Question: 1. lil. As discussed in class, the suitability process consists of three components: Know Your Client Know Your Product Assess Suitability The requirements of the

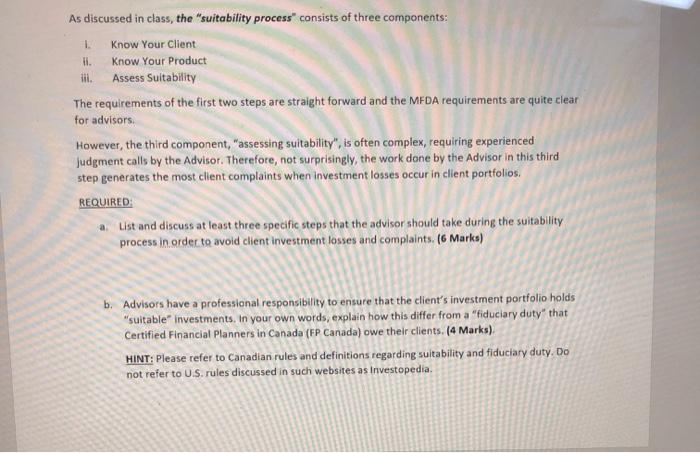

1. lil. As discussed in class, the "suitability process" consists of three components: Know Your Client Know Your Product Assess Suitability The requirements of the first two steps are straight forward and the MFDA requirements are quite clear for advisors. However, the third component, Wassessing suitability", is often complex, requiring experienced Judgment calls by the Advisor. Therefore, not surprisingly, the work done by the Advisor in this third step generates the most client complaints when investment losses occur in client portfolios. REQUIRED a List and discuss at least three specific steps that the advisor should take during the suitability process in order to avoid client investment losses and complaints. ( Marks) b. Advisors have a professional responsibility to ensure that the client's investment portfolio holds "suitable" investments. In your own words, explain how this differ from a "fiduciary duty" that Certified Financial Planners in Canada (EP Canada) owe their clients. (4 Marks) HINT: Please refer to Canadian rules and definitions regarding suitability and fiduciary duty. Do not refer to U.S.rules discussed in such websites as Investopedia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts