Question: 1) Net working capital is defined as: A) the value of a firm's current assets. B) current assets minus current liabilities. C) the depreciated book

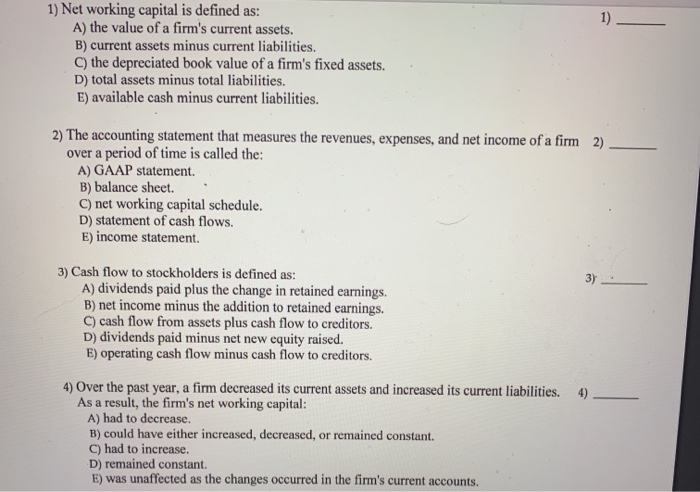

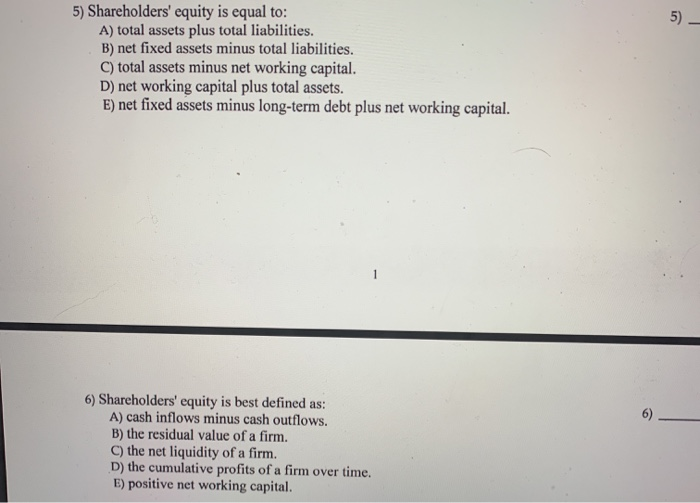

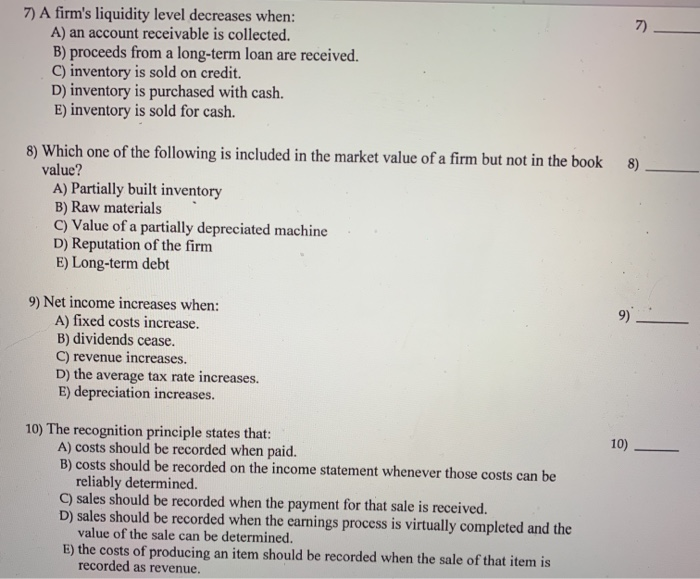

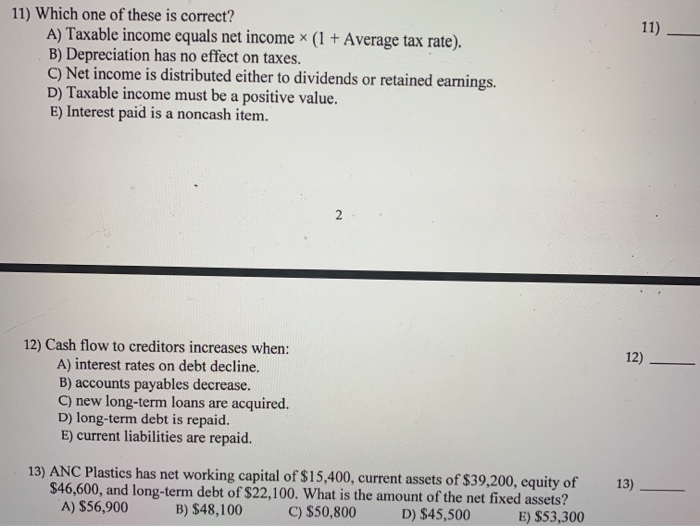

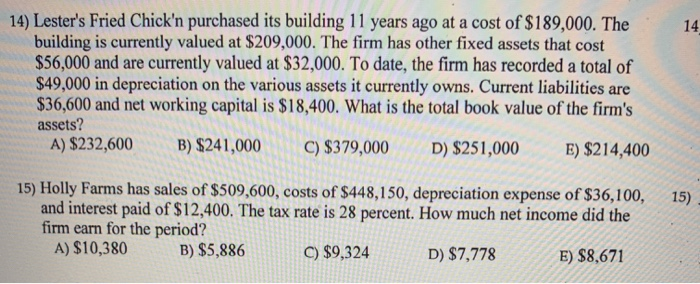

1) Net working capital is defined as: A) the value of a firm's current assets. B) current assets minus current liabilities. C) the depreciated book value of a firm's fixed assets. D) total assets minus total liabilities. E) available cash minus current liabilities. 1) 2) The accounting statement that measures the revenues, expenses, and net income of a firm over a period of time is called the: A) GAAP statement. B) balance sheet. C) net working capital schedule. D) statement of cash flows. E) income statement. 2) 3) Cash flow to stockholders is defined as: A) dividends paid plus the change in retained earnings. B) net income minus the addition to retained earnings. C) cash flow from assets plus cash flow to creditors. D) dividends paid minus net new equity raised. E) operating cash flow minus cash flow to creditors. 3) 4) Over the past year, a firm decreased its current assets and increased its current liabilities. As a result, the firm's net working capital: A) had to decrease. B) could have either increased, decreased, or remained constant. C) had to increase. D) remained constant. E) was unaffected as the changes occurred in the firm's current accounts. 4) 5) Shareholders' equity is equal to: A) total assets plus total liabilities. B) net fixed assets minus total liabilities. C) total assets minus net working capital. D) net working capital plus total assets. E) net fixed assets minus long-term debt plus net working capital. 5) 6) Shareholders' equity is best defined as: A) cash inflows minus cash outflows. B) the residual value of a firm. C) the net liquidity of a firm. D) the cumulative profits of a firm over time. E) positive net working capital. 6) 7) A firm's liquidity level decreases when: A) an account receivable is collected. B) proceeds from a long-term loan are received. C) inventory is sold on credit. D) inventory is purchased with cash. E) inventory is sold for cash. 7) 8) Which one of the following is included in the market value of a firm but not in the book value? 8) A) Partially built inventory B) Raw materials C) Value of a partially depreciated machine D) Reputation of the firm E) Long-term debt 9) Net income increases when: A) fixed costs increase. B) dividends cease. C) revenue increases. D) the average tax rate increases. E) depreciation increases. 9) 10) The recognition principle states that: A) costs should be recorded when paid. B) costs should be recorded on the income statement whenever those costs can be reliably determined. C) sales should be recorded when the payment for that sale is received. D) sales should be recorded when the earnings process is virtually completed and the value of the sale can be determined. E) the costs of producing an item should be recorded when the sale of that item is recorded as revenue. 10) 11) Which one of these is correct? A) Taxable income equals net income (1 + Average tax rate). B) Depreciation has no effect on taxes. C) Net income is distributed either to dividends or retained earnings. D) Taxable income must be a positive value. E) Interest paid is a noncash item. 11) 12) Cash flow to creditors increases when: A) interest rates on debt decline. B) accounts payables decrease. C) new long-term loans are acquired. D) long-term debt is repaid. E) current liabilities are repaid. 12) 13) ANC Plastics has net working capital of $15,400, current assets of $39,200, equity of $46,600, and long-term debt of $22,100. What is the amount of the net fixed assets? A) $56,900 13) B) $48,100 C) $50,800 D) $45,500 E) $53,300 14) Lester's Fried Chick'n purchased its building 11 years ago at a cost of $189,000. The building is currently valued at $209,000. The firm has other fixed assets that cost $56,000 and are currently valued at $32,000. To date, the firm has recorded a total of $49,000 in depreciation on the various assets it currently owns. Current liabilities are $36,600 and net working capital is $18,400. What is the total book value of the firm's 14 assets? A) $232,600 B) $241,000 C) $379,000 D) $251,000 E) $214,400 15) Holly Farms has sales of $509,600, costs of $448,150, depreciation expense of $36,100, and interest paid of $12,400. The tax rate is 28 percent. How much net income did the firm earn for the period? A) $10,380 15) B) $5,886 C) $9,324 D) $7,778 E) $8,671

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts