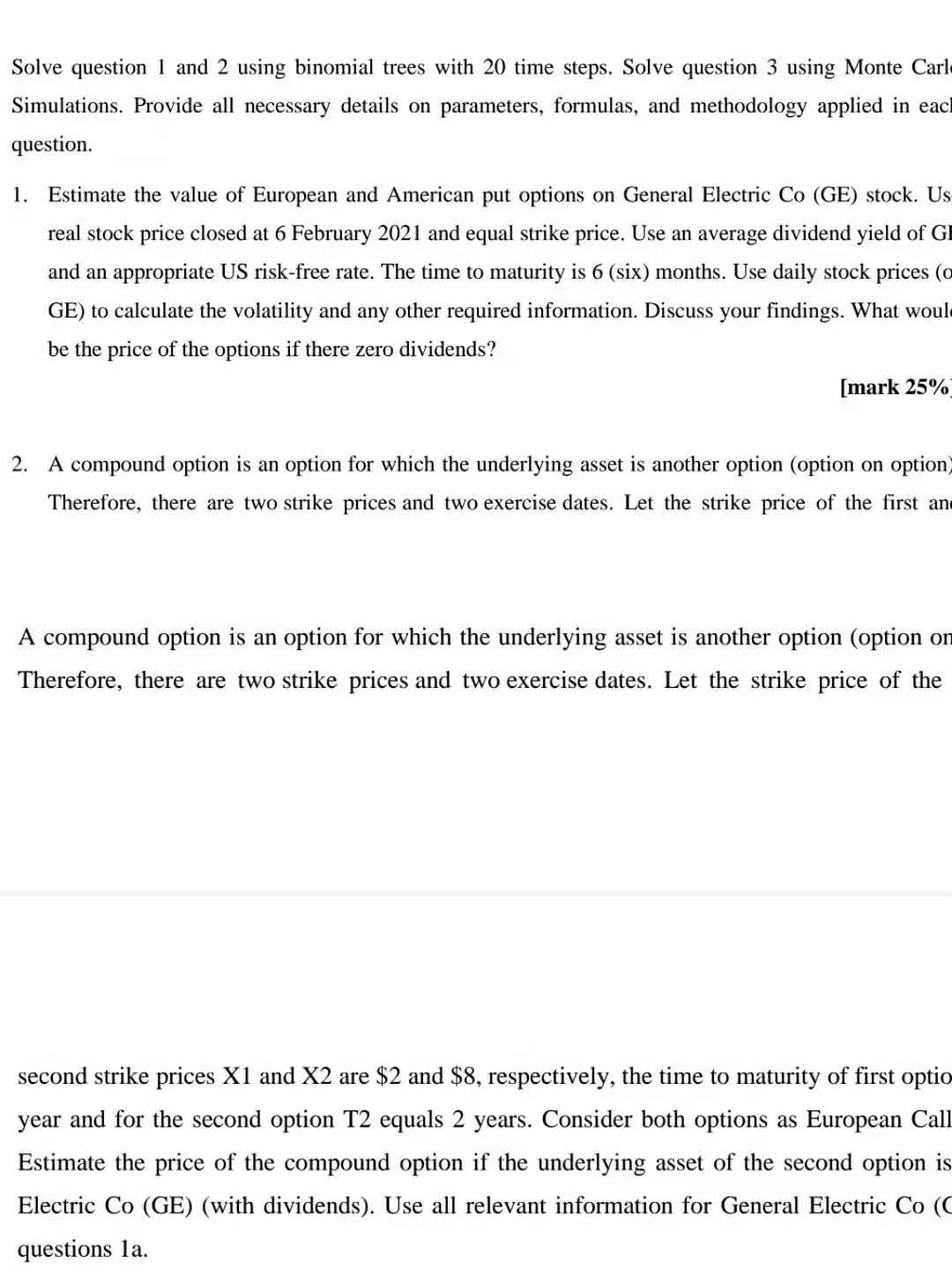

Solve question 1 and 2 using binomial trees with 20 time steps. Solve question 3 using Monte Carl Simulations. Provide all necessary details on parameters, formulas, and methodology applied in eac question. 1. Estimate the value of European and American put options on General Electric Co (GE) stock. Us real stock price closed at 6 February 2021 and equal strike price. Use an average dividend yield of GI and an appropriate US risk-free rate. The time to maturity is 6 (six) months. Use daily stock prices (o GE) to calculate the volatility and any other required information. Discuss your findings. What woul be the price of the options if there zero dividends? [mark 25% 2. A compound option is an option for which the underlying asset is another option (option on option Therefore, there are two strike prices and two exercise dates. Let the strike price of the first an A compound option is an option for which the underlying asset is another option (option on Therefore, there are two strike prices and two exercise dates. Let the strike price of the second strike prices X1 and X2 are $2 and $8, respectively, the time to maturity of first optio year and for the second option T2 equals 2 years. Consider both options as European Call Estimate the price of the compound option if the underlying asset of the second option is Electric Co (GE) (with dividends). Use all relevant information for General Electric Co ( questions la. Solve question 1 and 2 using binomial trees with 20 time steps. Solve question 3 using Monte Carl Simulations. Provide all necessary details on parameters, formulas, and methodology applied in eac question. 1. Estimate the value of European and American put options on General Electric Co (GE) stock. Us real stock price closed at 6 February 2021 and equal strike price. Use an average dividend yield of GI and an appropriate US risk-free rate. The time to maturity is 6 (six) months. Use daily stock prices (o GE) to calculate the volatility and any other required information. Discuss your findings. What woul be the price of the options if there zero dividends? [mark 25% 2. A compound option is an option for which the underlying asset is another option (option on option Therefore, there are two strike prices and two exercise dates. Let the strike price of the first an A compound option is an option for which the underlying asset is another option (option on Therefore, there are two strike prices and two exercise dates. Let the strike price of the second strike prices X1 and X2 are $2 and $8, respectively, the time to maturity of first optio year and for the second option T2 equals 2 years. Consider both options as European Call Estimate the price of the compound option if the underlying asset of the second option is Electric Co (GE) (with dividends). Use all relevant information for General Electric Co ( questions la

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts