Question: 1 . On 1 July 2 0 2 1 , Wonder Ltd acquired 7 5 0 0 ordinary shares in Bag Ltd for R 2

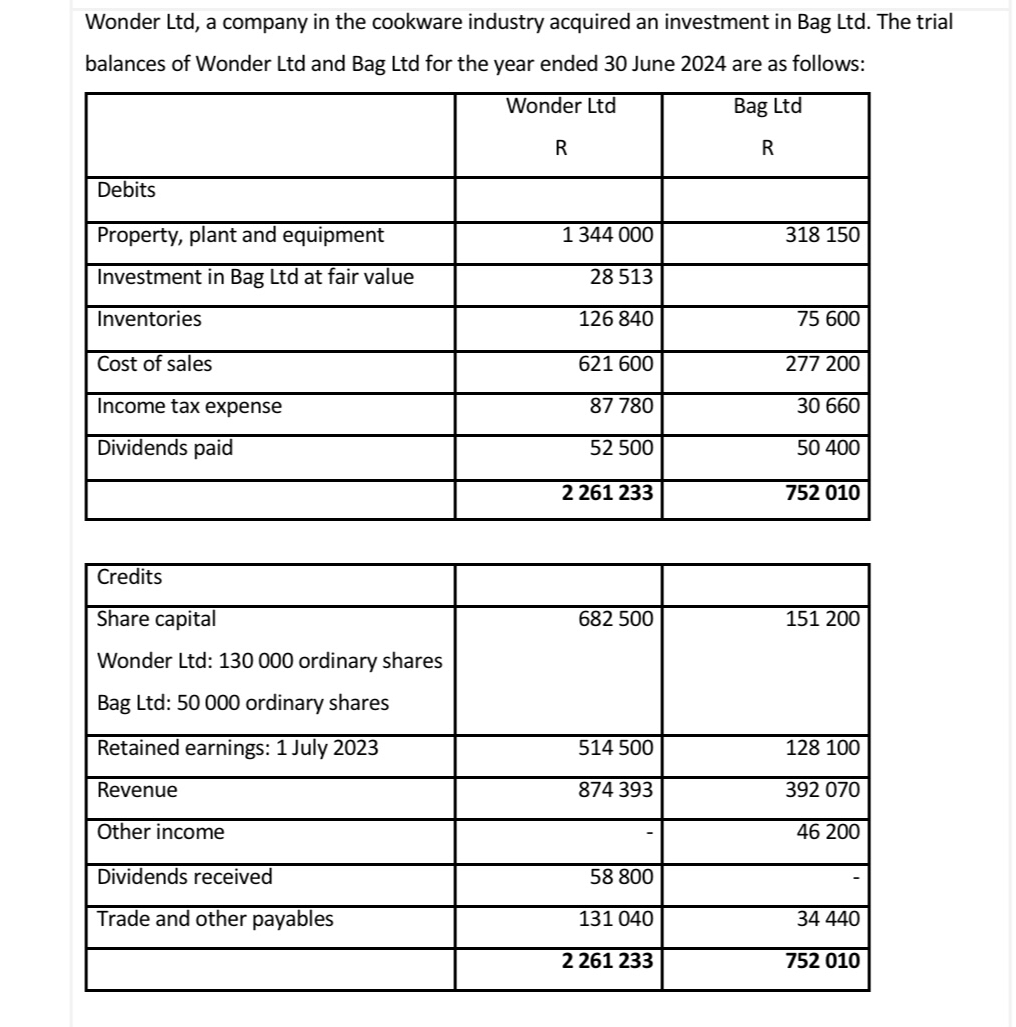

On July Wonder Ltd acquired ordinary shares in Bag Ltd for R The retained earnings of Bag Ltd amounted to R on July On the same day, Wonder Ltd also acquired call options in Bag Ltd The exercise of each call option entitles Wonder Ltd to one ordinary share, the call options are exercisable at any time. Wonder Ltd exercises significant influence over the management and financial policies of Bag Ltd since July

At acquisition date, no unidentifiable assets, liabilities, or contingent liabilities existed and the fair values of all assets, liabilities, and contingent liabilities were equal to their carrying amounts.

During the current financial year, Bag Ltd purchased inventory from Wonder Ltd at cost plus At the end of the current year, Bag Ltd had inventory amounting to R on hand that had been bought from Bag Ltd during the current financial year.

Assume the SA normal tax rate has remained at since

The published market price for the investment in Bag Ltd is R

The Wonder Ltd Group accounts for investments in associates using the equity method in accordance with IAS Investments in associates and joint ventures.

Wonder Ltd accounts for investments in associates at fair value through profit and loss in its separate financial statements. The fair value of the equity investment is equal to its cost price. Each share carries one vote.

Bag Ltd is incorporated in South Africa and its principal place of business is in Sandton. Bag Ltd produces inventory used in the manufacturing process of Wonder Ltd

QGiven the information in additional information explain why Wonder Ltdexercises significant influence over Bag LtdIn your explanation, refer to the definition of significant influence in terms of IAS Investment in associates and joint ventures

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock