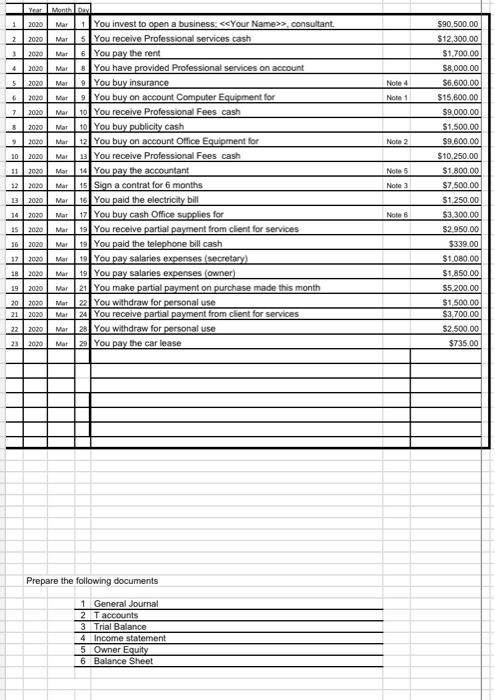

Question: 1 Note 4 Note 1 Note 2 Note 5 Year Month Day 2020 Mar1 You invest to open a business: consultant 2 2020 Mars You

1 Note 4 Note 1 Note 2 Note 5 Year Month Day 2020 Mar1 You invest to open a business: consultant 2 2020 Mars You receive Professional services cash 3 2020 Mar You pay the rent 4 2020 Mar You have provided Professional services on account 5 2020 Mar You buy insurance 2000 Mat You buy an account Computer Equipment for 7 2020 Mar 10 You receive Professional Fees cash 32920 Mar to You buy publicity cash 2000 Wat You buy an account Office Equipment for 20 2020 Mar 3 You receive Professional Fees cash 312020 Mar 14 You pay the accountant 22 2020 Mar 15 Sign a contrat for 6 months 32020 Mar 16 You paid the electricity bill 142020 Mar 17 You buy cash Office Supplies for 152020 Mar 19 You receive partial payment from client for services 16 2020 Mar 19 You paid the telephone bill cash 172020 Mar 19 You pay salaries expenses secretary) 18 2020 Mar 19 You pay salaries expenses (owner) 19 2020 Mar 21 You make partial payment on purchase made this month 20 2020 Mat 2 You withdraw for personal use 21 2020 Mar 24 You receive partial payment from client for services 22 2020 Mar 28 You withdraw for personal use 23 2020 Mar 20 You pay the car lease Note 3 $90,500.00 $12,300.00 $1.700.00 $8.000.00 56.600.00 $15,000.00 $9.000.00 $1,500.00 $9.600.00 $10.250.00 $1.800.00 $7,500.00 $1,250.00 $3.300.00 $2.950.00 $339.00 $1.080.00 $1,850.00 $5,200.00 $1,500.00 $3.700.00 $2.500.00 $735.00 Note 8 Prepare the following documents 1 General Journal 2 Taccounts 3 Trial Balance 4 Income statement 5 Owner Equity 6 Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts