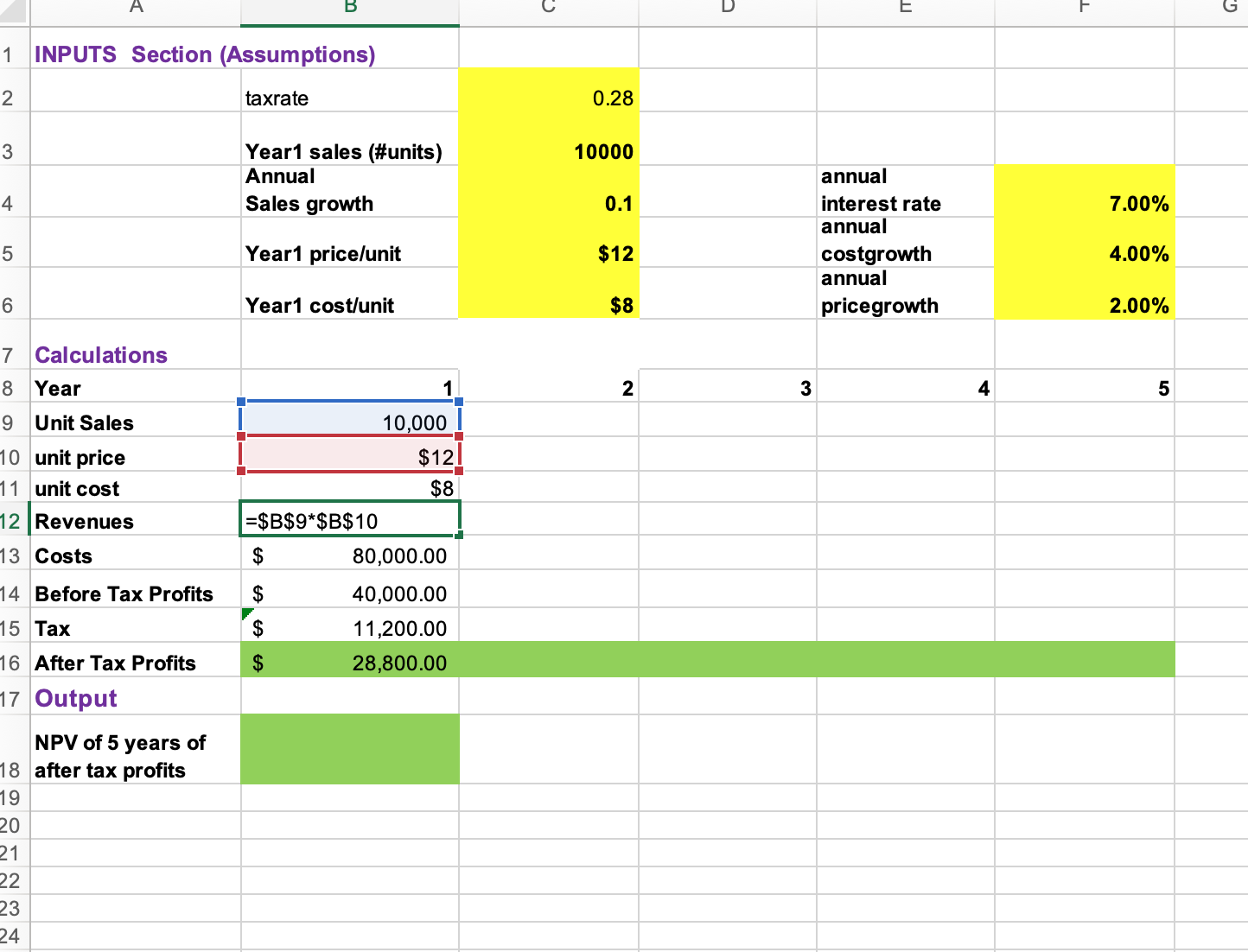

Question: 1 INPUTS Section (Assumptions) begin{tabular}{|l|l|r|r|r|} hline 2 & taxrate & 0.28 & hline 3 & Year1 sales (#units) & 10000 & hline 4

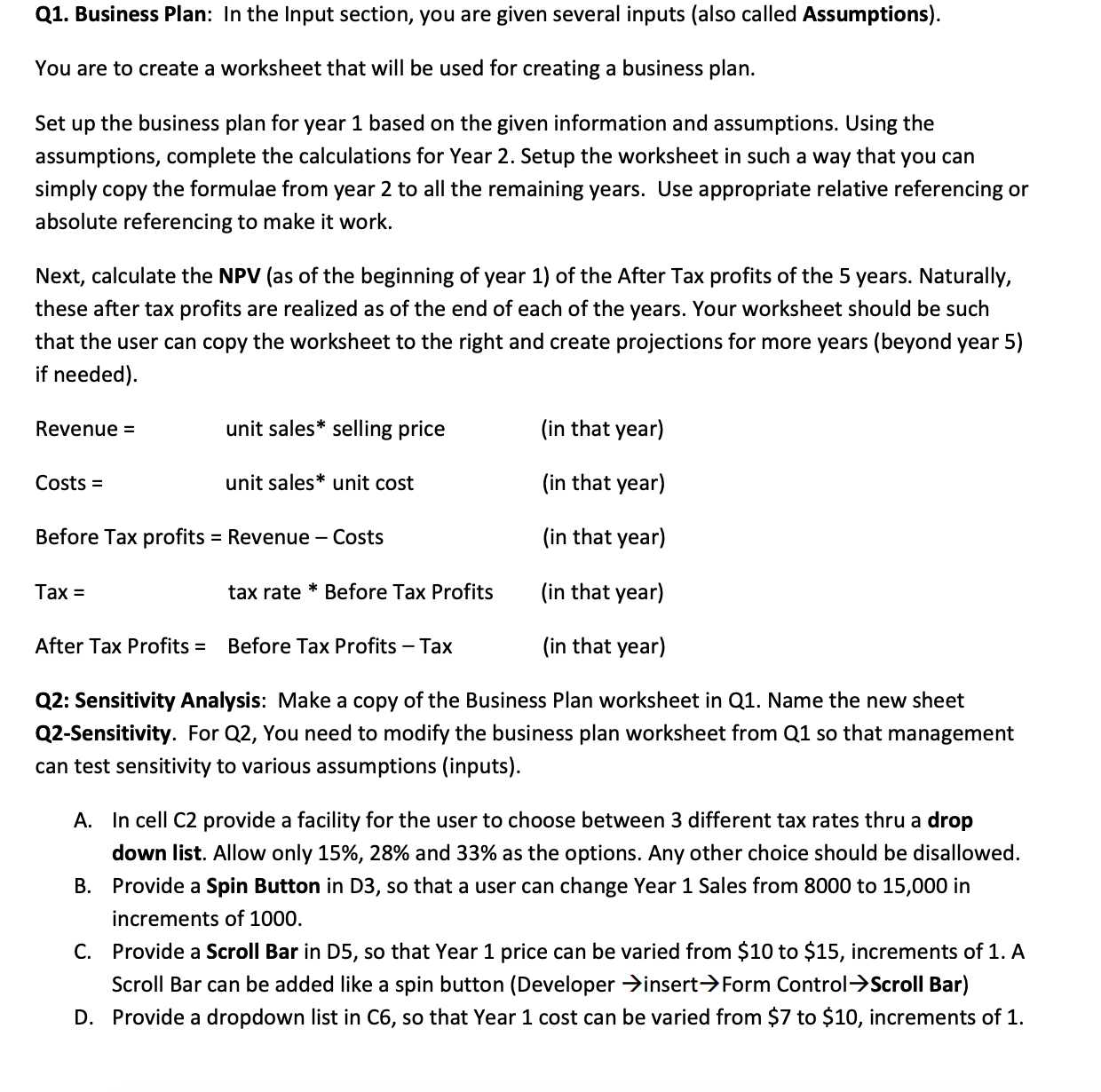

1 INPUTS Section (Assumptions) \begin{tabular}{|l|l|r|r|r|} \hline 2 & taxrate & 0.28 & \\ \hline 3 & Year1 sales (\#units) & 10000 & \\ \hline 4 & AnnualSalesgrowth & 0.1 & annualinterestrate \\ \hline 6 & Year1 price/unit & $12 & annualcostgrowthannualpricegrowth \\ \hline 6 & Year1 cost/unit & $8 & 4.00% \\ \hline \end{tabular} 7 Calculations 7 Output NPV of 5 years of after tax profits Q2: Sensitivity Analysis: Make a copy of the Business Plan worksheet in Q1. Name the new sheet Q2-Sensitivity. For Q2, You need to modify the business plan worksheet from Q1 so that management can test sensitivity to various assumptions (inputs). A. In cell C2 provide a facility for the user to choose between 3 different tax rates thru a drop down list. Allow only 15%,28% and 33% as the options. Any other choice should be disallowed. B. Provide a Spin Button in D3, so that a user can change Year 1 Sales from 8000 to 15,000 in increments of 1000. C. Provide a Scroll Bar in D5, so that Year 1 price can be varied from $10 to $15, increments of 1 . A Scroll Bar can be added like a spin button (Developer insert Form Control Scroll Bar) D. Provide a dropdown list in C6, so that Year 1 cost can be varied from $7 to $10, increments of 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts