Question: 1. Introduction 2. Problem statement 3. Case Analysis 4. conclusion and recommendations Case Study: Japanese Airlines - Japan Airlines (JAL) is the largest airline operator

1. Introduction 2. Problem statement 3. Case Analysis 4. conclusion and recommendations

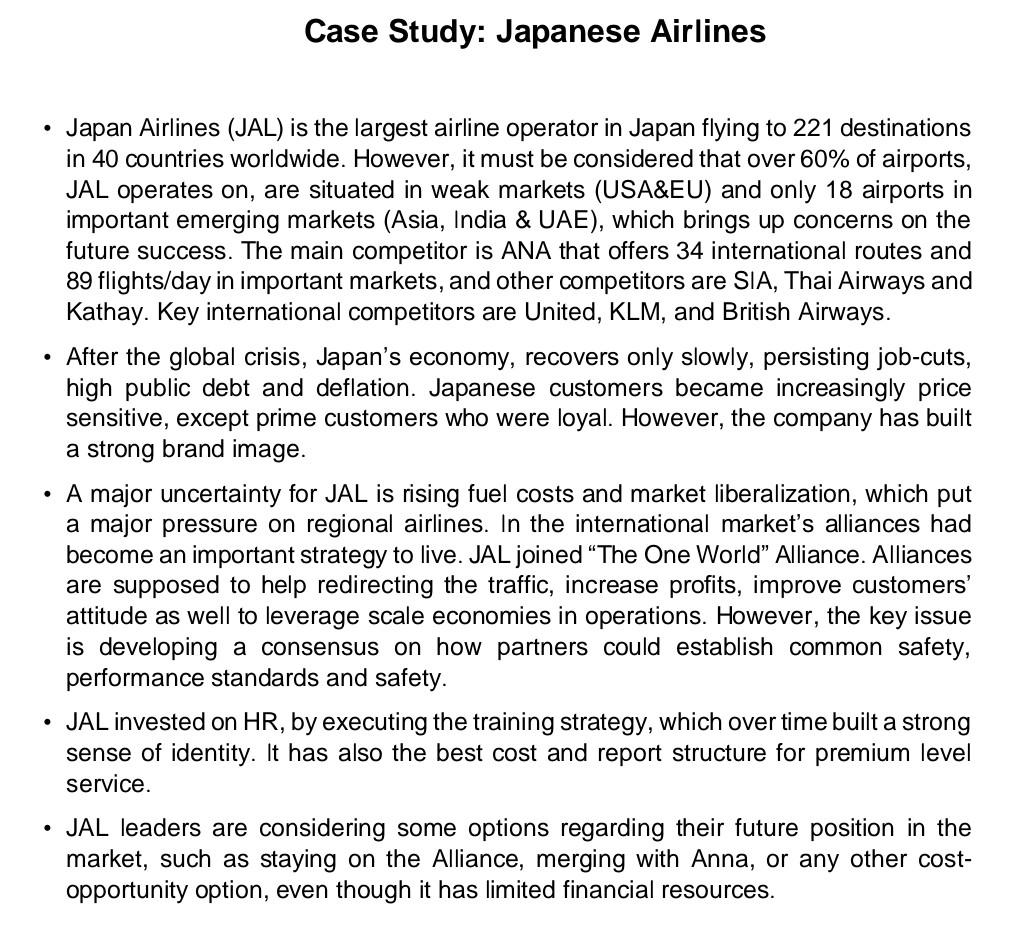

Case Study: Japanese Airlines - Japan Airlines (JAL) is the largest airline operator in Japan flying to 221 destinations in 40 countries worldwide. However, it must be considered that over 60% of airports, JAL operates on, are situated in weak markets (USA\&EU) and only 18 airports in important emerging markets (Asia, India \& UAE), which brings up concerns on the future success. The main competitor is ANA that offers 34 international routes and 89 flights/day in important markets, and other competitors are SIA, Thai Airways and Kathay. Key international competitors are United, KLM, and British Airways. - After the global crisis, Japan's economy, recovers only slowly, persisting job-cuts, high public debt and deflation. Japanese customers became increasingly price sensitive, except prime customers who were loyal. However, the company has built a strong brand image. - A major uncertainty for JAL is rising fuel costs and market liberalization, which put a major pressure on regional airlines. In the international market's alliances had become an important strategy to live. JAL joined "The One World" Alliance. Alliances are supposed to help redirecting the traffic, increase profits, improve customers' attitude as well to leverage scale economies in operations. However, the key issue is developing a consensus on how partners could establish common safety, performance standards and safety. - JAL invested on HR, by executing the training strategy, which over time built a strong sense of identity. It has also the best cost and report structure for premium level service. - JAL leaders are considering some options regarding their future position in the market, such as staying on the Alliance, merging with Anna, or any other costopportunity option, even though it has limited financial resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts