Question: 1. Make an Implementation plan for this Fitbit case study. 2. Make a weighted decision matrix analysis. 3. Sensitivity analysis when results of the weighted

1. Make an Implementation plan for this Fitbit case study.

2. Make a weighted decision matrix analysis.

3. Sensitivity analysis when results of the weighted decision matrix are close.

4. Primary issue of the case study.

5. Potential feasible solutions.

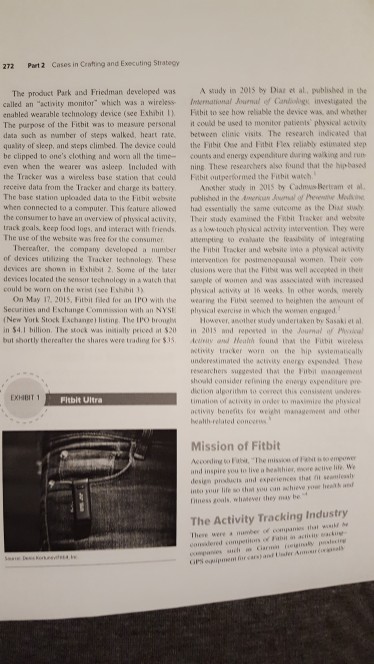

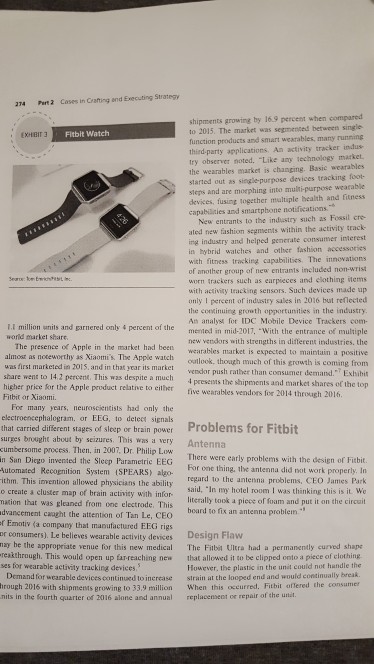

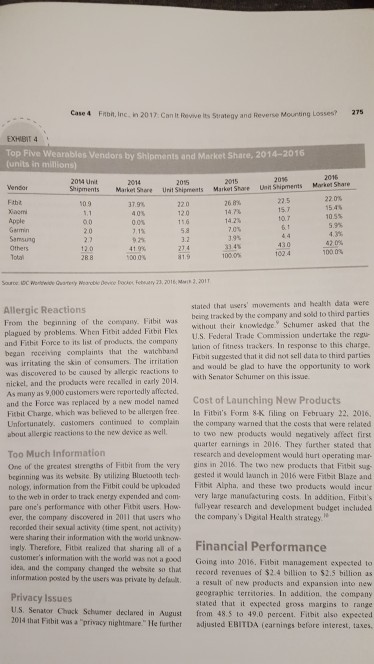

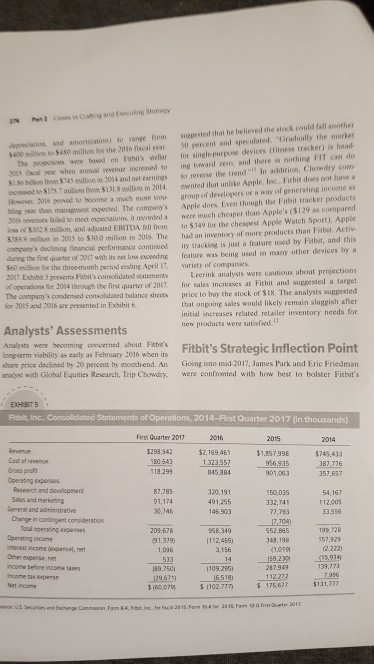

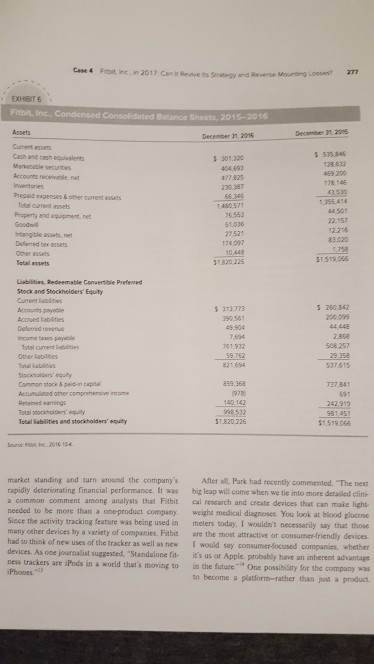

case 4 Fitbit, Inc., in 2017: Can It Revive Its Strategy and Reverse Mounting Losses? a connect MARLENERED BY in the muniber of devices sold. The company sold only 2.956 devices in the first quarter of 2017 compared to 4.842 during the first quarter of 2016. Correspond ingly, it's revenue declined from $505 million dus ing the first quarter of 2016 to 5199 million during the first quarter of 2017. The accelerating collapse of Fi bit's competitive advantage and financial performance created a crisis for founders James Park and Eric Frice man who were now faced with promptly establishing a new strategic course to save the company. Filbit revolutionized the personal fitness activity in 2009 with the introduction of its Tracker wearable activity monitor. By 2016 the company was a hit in the marketplace with Fitbit devices becoming nearly ubic uits with fitness enthusiasts and health conscious individuals wearing the devices and checking them throughout the day. The company's sales of activity monitors had increased from 5.000 units in 2009 to 21.4 million connected health and fitness devices by yearend 2015. The company executed a successful IPO (initial public offering) in 2015 that boosted liquidity by 54.1 billion and recorded revenues of $1.86 billion by the conclusion of its first year as a public company, Fitbit's chief managers expected 2016 revenues in the range of 52.4 billion to $25 billion. However, on the last day of February 2016 the price of Fitbit stock plunged nearly 20 percent after the company announced that the sales and earnings in the first quarter would fall short of analysts' forecasts. The company's revenues increased by nearly 17 percent from 2016 to 2017 and its number of devices sold increased from 21.4 mln in 2015 to 22.3 million in 2016. However, the com- pany's cost of revenue increased from 515 percent in 2015 60 61 percent in 2016. The dramatic cost of revenue increases coupled with rapidly increasing open ating expenses resulted in a not loss of S102 million in 2016 for Fitbit Fitbit's financial troubles accelerated in 2011 with the company reporting revenue for the first quarter of 2017 of 5299 million and a net loss of $60.1 million While the company's financial travail in 2016 was related primarily to increasing costs, the weak first quarter 2017 performance was driven by a decline Background on Fitbit Fitbit was founded in October 2007 by James Park (CEO) and Eric Friedman (CTO). The two men started the company after noticing the policial for using en sors in small wearable devices to track individuals physical activities. Before they had a prototype. Park and Friedman took a circuit board in a wooden box around to venture capitalists to raise money. In 2008 Park and Friedman addressed the TechCrunch50 Conference drumming up preorders for their product Neither man had any manufacturing experience, 50 they traveled to Asia and sought out suppliers and a company to produce the device for them. Fitbit put its product named "Tracker" on the market at the end of 2009, and the company shipped approximately 5,000 units at that time. They had additional orders for 2.000 units on the books CHM 2017 Brand Marlene M Rued. All Nerve 272 Part 2 Cases in Criting and Executing Strategy The product Park and Friedman developed was called an activity monitor which was a wireless enabled wearable technology device (see Exhibit) The purpose of the Fitbit was to measure personal data such as number of steps walked, heart rate quality of sleep, and steps climbed. The device could be clipped to one's clothing and won all the time even when the wearer was asleep Included with the Trucker was a wireless base station that could receive data from the Tracker and charge its battery The base station uploaded data in the Fitbit website when connected to a computer. This feature allowed the consumer to have an overview of physical activity track oals keep od logs, and interact with friends The use of the website was free for the consumer Thereafter the company developed of devices utilizing the Tracker technolony. These devices are shown in Exhibit 2. Some of the later devices located the sensor technolony in watch that could be worn on the Britse Ehihi) On May 17, 2015. Pitbit filed for an IPO with the Securities and Exchange Commission with an NYSE (New York Stock Exchange listine The Phone in $4.1 billion. The stock was inily priced at $20 but shortly thereafter the shares were trading for $15 A Study in 2015 y Dias et al, published in the Inmanal Animal of Cali investigated the Futbit to see how relate the device was whether it could be used to monitor ptical physical activit between clinic visits. The research indicated that the Fibit One and Fire Flex celih estimated step Cand energy expenditure during walking and run ning. The researchers also and that the Fitbit outperformed the Fitbit watch Another hy in 2015 Cam Bertam published in the he tad essentially the same wcame as the Diary Their lady and the whit Tracker and website 35 bow.touch posical interion. They were Sep site the fine the Hibit Tracker and website plovica intervention for postmenopausal women. Their com clusions were that the it was well accepted in the sample of women wassened with increased plusical willy 16 werks. In other words, wiely warme be it to beighten the mount physical exercise in which he wengi However, the mudy undertaken by Sasakietal in 2015 and reported in the Jumal w Melo A Health found that the hit wireless Intivity tracker war on the hip systematically underestimated the intentory On Thew researchers with the Piibil man should consider refining the enemy pre diction algorithm to correct this case timation of inity in order to maximi i plasical activity benefits for management and other Iwali relationne EXHIBIT 1 Fitbit Ultra Mission of Fitbit Marina Theme and inspire to live active line. We deste ans and experiences that are nitness, wever they may be The Activity Tracking Industry There were brownies that will tatati care w can final cansante Almer Case 4 Fit, Inc, in 2017. Con It Revive is Strategy and Reverse Mounting Losses? 273 EXHIBIT 2 Activity Tracker Devices Developed by Fitbit Name of Device Dwie First Unit Sold Fitbit Tracker 2008 Fitbitta 2011 Fibra 2012 Ft September 2012 thitp Capabilities and Options Device with a dia to foco Sensed user movement Mensured vepstaken, stance walked, calories burned, Floorsbed In black and bolony Digital och Scopul Ainter that mawrede of floors "Chatternessages that occurred when Utra moved New Colors of plume and blue Wi-Fi snart scale Recognized users of tracks Measured weight, boy made and percentage of body fat More vive digital display Seperatecipand charging cable Wireless ne con le Used Booth 4.0 See of a Tracked steps toen distance traveled and calories burned Induced a posate battery Lower price that others Women te wist Tracket 24 including sleep patterns LED deply story time and daily Traceedinte Mbretig alam Replacement for Fit Force istand displayed ca Siasmanth Mandante Tracked peece, and death GPS S to match Focused on Colored touchscreen Enchanables top and hane Pure heart rate tracking Spacing: 7-day baberite Four colors and the September 2012 Fit Flex May 2013 Fit Force October 2013 Fitbit Charge October 2014 October 2014 Fitbit Blaze FIDAR 2016 2012 Sewu producing undergarments for men). There were also companies such as Apple who produce smart watches that perform many of the same tasks as Fitbit's devices. Another company entering the market late was Jawbone. This company was formed in 1999, and its consumer devices were Bluetooth headphones and speakers initially and later fitness trackers. With the increased competition in the activity tracking industry beginning in 2015, Jawbone dropped to seventh place in the second quarter from in place in the first ter among makers of wearable tracking devices. Xinomi, a Chinese company, shipped 15.7 million wearable activity trackers in 2016. That gave the com puny a 15.4 percent global market share, which was second to Fitbit with Apple, Garmin, and Samsung behind the two leaders. In 2014, Xiaomi had shipped 214 Part 2 Cases in Crating and Executing Strategy EXHIBITS Fitbit Watch TERRIER shipments growing by 16 9 percent when compared to 2015. The market was segmented between single function products and smart wearables, many running third party applications. An activity tracker indus try observer noted, "Like any technology market the wearables market is changing. Basic wearables started out a single purpose devices tracking foot steps and are morphing into multi-purpose wearable devices, fusing together multiple health and fitness capabilities and smartphone notifications New entrants to the industry such as Fossil cre- ated new fashion segments within the activity track ing industry and helped generate consumer interest in hybrid watches and other fashion accessories with fitness tracking capabilities. The innovations of another group of new entrants included non wrist worn trackers such as earpieces and clothing items with activity tracking sensors. Such devices made up only 1 percent of industry sales in 2016 but reflected the continuing growth opportunities in the industry An analyst for IDC Mobile Device Trackers com- mente in mid-2017, "With the entrance of multiple new vendors with strengths in different industries, the wearables market is expected to maintain a positive outlook, though much of this growth is coming from vendor push rather than consumer demand." Exhibit 4 presents the shipments and market shares of the top five wearables vendors for 2014 through 2016 Sewwerte 1.1 million units and garnered only 4 percent of the world market share The presence of Apple in the market had been almost as noteworthy as Xiaomi's. The Apple Watch was first marketed in 2015 and in that year its marker share went to 14.2 percent. This was despite a much higher price for the Apple product relative to either Fitbit or Xiaomi. For many years, neuroscientists had only the clectroencephalogram, or EEG, to detect signals that carried different stages of sleep or brain power surges brought about by seizures. This was a very cumbersome process. Then, in 2007. Dr. Philip Low in San Diego invented the Sleep Parametric EEG Automated Recognition System (SPEARS) algo ithm. This invention allowed physicians the ability o create a cluster map of brain activity with infor mation that was gleaned from one electrode. This advancement caught the attention of Tan Le, CEO er Emotiv (a company that manufactured EEG rigs or consumers). Le believes wearable activity devices may be the appropriate venue for this new medical reakthrough. This would open up far-reaching new ses for wearable activity tracking devices Demand for wearable devices continued to increase through 2016 with shipments growing to 33.9 million nits in the fourth quarter of 2016 alone and annual Problems for Fitbit Antenna There were carly problems with the design of Fitbit For one thing, the antenna did not work properly. In regard to the antenna problems, CEO James Park said, 'In my hotel room I was thinking this is it. We literally took a piece of foam and put it on the circuit board to fix an antenna problem" Design Flaw The Fitbit Ultra had a permanently curved shape that allowed it to be clipped onto a piece of clothing However, the plastic in the unit could not handle the sirain at the looped end and would continually break When this occurred, Fitbit offered the consumer replacement or repair of the unit Case Fib, inc. In 2017. Can It Beweis Stegy and Reverse Mouring losses 275 2016 Market Share EXHIBIT 4 Top Five Wearables Vendors by Shipments and Market Share, 2014-2016 (units in millions 2014 UN Vendor 2014 2015 2015 2015 Shipments Marke Share Unit Shipments Market Share Unit Shipments Ft 109 37.9% 220 26 Xiaomi 1.1 405 120 147 15.7 Apple 00 0.0% 116 14.2 10.7 Garmin 58 7.00 Samsung 2.2 923 3.2 399 44 Others 12.0 41.9% 21.4 31.45 430 Total 288 90004 819 100.0% 1024 225 22.0 15.45 10.5% 5.9% 470 1000 Source Www Device och 7, 2016, 2011 Allergic Reactions From the beginning of the company. Fitbit was plagued by problems. When Hithit added Fitbit Fles and Fitbit Force to its list of products, the company began recening complaints that the watch and was irritating the skin of consumers. The irritation was discovered to be caused by allergic reactions to nickel, and the products were recalled in early 2014 As many as 9.000 customers were reportedly affected, and the Force was replaced by a new model named Fitbit Charge, which was believed to be allere free Unfortunately, customers continued to complain about allergic reactions to the new device as well stated the users' movements and health data were being tracked by the company and sold to third parties without their knowledge. Schumer asked that the U.S. Federal Trade Commission undertake the regu ution of fitness trackers. In response to this charge Fitbit slegested that it did not sell data to third parties and would be glad to have the opportunity to work with Senator Schuimer on this issue Cost of Launching New Products In Fitbit's Form 8-K filing on February 22, 2016. the company warned that the costs that were related to two new products would negatively affect first quarter earnings in 2016. They further stated that research and development would hurt operating mar gins in 2016. The two new products that Fitbit gested it would launch in 2016 were Futbit Blaze and Fitbit Alpha, and these two products would incur very large manufacturing costs. In addition, Fitbit's Tell year research and development budget included the company's Digital Health strategy Too Much Information One of the greatest strengths of Fitbit from the very beginning was its website. By tilizing Bluetooth tech nology, information from the Fitbit could be uploaded to the web in order to track energy expended and com pure one's performance with other Fichiers. How ever, the company discovered in 2011 that users who recorded their sexual activity (time spent, not activity) were sharing their information with the world unknow ingly. Therefore, the realized that sharing all of customer's information with the world was not a good idea, and the company changed the website so the information posted by the users was private by default Privacy Issues US Senator Chuck Schumer declared in August 2014 that Fitbit was a privacy nightmare" He further Financial Performance Going into 2016. Futbit management expected to record revenues of $2.4 billion to $2.5 billion as a result of new products and expansion into new geographie territories. In addition, the company stated that it expected gross margins to range from 48.5 to 49.0 percent. Fitbit also expected adjusted EBITDA earnings before interest, taxes, 2. Ste sed that he believed the stock could other $0 million to the 2016 scal sean percent and speculated. "Gradually the market The were but i wellar Il single pur devices the tracker) had war when we were to ing toward and there is nothing I can do Soms will 0 and net cantins to reverse the trend. In addition, Chowdry com S1mba SIM in 2014 mented at unike Apple Inc. this does not have Hot 306 to be a much more group of developers any of generating income year the expected. The com Apple does Even though the Fitbit tracker products Geomet expectations it redela were much cheaper than Apple's (5129 as compared 3028 mm, and died ENTDA Roll from to $10 for the cheapest Apple Watch Sport, Apple Simi in 2015 to 100 million in 2016. The had an inventory of more products than Fitbit Activ con declining facial erface continued ity tracking is just a feature used by tbt, and this during the best quarter of it with its met sewing feature was being used in many other devices by 560 million for the three month period ending April 17 variety of companies 2017 Exhibit pets it's consolidated statements Leerink analysts were cautious about projections of options for 2014 through the first quarter of 2017 for sales increases at Fitbit and suggested a target The company's condensed consolidated balance sheets price to buy the stock of $18. The analysts ested for 2015 and 2016 are presented in Exhibit that ongoing sales would likely remain sluggish after initial increases related retailer inventory needs for Analysts' Assessments new products were satisfied!! Analysts were becoming concerned about he's Fitbit's Strategic Inflection Point longterm viability as early as February 2016 when its share price declined by 20 percent by month end. An Going into mid-2017, James Park and Eric Friedman analyst with Global Equities Research, Trip Chowdry. were confronted with how best to bolster Fitbit's EXHIBITS Fitbit, Inc. Consolated Statements of Operations, 2014-First Quarter 2017 (in thousands) Flest Quarter 2017 2016 2015 2014 $299,942 130443 118.299 $2.169.451 1.323,557 845884 $1.657938 956.935 901,063 5745,433 387.736 357,657 87,785 91.174 30,146 320,191 491,255 145,903 54,167 112.005 33556 Grosso Operating expenses Research and development Sales and marketing General and administrative Crange in content consideration operating espes Operating income interconnet Orenset income before incontes comesse Netcon 209,678 191.319) 1,036 533 189.750 1967 $ 160,070 95R 349 1112.455 3156 14 1109.295 16.518 $ 1102.717 150,035 332.741 77,793 7.709 552,665 348,198 (1.0191 159.2001 287949 112.212 $ 175,677 199,20 157.929 2.222 5.914 139,73 7016 $131.773 Stengewoon Komfort for 2016. Or 2017 Case Fotin, 2017 Cont Beweis Serey and Reverse More 277 EXHIBITS Fitbit, Inc., Condensed Consolidated Estance Sheets. 2015-2016 December 11, 2016 December 2015 Current Cash and houses te scurtes $ 0.120 overies Pred penses other current 4775 230.187 66340 1.480.571 16553 51.036 27521 $ 556 1286 469 200 178.65 63.50 1955 41 LOS 22.157 12.216 23.020 Property and the Goodwill De taxa Others 10.4 51320226 51515066 Libilities Redeemable Convertible Preferred Stock and Stockholders' Equity $313.773 $ 250.342 200.00 Accounts payable Acued tables Datadreritus Incomic Total current Others Totes Stockholders Common capital Accumulated other comprehensive Dating 49 904 7.694 761932 59752 32654 28 508257 29253 537.615 259 160 1978 180.142 18512 51.620 226 737.341 991 242.919 981451 515190066 Total abilities and stockholders' suity Sot 2016 10 market standing and turn around the company's rapidly deteriorating financial performance. It was a common comment among analysts that Fitbit needed to be more than a one-product company Since the activity tracking feature was being used in many other devices by a variety of companies. Fitbit had to think of new uses of the tracker as well as new devices. As one journalist suggested. "Standalone fit ness trackers are iPods in a world that's moving to Phones After Park had recently commented, "The next big cap will come when we tle into more detailed clin cal research and create devices that can make light weight medical diagnoses. You look at blood glucose meters today. I wouldn't necessarily say that those are the most attractive or consumer-friendly devices I would say consume focused companies whether it's us or Apple, probably have an inherent advantage in the future. One possibility for the company was to become a platform-rather than just productStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts