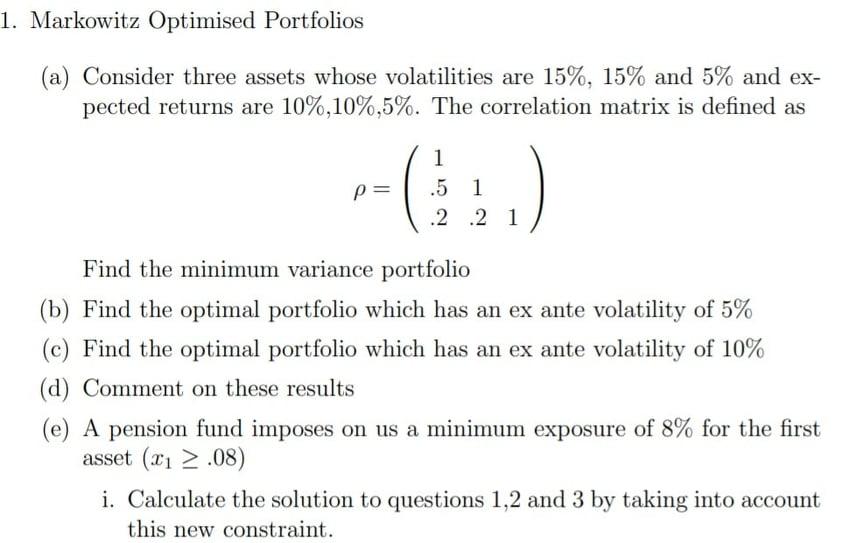

Question: 1. Markowitz Optimised Portfolios (a) Consider three assets whose volatilities are 15%, 15% and 5% and ex- pected returns are 10%,10%,5%. The correlation matrix is

1. Markowitz Optimised Portfolios (a) Consider three assets whose volatilities are 15%, 15% and 5% and ex- pected returns are 10%,10%,5%. The correlation matrix is defined as P= 1 .5 1 .2 2 1 Find the minimum variance portfolio (b) Find the optimal portfolio which has an ex ante volatility of 5% (c) Find the optimal portfolio which has an ex ante volatility of 10% (d) Comment on these results (e) A pension fund imposes on us a minimum exposure of 8% for the first asset (21 >.08) i. Calculate the solution to questions 1,2 and 3 by taking into account this new constraint. 1. Markowitz Optimised Portfolios (a) Consider three assets whose volatilities are 15%, 15% and 5% and ex- pected returns are 10%,10%,5%. The correlation matrix is defined as P= 1 .5 1 .2 2 1 Find the minimum variance portfolio (b) Find the optimal portfolio which has an ex ante volatility of 5% (c) Find the optimal portfolio which has an ex ante volatility of 10% (d) Comment on these results (e) A pension fund imposes on us a minimum exposure of 8% for the first asset (21 >.08) i. Calculate the solution to questions 1,2 and 3 by taking into account this new constraint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts