Question: Project 1 - Developing Financial Statements This is an individual assignment. All work is to be completed in Excel and the completed worksheet must be

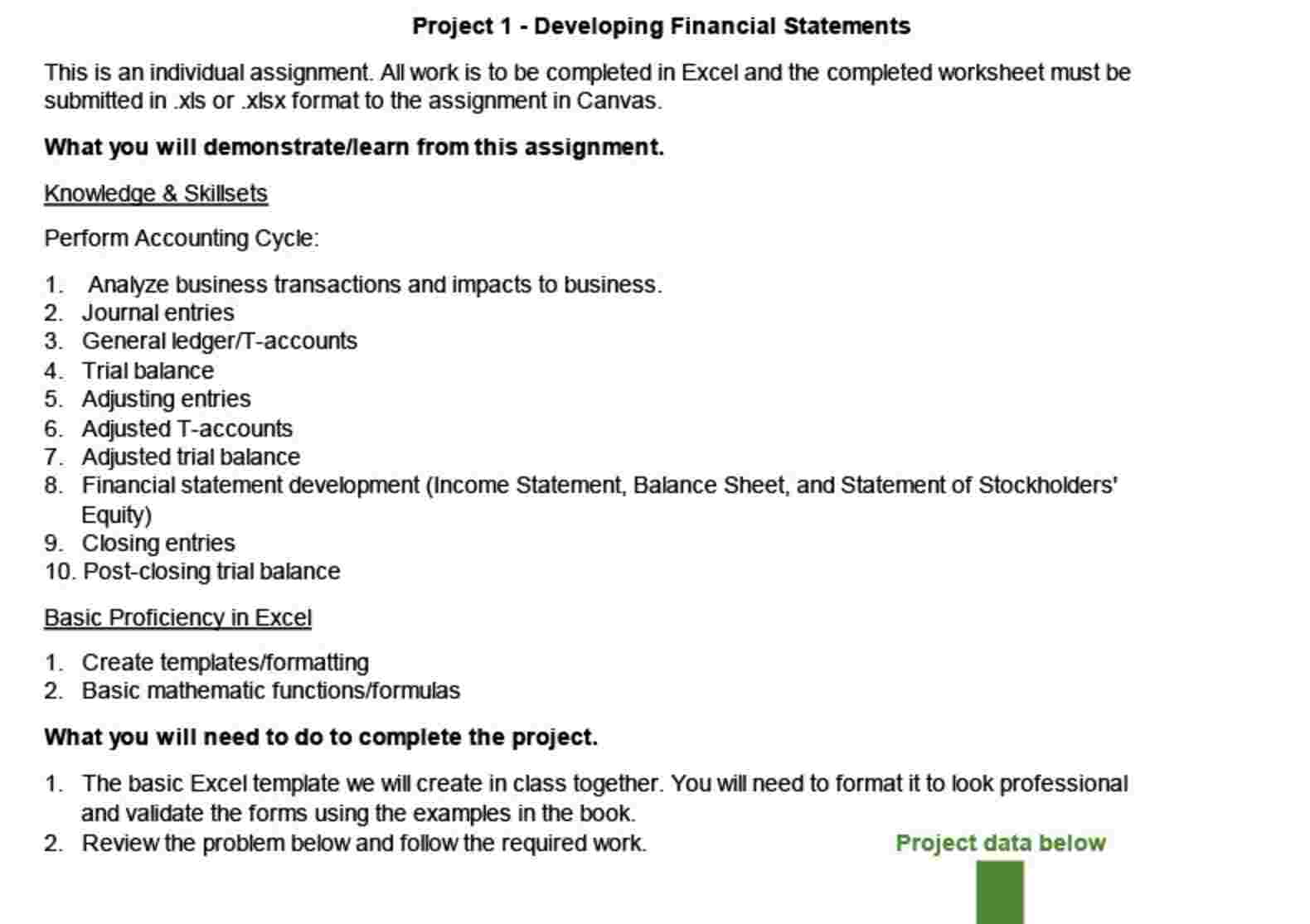

Project Developing Financial Statements

This is an individual assignment. All work is to be completed in Excel and the completed worksheet must be

submitted in xls or xlsx format to the assignment in Canvas.

What you will demonstratelearn from this assignment.

Knowledge & Skillsets

Perform Accounting Cycle:

Analyze business transactions and impacts to business.

Journal entries

General ledgerTaccounts

Trial balance

Adjusting entries

Adjusted Taccounts

Adjusted trial balance

Financial statement development Income Statement, Balance Sheet, and Statement of Stockholders'

Equity

Closing entries

Postclosing trial balance

Basic Proficiency in Excel

Create templatesformatting

Basic mathematic functionsformulas

What you will need to do to complete the project.

The basic Excel template we will create in class together. You will need to format it to look professional

and validate the forms using the examples in the book.

Review the problem below and follow the required work.

first team in each category to complete all checkpoints in order wins. The entry fee

for each team is $

Dec To help organize and promote the race, Tony hires his college roommate, Victor.

Victor will be paid $ in salary for each team that competes in the race. His

salary will be paid after the race.

Dec The company pays $ to purchase a permit from a state park where the race

will be held. The amount is recorded as a miscellaneous expense.

Dec The company purchases racing supplies for $ on account due in days.

Supplies include trophies for the topfinishing teams in each category, promotional

shirts, snack foods and drinks for participants, and field markers to prepare the

race course.

Dec The company receives $ cash from a total of forty teams, and the race

is held.

Dec The company pays Victor's salary of $

Dec The company pays a dividend of $ $ to Tony and $ to Suzie

Dec Using his personal money, Tony purchases a diamond ring for $ Tony

surprises Suzie by proposing that they get married. Suzie accepts and they get

married!

The following information relates to yearend adjusting entries as of December

a Depreciation of the mountain bikes purchased on July th useful life years.

b Depreciation of kayaks purchased on August th useful life years.

c Six months of the oneyear insurance policy purchased on July has expired.

d Four months of the oneyear rental agreement purchased on September

has expired.

e Of the $ of office supplies purchased on July $ remains.

f Interest expense on the $ loan obtained from the city council on August

should be recorded.

g Of the $ of racing supplies purchased on December $ remains.

h Suzie calculates that the company owes $ in income taxes.

Record transactions journal entries from July through December

Post transactions from July through December to General Ledger TAccounts

Prepare the trail balance.

Record adjusting entries as of December

Post adjusting entries on December to TAccounts.

Prepare an adjusted trial balance as of December

For the period July to December prepare an income statement, statement

of stockholders' equity, and a classified balance sheet as of December

Record closing entries as of December

Postclosing entries to TAccounts.

Prepare a postclosing trail balance as of December

Requirement # This should be at the top of each worksheet

For journal entries, replace all of the words with their actual items. Exception is debitcredit at the top of column G & Hthat's a title

However, the word date is not a title please put the actual date there.

TAccounts should have the account name on top. Debit balance accounts have the balance total on the bottom left, credit balance accounts have the balance

total on the bottom right.

TAccount set enter numbers in black

TAccount set copy TAccount set to the new worksheet and then enter new numbers in blue italics

TAccount set copy TAccount set to the new worksheet and then enter new numbers in red italics

Trial Balance, Adjusted Trial Balance, PostClosing Trial Balance

Income Statement, Statement of Stockholders' Equity, Balance Sheet

Company Name

Statement Name

There are multiple requirements worksheets that have statements. Make sure all have the appropriate header required for

Date

statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock