Question: 1 . Journalized transactions 2 . Post all hournal entries as needed to subsidiary ledgers 3 . Post all journal entries to the general ledger

Journalized transactions

Post all hournal entries as needed to subsidiary ledgers

Post all journal entries to the general ledger

Create trail balance balance using general ledge balances for

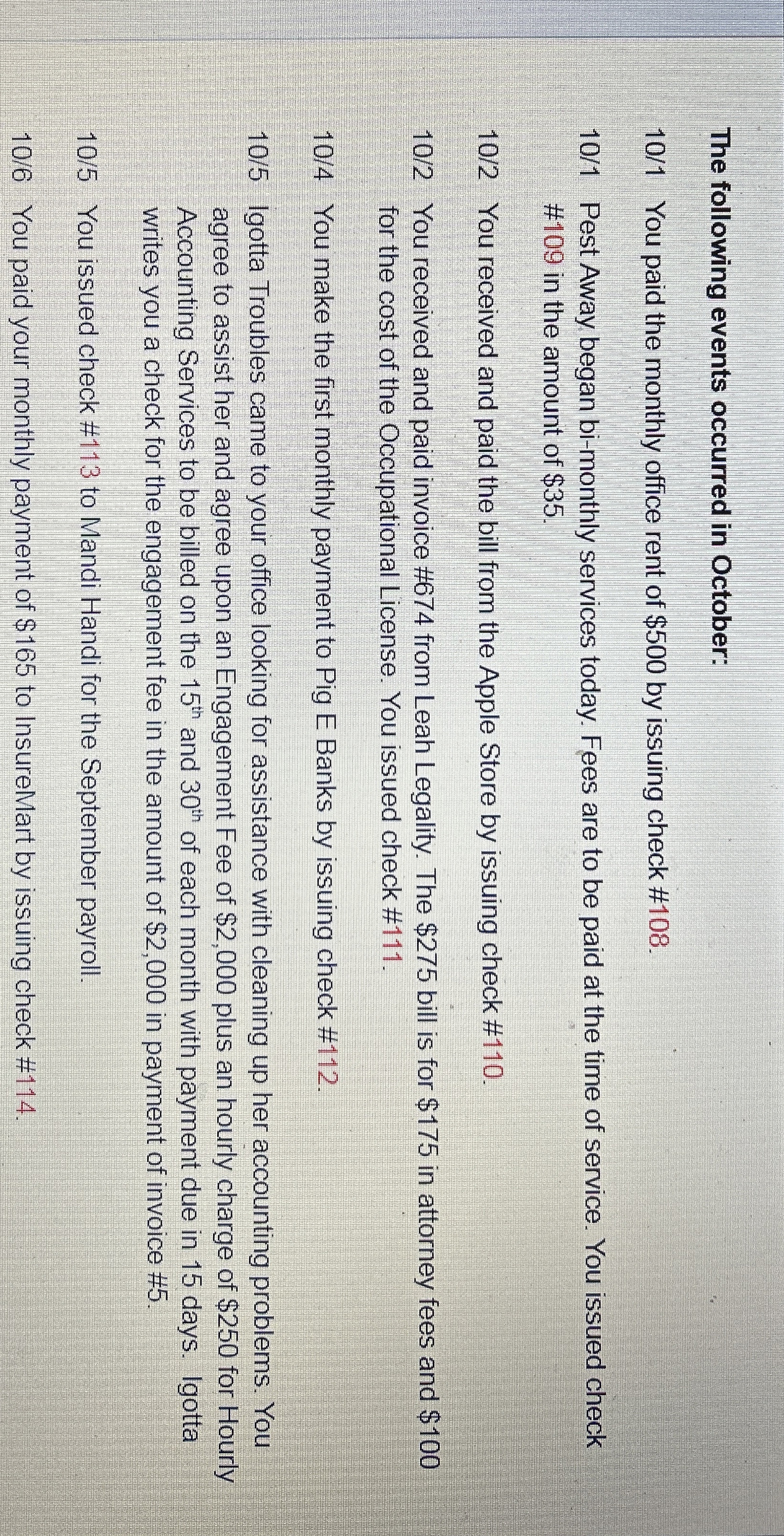

The following events occurred in October:

You paid the monthly office rent of $ by issuing check #

Pest Away began bimonthly services today. Fees are to be paid at the time of service. You issued check # in the amount of $

You received and paid the bill from the Apple Store by issuing check #

You received and paid invoice # from Leah Legality. The $ bill is for $ in attorney fees and $ for the cost of the Occupational License. You issued check #

You make the first monthly payment to Pig E Banks by issuing check #

lgotta Troubles came to your office looking for assistance with cleaning up her accounting problems. You agree to assist her and agree upon an Engagement Fee of $ plus an hourly charge of $ for Hourly Accounting Services to be billed on the and of each month with payment due in days. Igotta writes you a check for the engagement fee in the amount of $ in payment of invoice #

You issued check # to Mandi Handi for the September payroll.

You paid your monthly payment of $ to InsureMart by issuing check #

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock