Question: | | . 1 Normal 1 No Spac... Heading 1 Heading 2 Heading 3 Heading 4 Title Subtitle Subtle Em... Styles 2018 Preparing a Statement

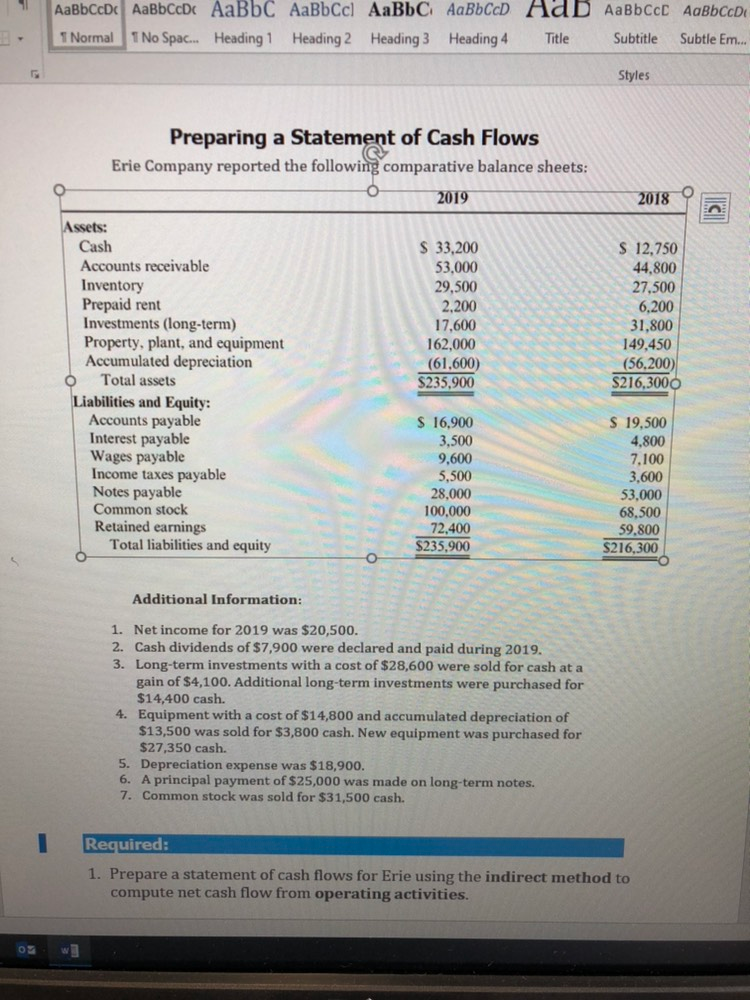

| | . 1 Normal 1 No Spac... Heading 1 Heading 2 Heading 3 Heading 4 Title Subtitle Subtle Em... Styles 2018 Preparing a Statement of Cash Flows Erie Company reported the following comparative balance sheets: 2019 Assets: Cash $ 33,200 Accounts receivable 53,000 Inventory 29,500 Prepaid rent 2,200 Investments (long-term) 17,600 Property, plant, and equipment 162,000 Accumulated depreciation (61,600) o Total assets S235,900 Liabilities and Equity: Accounts payable $ 16,900 Interest payable 3,500 Wages payable 9,600 Income taxes payable 5,500 Notes payable 28,000 Common stock 100,000 Retained earnings 72,400 Total liabilities and equity $235.900 S 12,750 44.800 27,500 6,200 31,800 149,450 (56,200) S216,3000 $ 19,500 4.800 7.100 3,600 53,000 68,500 59.800 S216,300 Additional Information: 1. Net income for 2019 was $20,500. 2. Cash dividends of $7,900 were declared and paid during 2019. 3. Long-term investments with a cost of $28,600 were sold for cash at a gain of $4,100. Additional long-term investments were purchased for $14,400 cash. 4. Equipment with a cost of $14,800 and accumulated depreciation of $13,500 was sold for $3,800 cash. New equipment was purchased for $27,350 cash. 5. Depreciation expense was $18,900. 6. A principal payment of $25,000 was made on long-term notes. 7. Common stock was sold for $31,500 cash. Required: 1. Prepare a statement of cash flows for Erie using the indirect method to compute net cash flow from operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts