Question: 1. Let now be time t = 0. If we receive/pay ct t = 0, 1, 2,..., T years from now, the net present

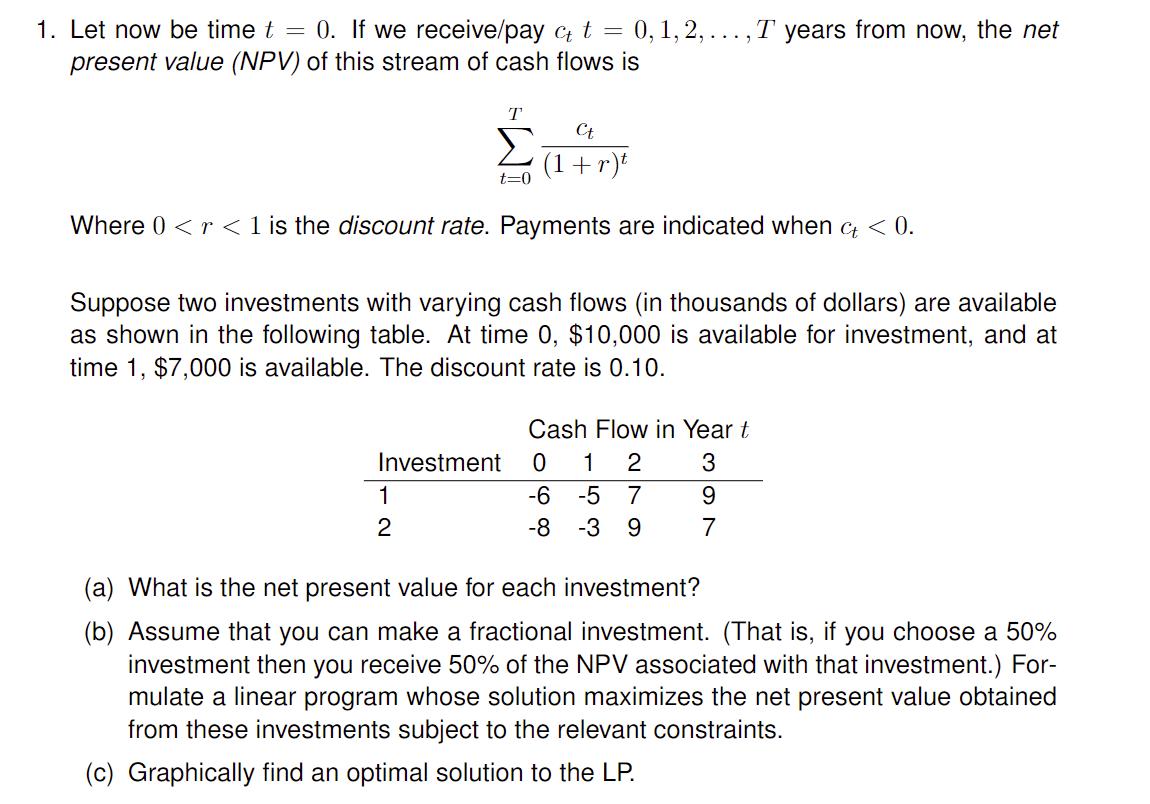

1. Let now be time t = 0. If we receive/pay ct t = 0, 1, 2,..., T years from now, the net present value (NPV) of this stream of cash flows is T t=0 Ct (1+r)t Where 0 < r < 1 is the discount rate. Payments are indicated when ct < 0. Suppose two investments with varying cash flows (in thousands of dollars) are available as shown in the following table. At time 0, $10,000 is available for investment, and at time 1, $7,000 is available. The discount rate is 0.10. Cash Flow in Year t Investment 0 1 2 3 1 2 -6 -5 7 9 -8 -3 9 7 (a) What is the net present value for each investment? (b) Assume that you can make a fractional investment. (That is, if you choose a 50% investment then you receive 50% of the NPV associated with that investment.) For- mulate a linear program whose solution maximizes the net present value obtained from these investments subject to the relevant constraints. (c) Graphically find an optimal solution to the LP.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts