Question: #1 is reference... need #2 solved Using BA II Plus Texas Instrument if possible to show steps... 1. Your younger sister, Jennifer, will start college

#1 is reference... need #2 solved

Using BA II Plus Texas Instrument if possible to show steps...

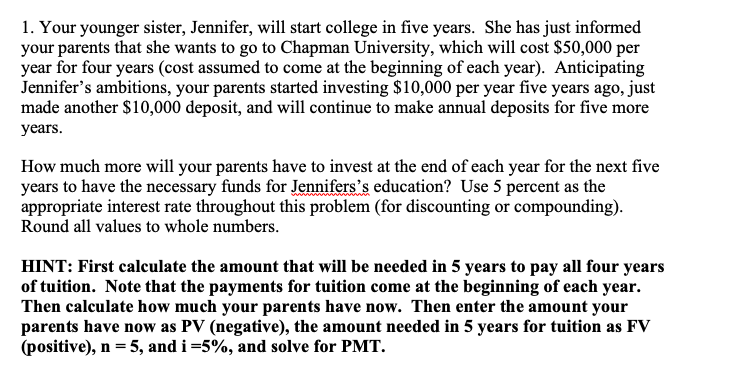

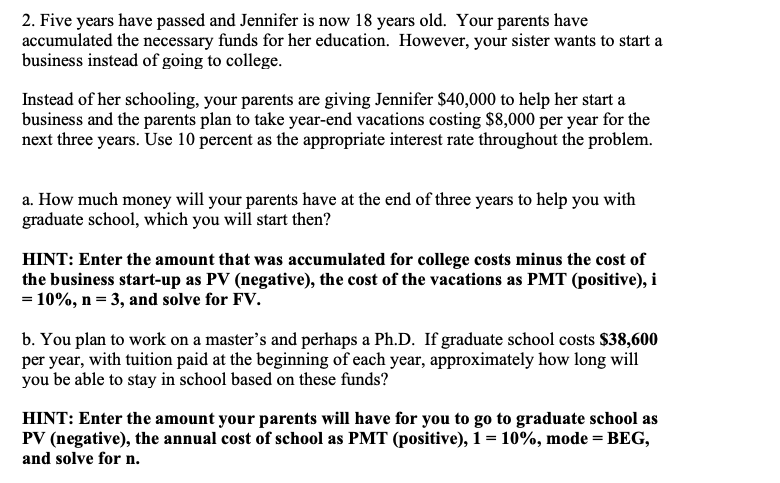

1. Your younger sister, Jennifer, will start college in five years. She has just informed your parents that she wants to go to Chapman University, which will cost $50,000 per year for four years (cost assumed to come at the beginning of each year). Anticipating Jennifer's ambitions, your parents started investing $10,000 per year five years ago, just made another $10,000 deposit, and will continue to make annual deposits for five more years How much more will your parents have to invest at the end of each year for the next five years to have the necessary funds for Jennifers's education? Use 5 percent as the appropriate interest rate throughout this problem (for discounting or compounding) Round all values to whole numbers. HINT: First calculate the amount that will be needed in 5 years to pay all four years of tuition. Note that the payments for tuition come at the beginning of each year Then calculate how much your parents have now. Then enter the amount your parents have now as PV (negative), the amount needed in 5 years for tuition as FV (positive), n 5, and i =5%, and solve for PMT. 2. Five years have passed and Jennifer is now 18 years old. Your parents have accumulated the necessary funds for her education. However, your sister wants to start a business instead of going to college. Instead of her schooling, your parents are giving Jennifer $40,000 to help her start a business and the parents plan to take year-end vacations costing $8,000 per year for the next three years. Use 10 percent as the appropriate interest rate throughout the problem a. How much money will your parents have at the end of three years to help you with graduate school, which you will start then? HINT: Enter the amount that was accumulated for college costs minus the cost of the business start-up as PV (negative), the cost of the vacations as PMT (positive), i = 10%, n 3, and solve for FV. b. You plan to work on a master's and perhaps a Ph.D. If graduate school costs $38,600 per year, with tuition paid at the beginning of each year, approximately how long will you be able to stay in school based on these funds? HINT: Enter the amount your parents will have for you to go to graduate school as PV (negative), the annual cost of school as PMT (positive), 1 = 10%, mode = BEG, and solve for n. 1. Your younger sister, Jennifer, will start college in five years. She has just informed your parents that she wants to go to Chapman University, which will cost $50,000 per year for four years (cost assumed to come at the beginning of each year). Anticipating Jennifer's ambitions, your parents started investing $10,000 per year five years ago, just made another $10,000 deposit, and will continue to make annual deposits for five more years How much more will your parents have to invest at the end of each year for the next five years to have the necessary funds for Jennifers's education? Use 5 percent as the appropriate interest rate throughout this problem (for discounting or compounding) Round all values to whole numbers. HINT: First calculate the amount that will be needed in 5 years to pay all four years of tuition. Note that the payments for tuition come at the beginning of each year Then calculate how much your parents have now. Then enter the amount your parents have now as PV (negative), the amount needed in 5 years for tuition as FV (positive), n 5, and i =5%, and solve for PMT. 2. Five years have passed and Jennifer is now 18 years old. Your parents have accumulated the necessary funds for her education. However, your sister wants to start a business instead of going to college. Instead of her schooling, your parents are giving Jennifer $40,000 to help her start a business and the parents plan to take year-end vacations costing $8,000 per year for the next three years. Use 10 percent as the appropriate interest rate throughout the problem a. How much money will your parents have at the end of three years to help you with graduate school, which you will start then? HINT: Enter the amount that was accumulated for college costs minus the cost of the business start-up as PV (negative), the cost of the vacations as PMT (positive), i = 10%, n 3, and solve for FV. b. You plan to work on a master's and perhaps a Ph.D. If graduate school costs $38,600 per year, with tuition paid at the beginning of each year, approximately how long will you be able to stay in school based on these funds? HINT: Enter the amount your parents will have for you to go to graduate school as PV (negative), the annual cost of school as PMT (positive), 1 = 10%, mode = BEG, and solve for n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts