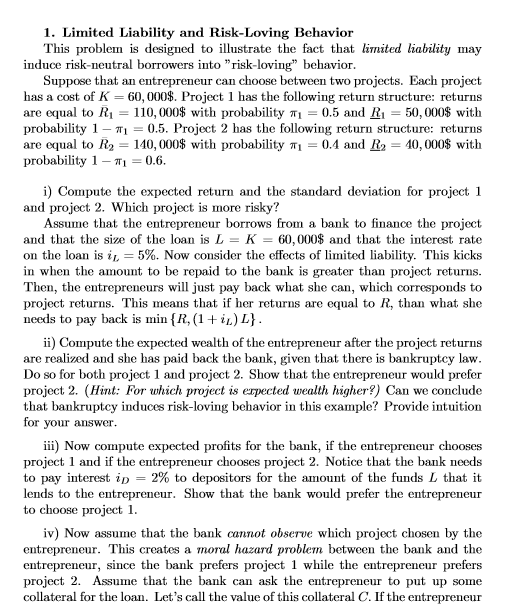

Question: 1. Limited Liability and Risk-Loving Behavior This problem is designed to illustrate the fact that limited liability may induce risk-neutral borrowers into risk-loving behavior Suppose

1. Limited Liability and Risk-Loving Behavior This problem is designed to illustrate the fact that limited liability may induce risk-neutral borrowers into "risk-loving" behavior Suppose that an entrepreneur can choose between two projects. Each project has a cost of K 60, 0008. Project 1 has the following return structure: returns are equal to R1 110,000% with probability 0.5 and R1 50,000 with probability 1 1 0.5. Project 2 has the following return structure: returns are equal to R2 140,000 with probability 0.4 and R2 40,000 with probability 1 T0.6. i) Compute the expected return and the standard deviation for project 1 and project 2. Which project is more risky? Assume that the entrepreneur borrows from a bank to finance the project and that the size of the loan isL K 60,000 and that the interest rate on the loan is il 5%. Now consider the effects of limited liability. This kicks in when the amount to be repaid to the bank is greater than project returns. Then, the entrepreneurs will just pay back what she can, which corresponds to project returns. This means that if her returns are equal to R, than what she needs to pay back is min { R, (1 + i.) L} ii) Compute the expected wealth of the entrepreneur after the project returns are realized and she has paid back the bank, given that there is bankruptcy law Do so for both project 1 and project 2. Show that the entrepreneur would prefer project 2. (Hint: For which project is erpected wealth higher?) Can we conclude that bankruptcy induces risk-loving behavior in this example? Provide intuition for your answer iii Now compute expected profits for the bank, if the entrepreneur chooses project 1 and if the entrepreneur chooses project 2. Notice that the bank needs to pay interest iD-2% to depositors for the amount of the funds L that it lends to the entrepreneur. Show that the bank would prefer the entrepreneur to choose project 1 iv) Now assume that the bank cannot observe which project chosen by the entrepreneur. This creates a moral hazard problem between the bank and the entrepreneur, since the bank prefers project 1 while the entrepreneur prefers project 2. Assume that the bank can ask the entrepreneur to put up some collateral for the loan. Let's call the value of this collateral C. If the entrepreneuir defaults on her loan repayments, the bank can seize this collateral. When the entrepreneur declares bankruptcy, she is defaulting on her loan repayments, and thus the bank can seize the collateral. Note that given our assumptions on bankruptcy and project returns, if the entrepreneur chooses project 1, the probability of declaring bankruptcy is 0.5, while if she chooses project 2 it is 0.6. Is there a value of the collateral, C, such that the entrepreneur will find it optimal to choose project 1? Hint: To find this value, you must derive ezpected wealth for project 1 and 2 under the collateral requirement and compare them 1. Limited Liability and Risk-Loving Behavior This problem is designed to illustrate the fact that limited liability may induce risk-neutral borrowers into "risk-loving" behavior Suppose that an entrepreneur can choose between two projects. Each project has a cost of K 60, 0008. Project 1 has the following return structure: returns are equal to R1 110,000% with probability 0.5 and R1 50,000 with probability 1 1 0.5. Project 2 has the following return structure: returns are equal to R2 140,000 with probability 0.4 and R2 40,000 with probability 1 T0.6. i) Compute the expected return and the standard deviation for project 1 and project 2. Which project is more risky? Assume that the entrepreneur borrows from a bank to finance the project and that the size of the loan isL K 60,000 and that the interest rate on the loan is il 5%. Now consider the effects of limited liability. This kicks in when the amount to be repaid to the bank is greater than project returns. Then, the entrepreneurs will just pay back what she can, which corresponds to project returns. This means that if her returns are equal to R, than what she needs to pay back is min { R, (1 + i.) L} ii) Compute the expected wealth of the entrepreneur after the project returns are realized and she has paid back the bank, given that there is bankruptcy law Do so for both project 1 and project 2. Show that the entrepreneur would prefer project 2. (Hint: For which project is erpected wealth higher?) Can we conclude that bankruptcy induces risk-loving behavior in this example? Provide intuition for your answer iii Now compute expected profits for the bank, if the entrepreneur chooses project 1 and if the entrepreneur chooses project 2. Notice that the bank needs to pay interest iD-2% to depositors for the amount of the funds L that it lends to the entrepreneur. Show that the bank would prefer the entrepreneur to choose project 1 iv) Now assume that the bank cannot observe which project chosen by the entrepreneur. This creates a moral hazard problem between the bank and the entrepreneur, since the bank prefers project 1 while the entrepreneur prefers project 2. Assume that the bank can ask the entrepreneur to put up some collateral for the loan. Let's call the value of this collateral C. If the entrepreneuir defaults on her loan repayments, the bank can seize this collateral. When the entrepreneur declares bankruptcy, she is defaulting on her loan repayments, and thus the bank can seize the collateral. Note that given our assumptions on bankruptcy and project returns, if the entrepreneur chooses project 1, the probability of declaring bankruptcy is 0.5, while if she chooses project 2 it is 0.6. Is there a value of the collateral, C, such that the entrepreneur will find it optimal to choose project 1? Hint: To find this value, you must derive ezpected wealth for project 1 and 2 under the collateral requirement and compare them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts