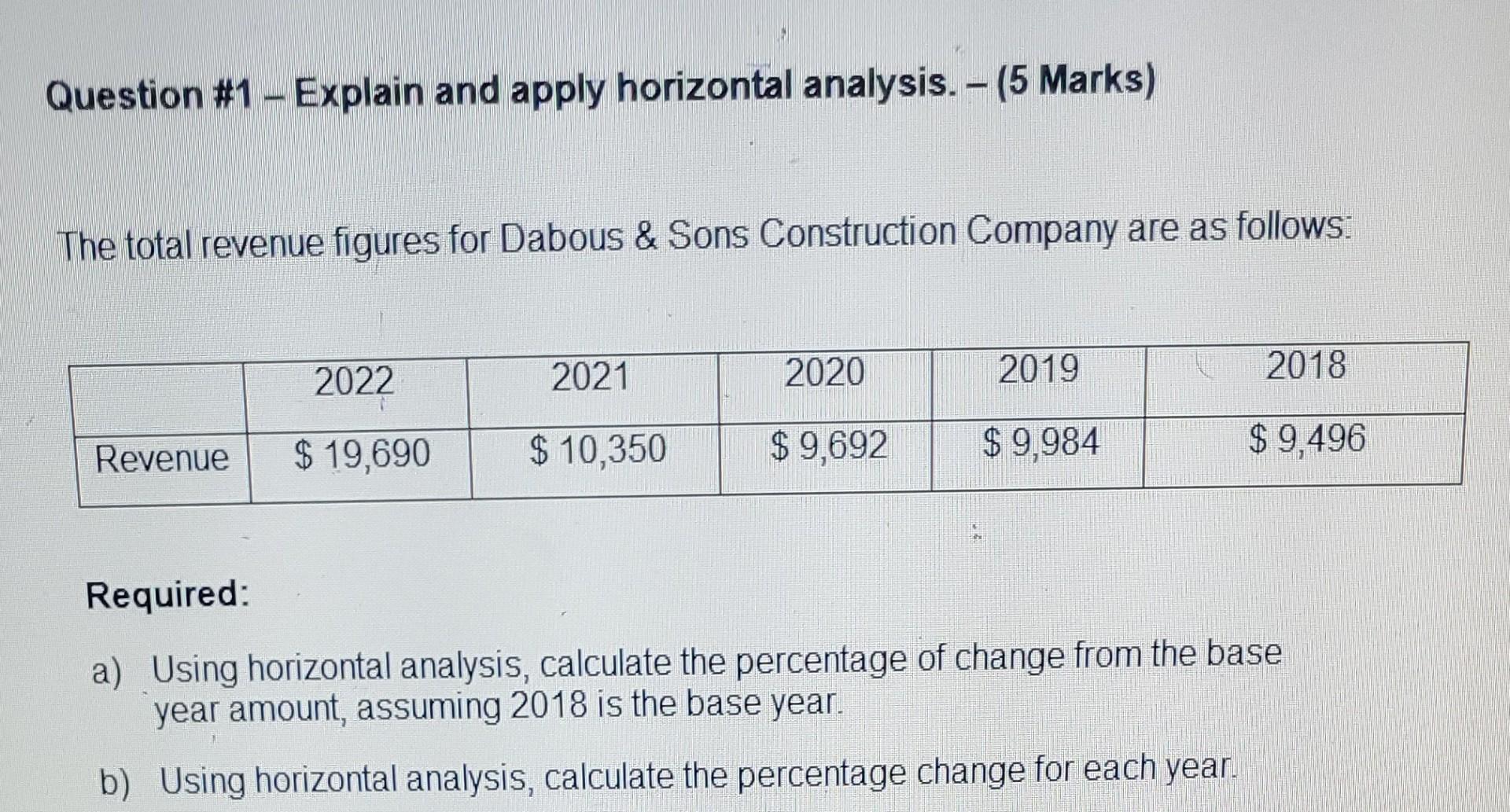

Question: Question #1 - Explain and apply horizontal analysis. - (5 Marks) The total revenue figures for Dabous & Sons Construction Company are as follows: 2022

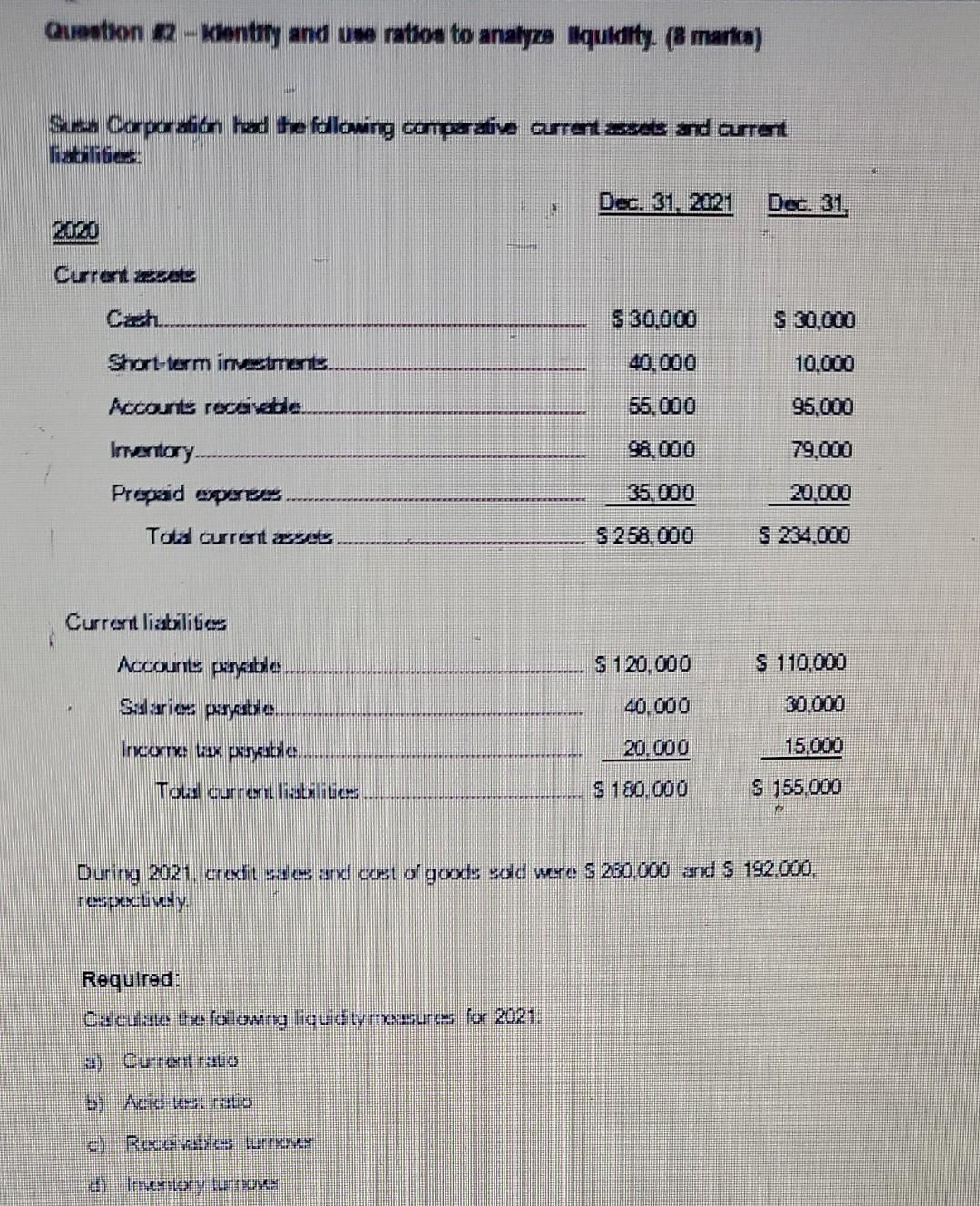

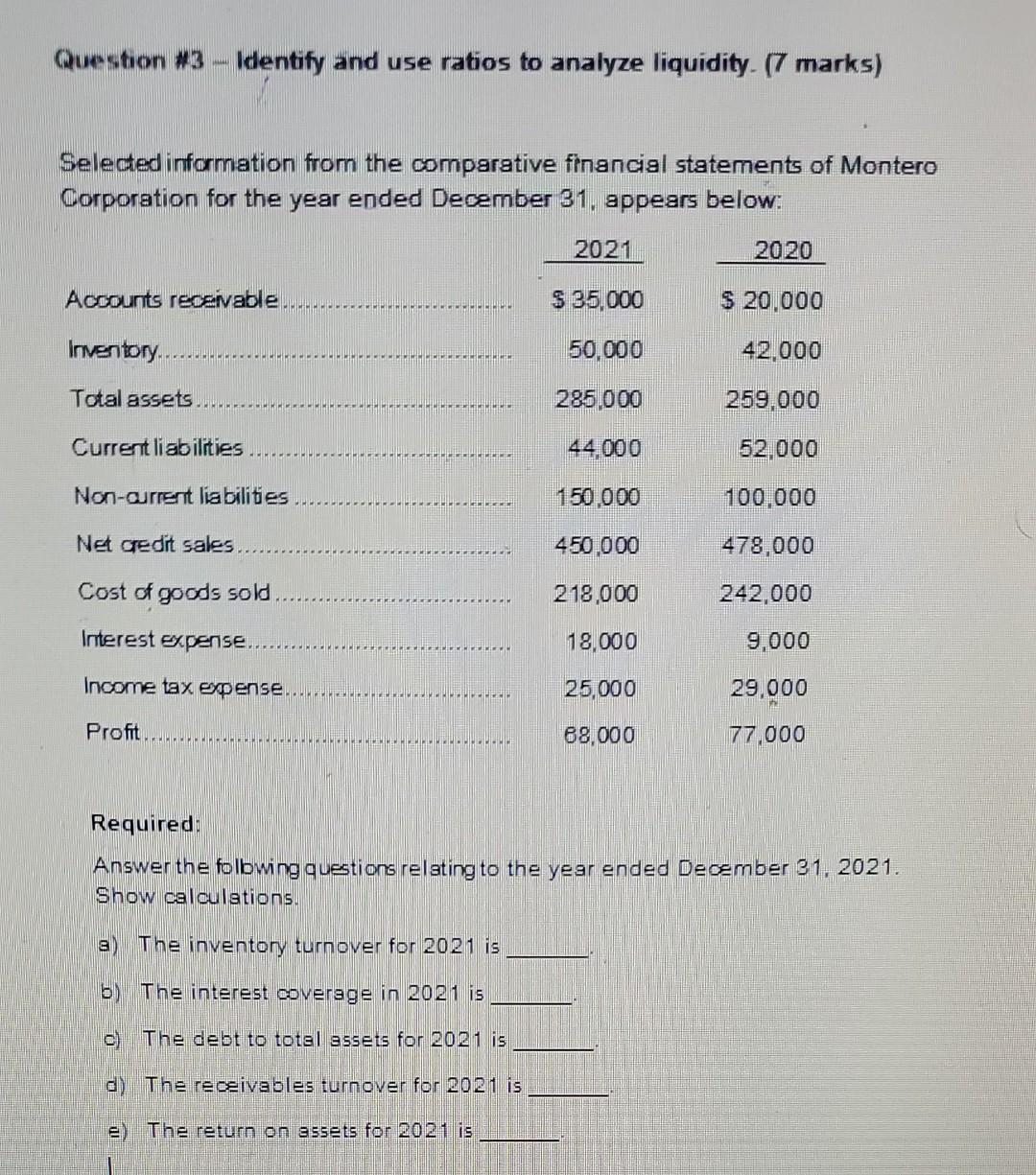

Question #1 - Explain and apply horizontal analysis. - (5 Marks) The total revenue figures for Dabous & Sons Construction Company are as follows: 2022 2021 2020 2019 2018 Revenue $ 19,690 $ 10,350 $9,692 $ 9,496 $ 9,984 Required: a) Using horizontal analysis, calculate the percentage of change from the base year amount, assuming 2018 is the base year. b) Using horizontal analysis, calculate the percentage change for each year. Question 2 -Kentory and une ration to analyze aqulrty. (8 marka) Se Corporation had the fdlowing comparative currents and arrerit Dec. 31. 2021 LILO $ 30.000 $ 30.000 40.000 10.000 Short-term inement Accounts receivable Inventory 55.000 95.000 98.000 79,000 Prepaid "pu Told current , $ 258,000 $ 234,000 Current liabilities $ 120,000 S 110.000 Accounts payable Salaries puble Incore lux puble 40.000 20.000 15.000 Tou current Tablice $ 180.000 S 155.000 During 2021, credit sales and cost of goods sold were $ 200.000 and $ 192.000. rescuely Required: Calculate the following liquidity ressures for 2021. 2 Current raio Acid leto Rezerves di lerrory On: Question #3 - Identify and use ratios to analyze liquidity. (7 marks) Selected information from the comparative financial statements of Montero Corporation for the year ended December 31, appears below: 2021 2020 Accounts receivable $ 35,000 $ 20.000 Inventory 50,000 42,000 Total assets 285,000 259.000 Current liabilities 44.000 52.000 Non-current liabilities 150,000 100,000 Net gedit sales.. 450.000 478,000 Cost of goods sold 218,000 242,000 Interest expense. 18,000 9,000 Income tax expense. 25,000 29,000 Profit 88,000 77,000 Required: Answer the folbwing questions relating to the year ended December 31, 2021. Show calculations. 3) The inventory turnover for 2021 is b) The interest coverage in 2021 is c) The debt to total assets for 2021 is d) The receivables turnover for 2021 is e) The return on assets for 2021 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts