Question: 1. Loan commitments are classified as A. B. c. On-balance-sheet assets. Off-balance-sheet assets. Off-balance-sheet liabilities. On-balance-sheet liabilities. 2. Which of the following is false? It

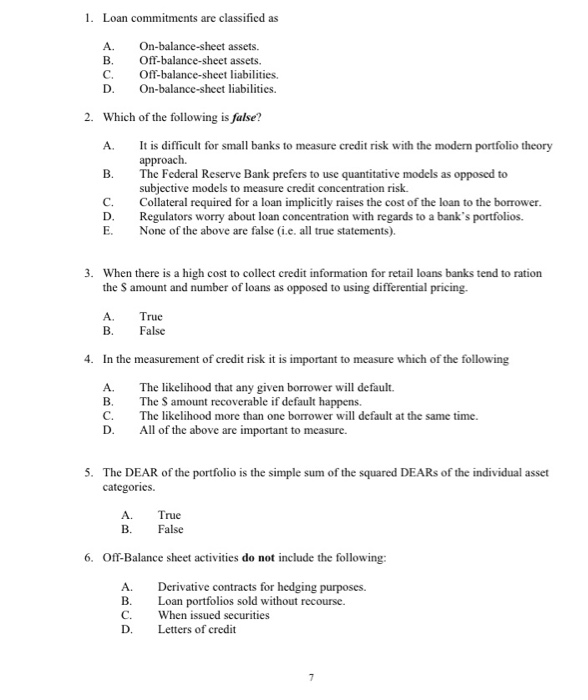

1. Loan commitments are classified as A. B. c. On-balance-sheet assets. Off-balance-sheet assets. Off-balance-sheet liabilities. On-balance-sheet liabilities. 2. Which of the following is false? It is difficult for small banks to measure credit risk with the modern portfolio theory approach. The Federal Reserve Bank prefers to use quantitative models as opposed to subjective models to measure credit concentration risk. Collateral required for a loan implicitly raises the cost of the loan to the borrower. Regulators worry about loan concentration with regards to a bank's portfolios. None of the above are false (i.e. all true statements). 3. When there is a high cost to collect credit information for retail loans banks tend to ration the amount and number of loans as opposed to using differential pricing. A B. True False 4. In the measurement of credit risk it is important to measure which of the following A. The likelihood that any given borrower will default. The S amount recoverable if default happens. The likelihood more than one borrower will default at the same time. All of the above are important to measure. D. 5. The DEAR of the portfolio is the simple sum of the squared DEARs of the individual asset categories. A. B. True False 6. Off-Balance sheet activities do not include the following: A B. C. D. Derivative contracts for hedging purposes. Loan portfolios sold without recourse. When issued securities Letters of credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts