Question: The below figures are captured from lecture notes. --- For Fig.1, to calculate free cash flow to firm, we need to minus net working capital

The below figures are captured from lecture notes.

---

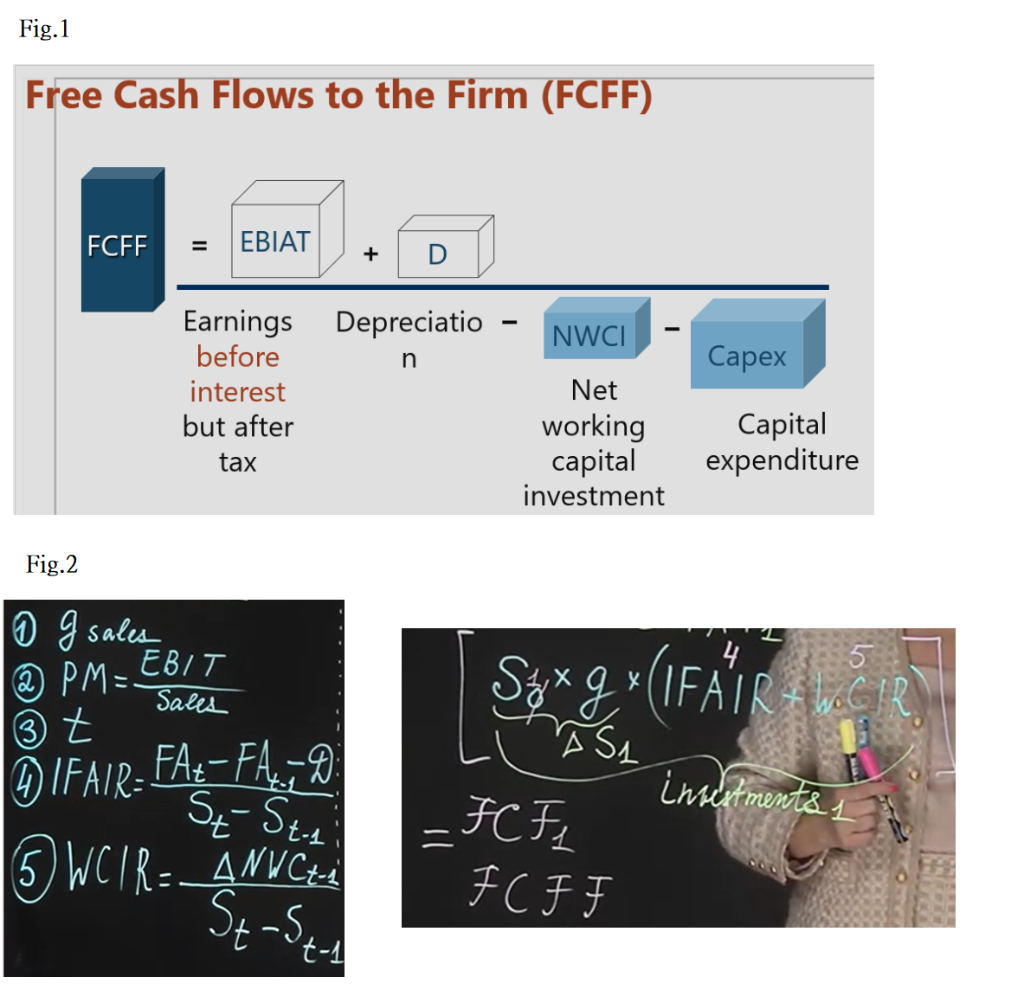

For Fig.1,

to calculate free cash flow to firm, we need to minus net working capital investment and capital expenditure. And by definition, net working capital investment is current assets minus current liabilities, while capital expenditure is money spent on fixed assets.

May I know, if the minus on NWCI and CapEx would duplicate? Because the current assets in NWCI could also include fixed assets, which is same as those in CapEx.

---

As for Fig.2,

sales * sales revenue growth rate * (incremental fixed assets investment rate + working capital investment rate) = investments

while, IFAIR = change in fixed assets minus depreciation then divided by change in sales,

WCIR = change in net working capital divided by change in sales

May I know, if the adding of IFAIR and WCIR would duplicate? Because IFAIR included the value of fixed assets, and WCIR also calculate the current asset minus liabilities.

---

THANK YOU!!!!

Fig.1 Free Cash Flows to the Firm (FCFF) FCFF = EBIAT + D NWCI n Capex Earnings Depreciatio before interest but after tax Net working ital investment Capital expenditure Fig.2 4 5 2 PM - EBIT 0 g sales =. Sales t Stxgx (IFAIR + WC PRO * A S1 O IFAIR- FA+ - FAL D) investments 1 St Ste 5WCTR=_ANICA - FC F F C F Stos 't-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts